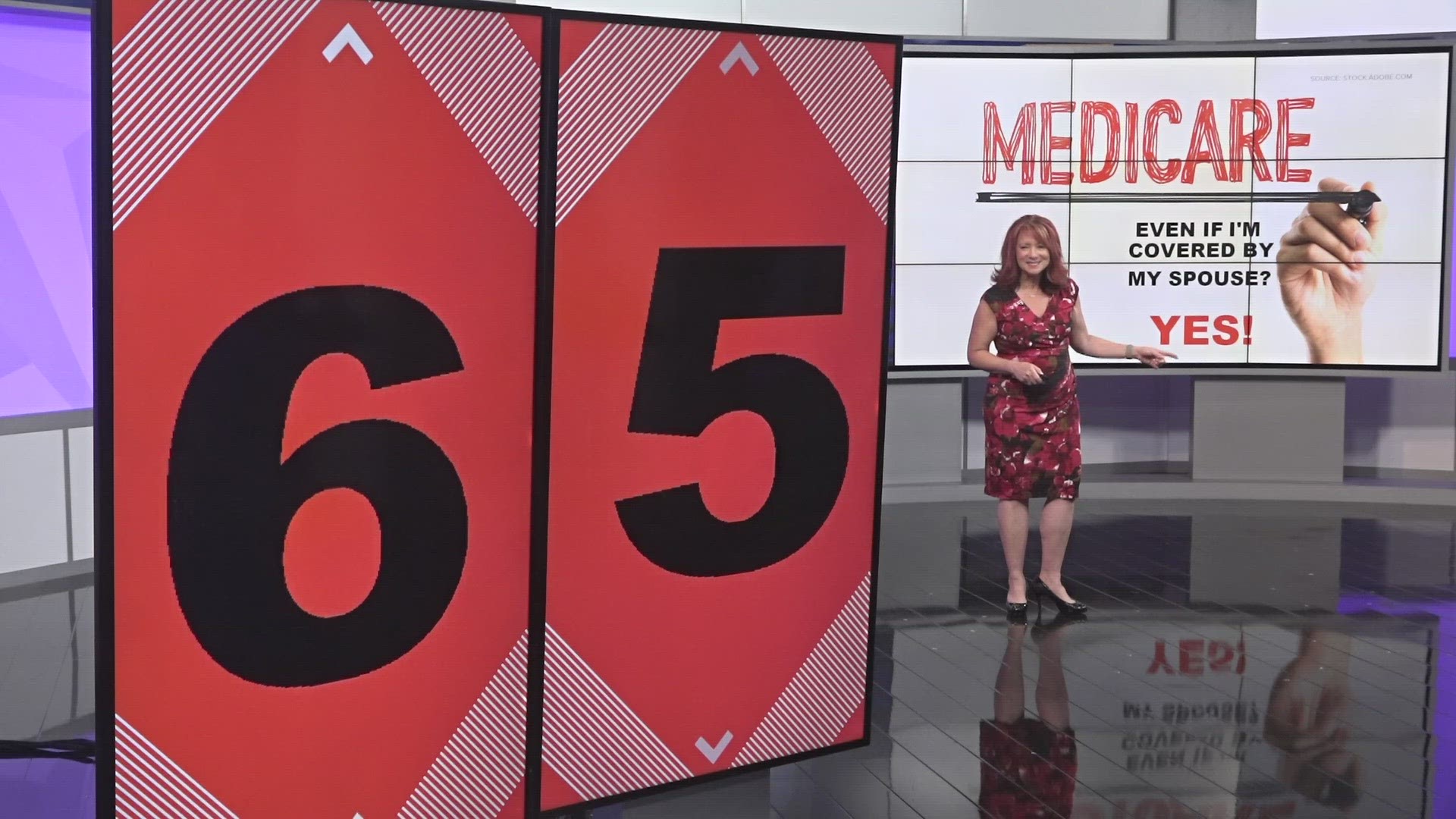

GREENSBORO, N.C. — When you're 65 years old, you need to sign up for Medicare. Period.

Even if you’re still working? Yes.

Even if you still have insurance? Yes

Even if you’re covered by your spouses' insurance? Yes.

“You must sign up at 65 there is no exception to that. Unless you want to pay a penalty when you do sign up later and there are penalties associated with all the parts, but with part b penalty is forever,” said Catherine Sevier of AARP.

Everyone has to sign up when they're 65. The answer is yes. Your Medicare sign-up time is a seven-month window.

MEDICARE SIGN-UP WINDOW

You have the three months before your birthday month, the month of your birthday, and the three months after to sign up for Medicare. If you don't sign up for Medicare in that window, you'll be paying a penalty.

MAIN PARTS OF MEDICARE & THEIR LATE PENALTIES

Here are the main parts of Medicare:

Part A-- covers inpatient hospital stays. It's free for most people.

Part B-- comes with a premium. It covers doctor visits

Part D-- covers prescriptions. It's free.

Part A has a late enrollment penalty only if you don't qualify for the free coverage. It could add 10% to the premium.

Part D’s late enrollment penalty costs you 1% more for every month you're late.

Part B's penalty is forever.

“Once you say, oops I should have signed up for it, you're going to pay a penalty of 10% more every year. And if find yourself signing up at 67 or 68, you could find yourself paying 20% to 30% more every year for the rest of your life,” said Sevier.

SIGNING UP & DEFERRING PART B

Now, if you're working at 65 and you have work health insurance, you'll sign up for Part B-- and defer coverage until you retire. Insurance experts say when you defer Part B. it's best to do it one-on-one.

“Part B is usually the one you're going to have to call into Social Security and let them know what you want to do. You can defer Part B if you have your own credible insurance, but guess what, Social Security needs to know about that and it’s better to do it on the phone than online to make sure it’s correct,” said Steve Edmunds of Alliance Insurance Services.

Before you leave your employer to retire, make sure you get a letter stating you had credible health insurance. You’ll need that to give to Social Security so you don’t pay any penalties.