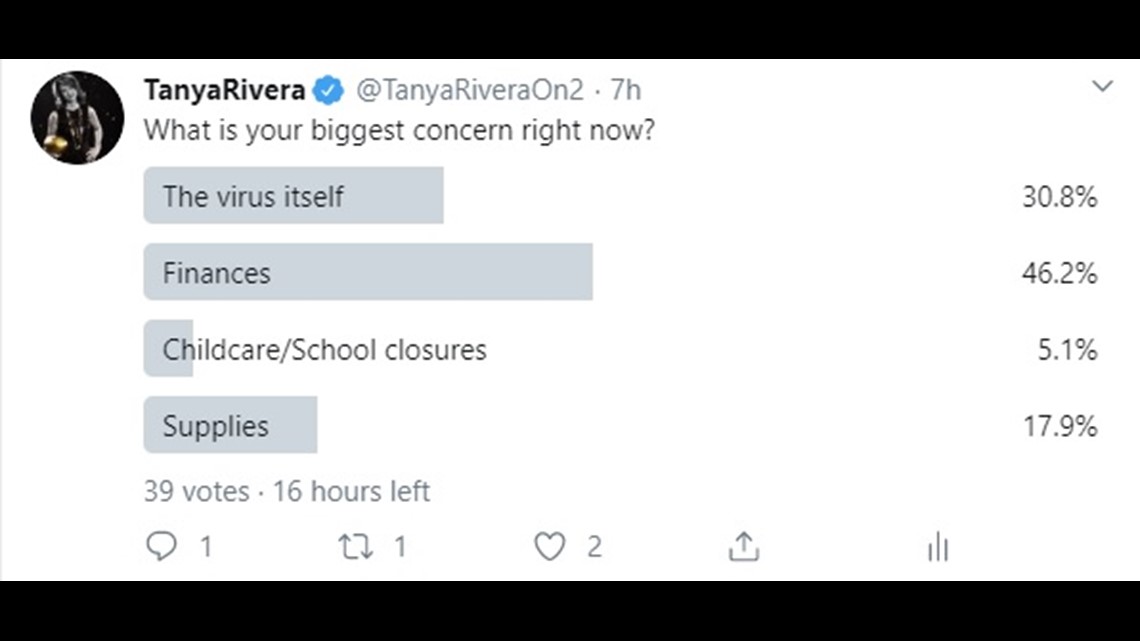

GREENSBORO, N.C. — I did a twitter poll and asked what your biggest concern was:

The top vote-getter was finances.

2WTK viewer Ray called the 2WTK line and asked, ”Now that the banks have dropped the interest rates to near zero, can I refinance my loans?”.

The short answer is yes if you qualify and have a good credit rating. Certified Financial Planner Matt Logan adds, ”Look at your own mortgage and see if this is an opportunity for yourself could really help your cash flow situation at home. For instance, if you did a loan a year ago versus a loan today. You might wind up keeping a good amount of money that maybe you could start to invest, or would help with cash flow for other purposes or help pay down debt faster.”

His example:

A year ago, the national mortgage average for 30-year loan: 4.41%. On a $200,000 home, you're paying a little over a thousand a month.

Now, we're seeing the national mortgage average for a 30-year loan at 3.36%. That same $200,000 home would bring down your monthly costs to about $882 a month.

But make sure you take into consideration, there are closing costs---

this is a cost of between 1.5% and 2% of the value of the loan.