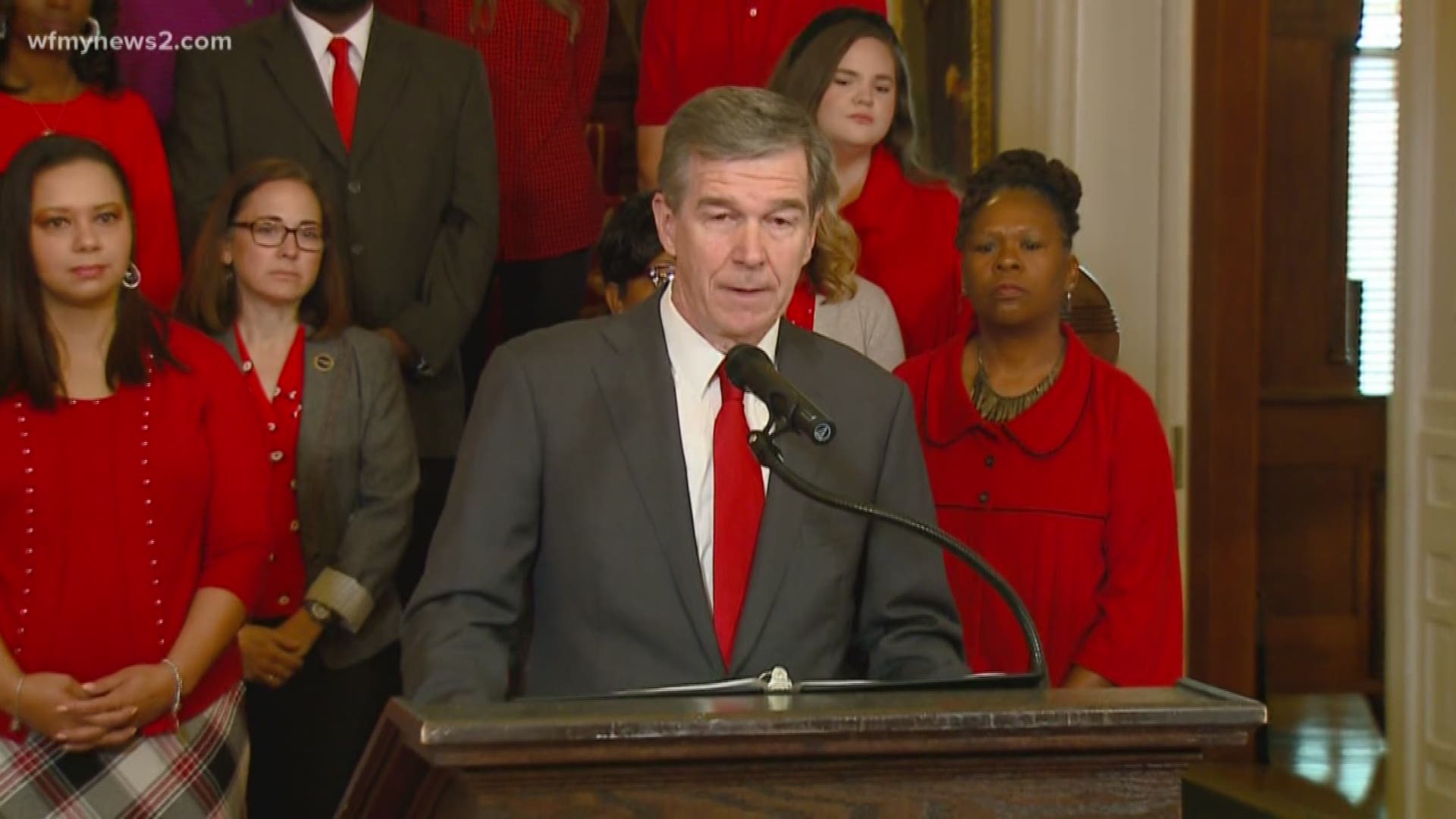

RALEIGH, N.C. — Governor Roy Cooper just signed a bill that's supposed to give you more money in your tax refund next year if you make less than $21,000. To pay for that extra in the refund, NC sales tax will be charged on more online purchases.

Two state senators from Forsyth County were among the bill's primary sponsors: Democratic Senator Paul Lowe and Republican Senator Joyce Krawiec.

We've only heard back from Krawiec, so far. She says in part, policies like this one "have allowed all North Carolinians -- particularly those with low incomes -- keep more of the money they earn, and S557 is a continuation of those policies."

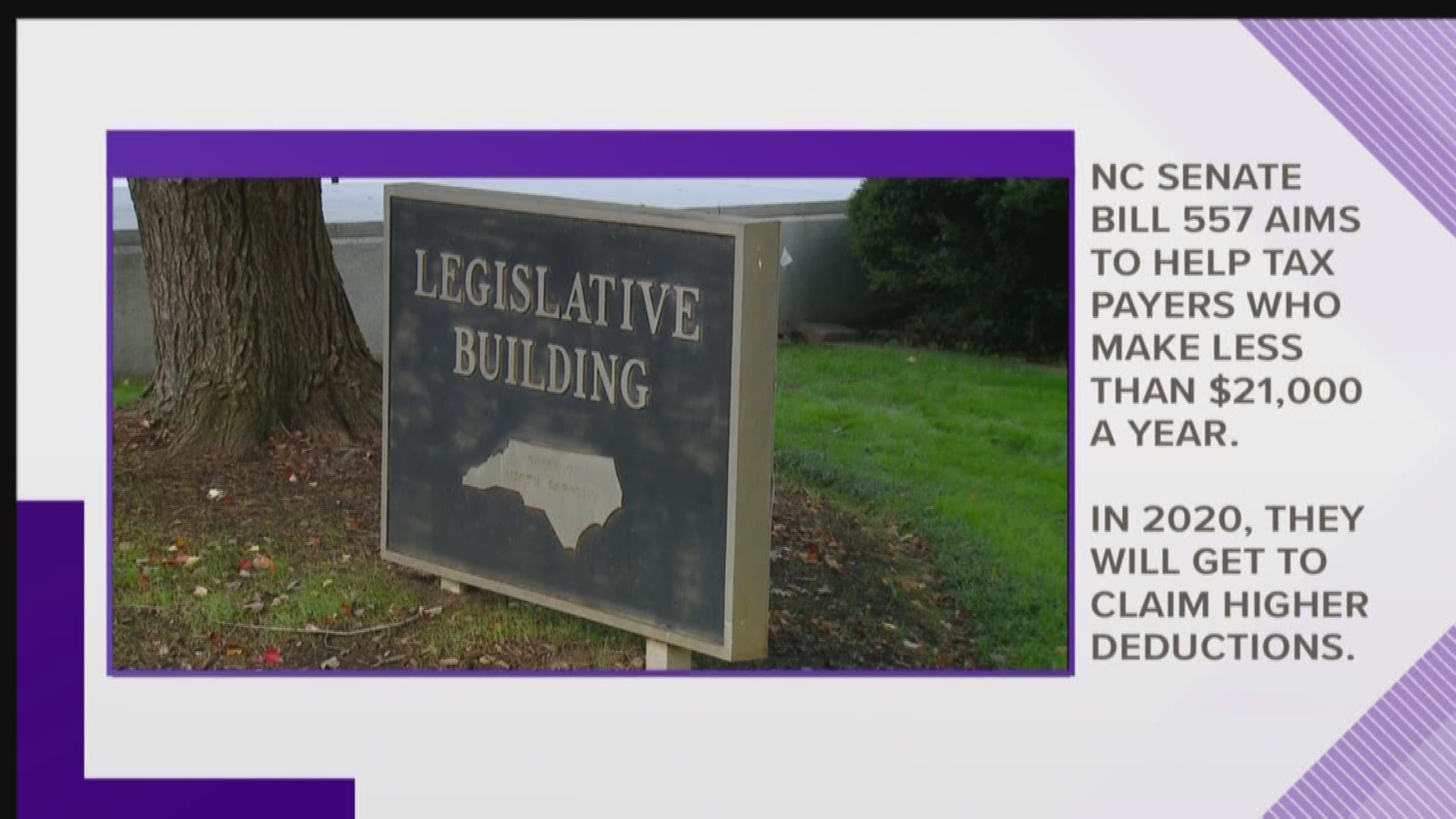

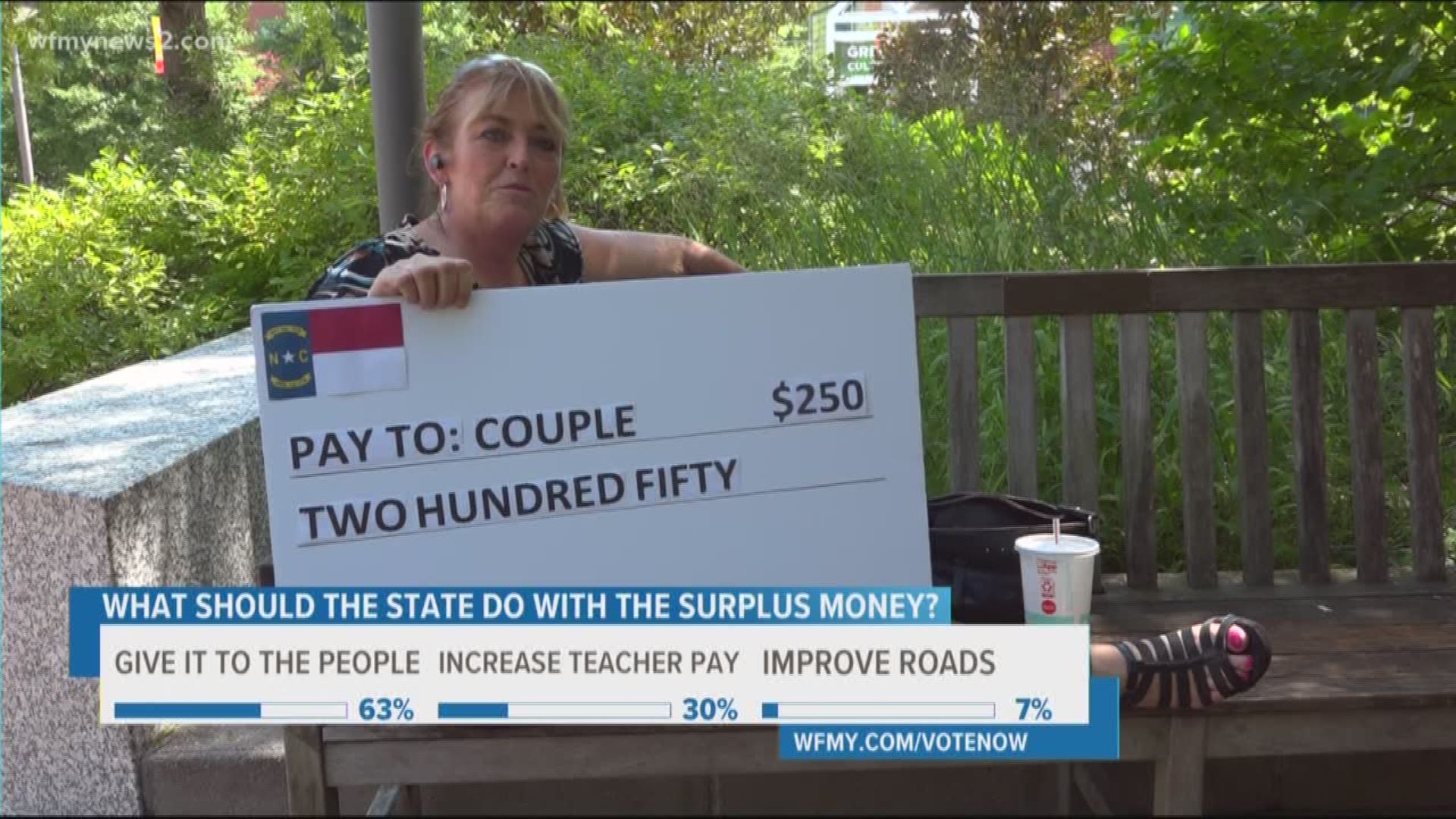

Senate Bill 557 increases the zero-tax bracket from $20,000 to $21,500 for a married couple filing jointly, $15,000 to $16,125 if you're head of household, and $10,000 if you're single, or married but filing separately.

While bigger state standard deductions mean more money on your return, your favorite online retailers like Amazon and eBay will have to charge sales tax on third-party transactions through their site. Most online retailers already assess NC sales tax when they sell to you directly, but third-party sales often went without tax.

You will see the new tax as of 2020 when you make purchases.

Governor Roy Cooper, who signed the bill into law Friday, says this is to make things more fair for North Carolina retailers so they can compete against buys online.

So, unless you're not part of 79% of Americans who shop online, according to Tech Crunch, this might not be great news for you.