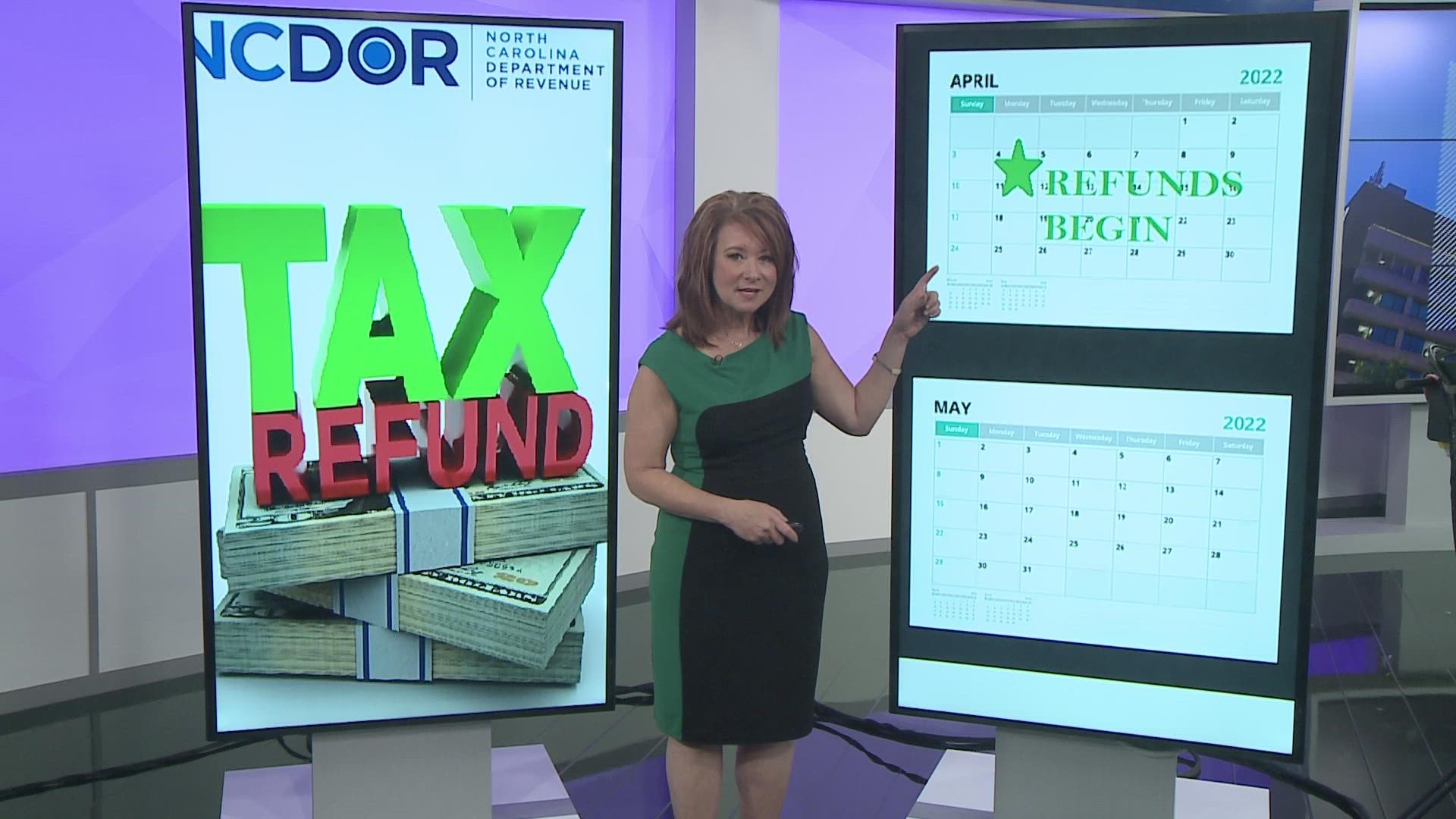

GREENSBORO, N.C. — Are you asking where your North Carolina tax refund is? The North Carolina Department of Revenue began sending out refunds the first full week of April. It’s almost June and all refunds have not been issued yet.

As of May 23, 2022, the NCDOR has issued approximately 2.12 million refunds. In terms of the dollar amount, that is about $700 million. The estimate is that another 190,000 refunds remain to be issued.

What is the cause of the delay? The NCDOR references it on the tax refund page on the website.

Tax season opened late due to the delayed state budget, which included tax law changes. The state didn't begin accepting returns until March 1, 2022.

You can always check the Where Is My Refund tool. Before you submit your information, the site lists the different stages of the refund process. There are seven in all. Stage one is the return received. It goes on to explain processing, and initial review and even requires further examination.

More than 90 percent of returns go through three stages of processing before a refund is approved. This process typically takes less than three weeks after the electronic submittal date. The process will be longer for taxpayers who filed paper returns.

Less than 10 percent of returns may require up to seven stages of processing to protect your identity and refund from potential identity theft refund fraud. These additional measures are implemented to protect your identity and ensure you receive the appropriate refund. If your return requires the additional review, it will take longer to process - typically six weeks for electronically filed returns and 12 weeks for paper returns.

You’ll need the social security number of the person listed first on your tax return as well as the amount you’re supposed to get back.