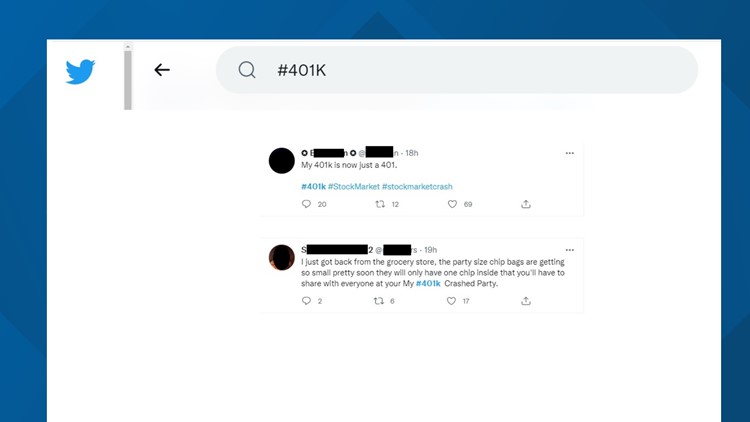

GREENSBORO, N.C. — If you do a search for what people are saying about their 401k's on Twitter, it's ugly. For example:

My #401k is now just a 401.

I just got back from the grocery store-- the party size chip bags are getting so small, pretty soon they will only have one chip inside that you'll have to share with everyone at your my #401k crashed party.

If you haven't looked at your 401k lately, it's not pretty. The question 2 Wants To Know is helping you answer is, what should you do?

Let's look at these three scenarios:

You have decades before you need your 401k

You want to retire in less than 5 years

You're retiring in a year

If you need your money within a year, you need to talk to a financial planner, now!

If you're getting close to retirement, but not at it, advisors say, stay put.

“For those who are nearing retirement, before you pull the plug before you panic think of this, even if you were 62 years old and you said, I want to retire in two years and you're really scared. I would suggest that you're not going to pull all of your money out of an account today because you need your money to grow and we don't know when the recovery is going to come money to grow and we don't know when the recovery is going to come,” said CBS News Business Analyst, Jill Schlesinger.

That last statement is key for those of you with decades to go.

We don't know when recovery will come. You have time to wait for it and make, if history repeats, money off of it.