GREENSBORO, N.C. — There’s good news and bad news when it comes to homeowners insurance rates in NC.

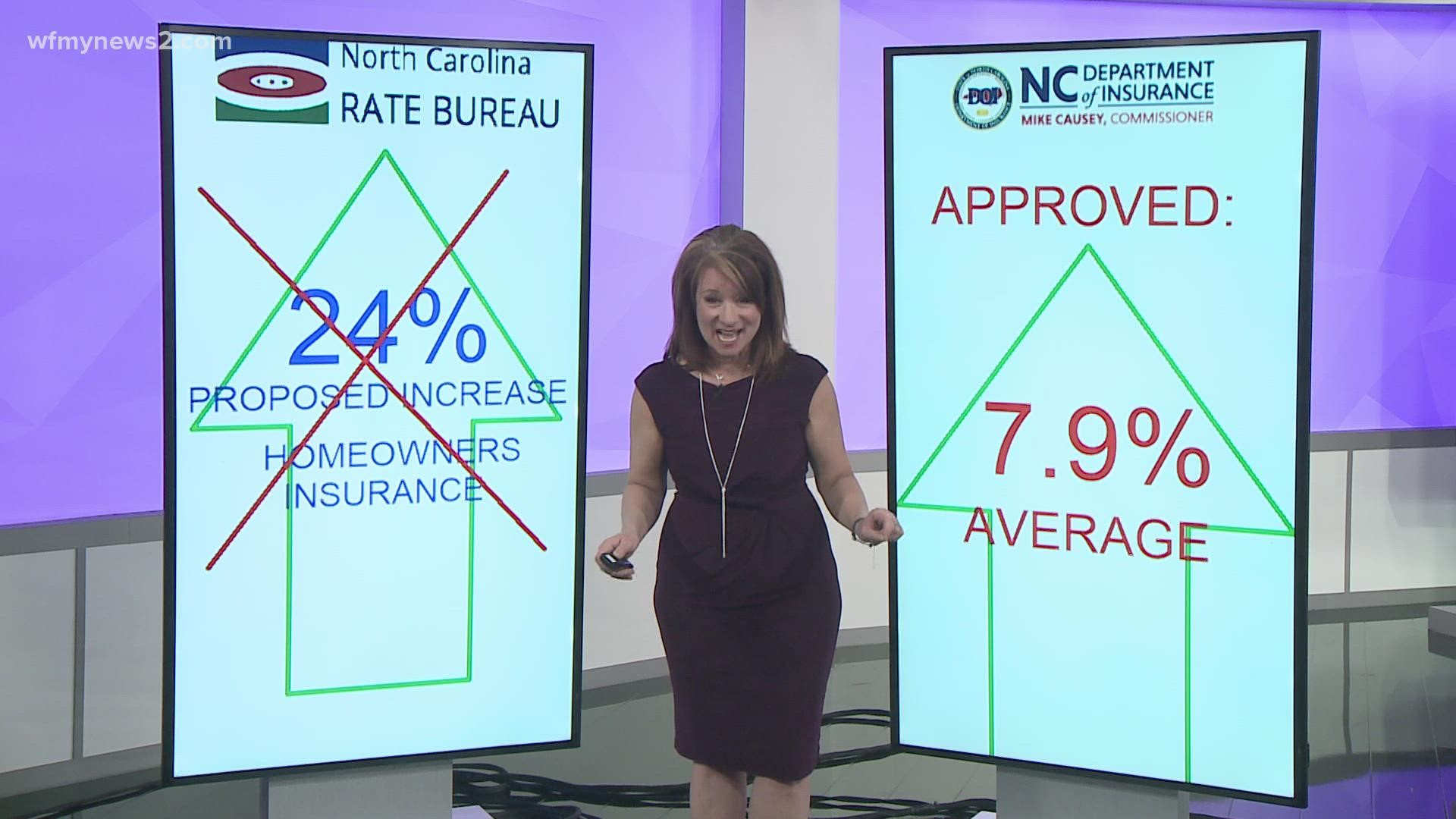

The good news: The Rate Bureau wanted the North Carolina Department of Insurance to approve a 24% increase on homeowners insurance premiums. It did not pass. The NC Insurance Commissioner approved an average of 7.9% increase instead. The new rates kick in on June 1, 2022.

Folks living near the coast, with a greater chance of storm damage, will see more like a 10% increase while most folks in the Triad area will see a 6% increase.

The bad news: You're about to get an increase, twice. You have this increase coming in June of this year and right now, the cost to rebuild your house if something were to happen, has increased due to supply chain issues and inflation, which means you need more insurance on your house.

“If your homeowners policy covers your $200,000 house and now it would take $250,000 to insure your home, you have an approximately 20% rate increase to do that. Plus another rate increase on top of that of 6% coming in June. So, it's going to feel a little more substantial to your viewers,” said Christopher Cook with Alliance Insurance Services.

Be prepared for two increase letters, one now about upping your insurance to meet rebuilding costs and one in the summer.

This would be the time consumers will start shopping around to see if another insurance company can give them a better deal. Cook says, don’t be surprised if you can’t find another insurance company to cover you.

“Homeowners insurance premium rose, condition of the property deteriorated, upkeep hasn't been done, and so Mr. or Mrs. Customer, I can't move your policy, I can't move your property to a new insurer who may have a more competitive rate, because you don't meet the underwriting parameters of the other insurance companies,” said Cook.

What parameters could be lacking? Cook says it is often an age of roof issue. Remember, insurance companies are looking to see who they can insure that may not have as many claims.