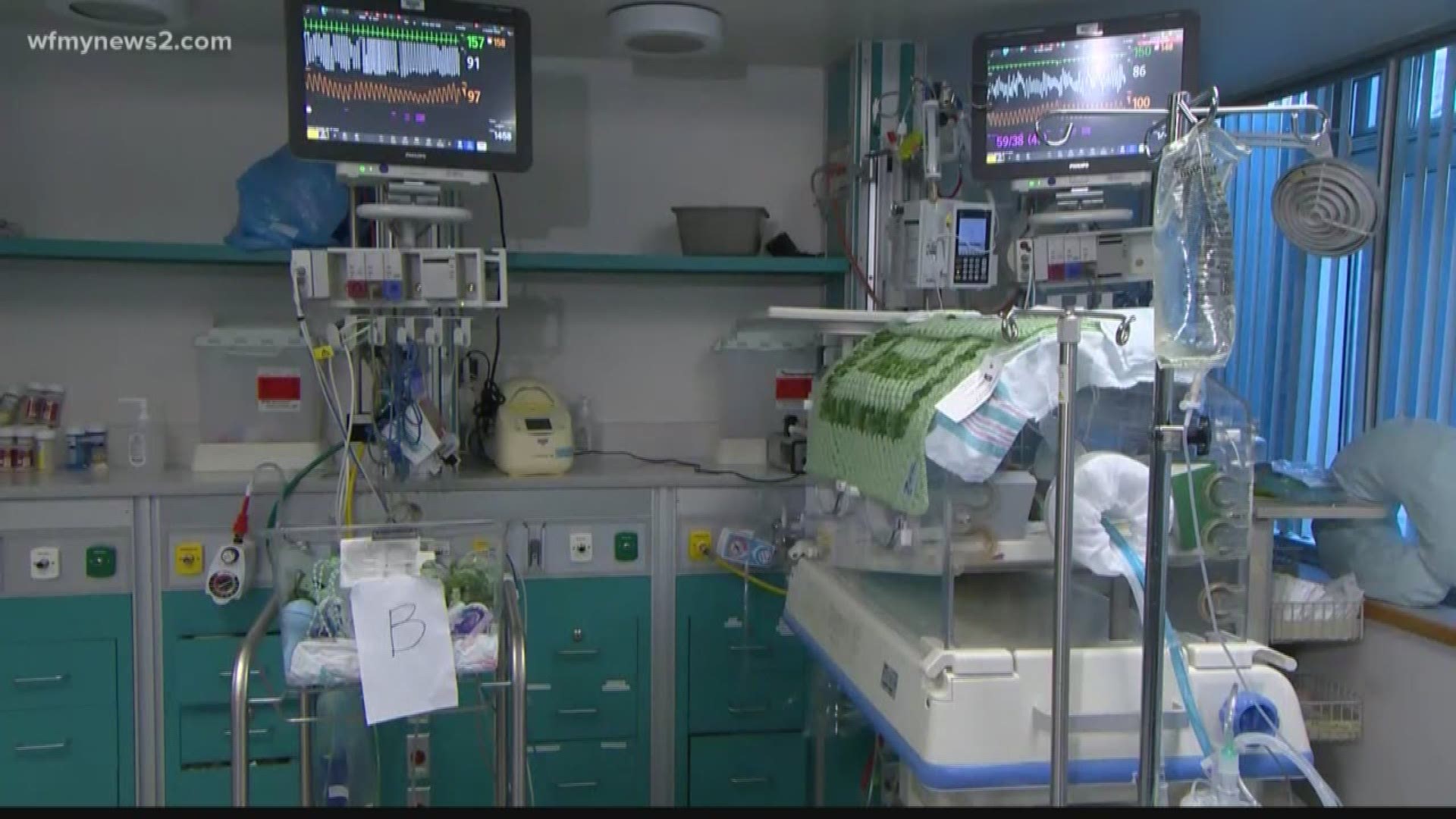

Sonji Wilkes and her family have endured a medical and financial nightmare. Her son, Thomas, was diagnosed with a blood disorder shortly after birth. She went to an in-network hospital thinking her insurance would cover treatment in the neonatal intensive care unit.

"A few weeks later we received another shock,” said Wilkes “A $50,000 bill for Thomas' stay in the NICU. We were dumbfounded."

The NICU was subcontracted to a third party provider, out of network for the family’s plan. Wilkes testified before a House subcommittee as lawmakers propose legislation to address surprise medical bills, which are common.

Another patient advocate testified Wednesday that one in five visits to an emergency room results in a surprise bill.

A survey from the University of Chicago shows 57% of Americans are surprised by bills they thought would be covered by insurance.

The surprise charges are most commonly for ambulances and specialty doctors, including anesthesiologists and radiologists.

"It is not fair, it should not happen and we're going to put a stop to it one way or another," said Rep. Greg Walden, a Republican from Oregon.

But lawmakers are split on how to fix the problem one proposal doctors favor includes setting up an arbitration system to resolve billing disputes.

"This cuts both ways,” said Dr. Sherif Zaafran, a representative for Physicians for Fair Coverage. “Plans and providers alike will have the opportunity to appeal."

But insurers reject that proposal. "It adds unnecessary administrative costs to the system," said Jeanette Thornton, a representative for America's Health Insurance Plans.

Insurers prefer a single, standard payment. A Senate hearing is scheduled for next week.