GREENSBORO, N.C. — More than one million checks have been mailed out, but there are still people in the state eligible to receive the Extra Credit Child Grant. The state is now extending the deadline to get the money until July 1, 2021.

In 2020, the state of NC used money from the Coronavirus Relief Fund to help families offset the cost of virtual learning and child care costs during the pandemic. The check is $335.

Who is eligible:

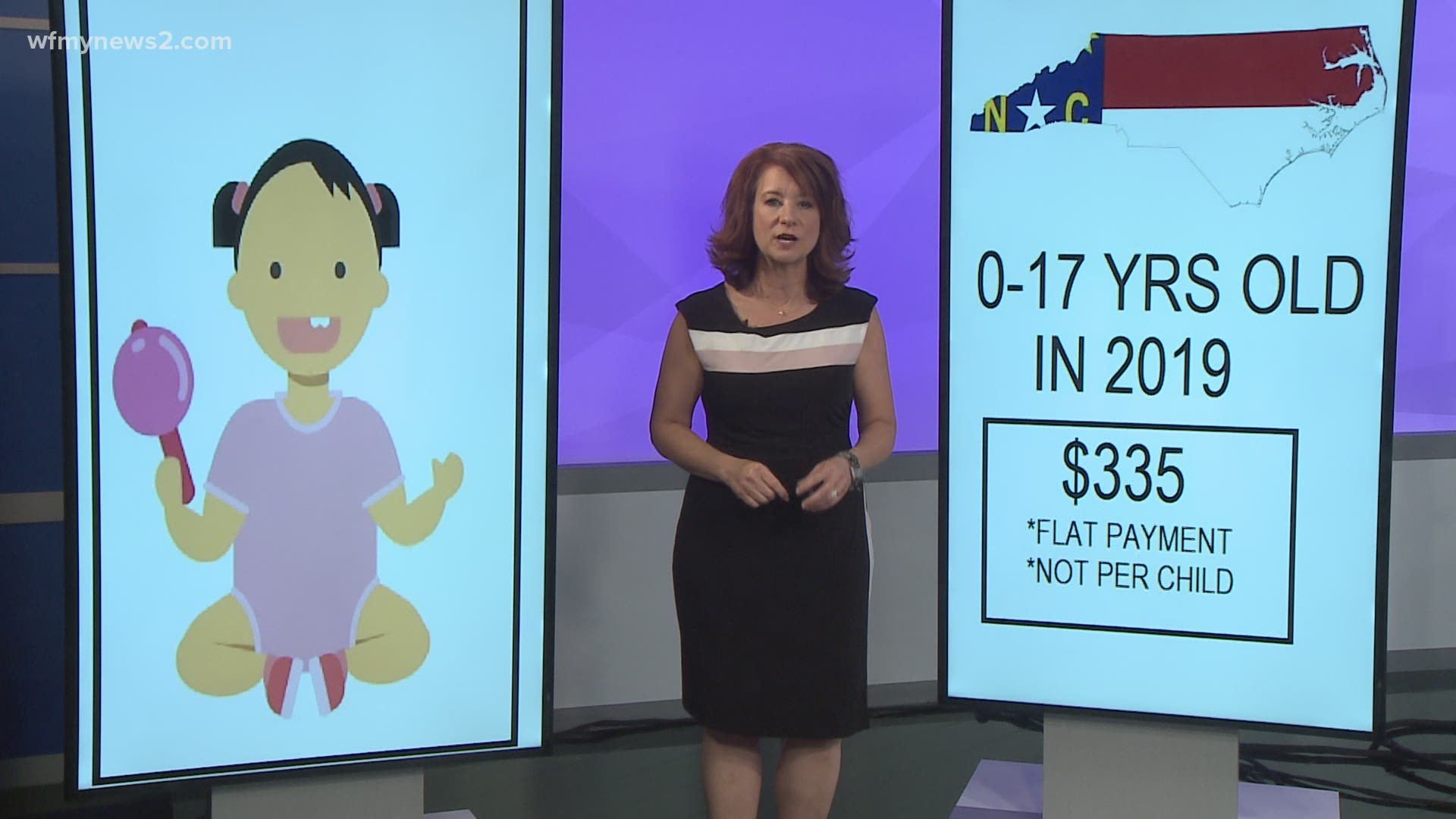

Families with a child under the age of 17 in the 2019 tax year

Qualifying Child:

- In order to be eligible for the grant, your child had to be a “qualifying child” for purposes of the federal child tax credit for tax year 2019. In general, a child qualifies you for the federal child tax credit if the child meets all of the following conditions:

- The child is your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them (for example, your grandchild, niece, or nephew).

- The child was 16 or younger (under age 17) at the end of 2019.

- The child did not provide over half of his or her own support for 2019.

- The child lived with you for more than half of 2019.

- The child is claimed as a dependent on your 2019 federal tax return if you are required to file a return. If you did not file a 2019 federal tax return, the child would be claimed as a dependent on your 2019 federal tax return had you filed a return.

- The child does not file a joint 2019 federal tax return.

- The child was a U.S. citizen, U.S. national, or U.S. resident alien.

It's one flat payment, not $335 per child.

How To Apply:

You can apply online or download the extra credit grant form. There are different forms depending on whether you filed taxes or not. This link takes you to the application forms.

The NCDOR confirms:

1,118,724 Extra Credit grant checks were issued in 2020

6,133 checks have gone out in 2021

Approximately 171,000 of those checks have been issued to individuals who were not required to file a tax return because of their income level (under $10,000 single and under $20,000 joint).