GREENSBORO, N.C. — This week, the first payments for the Advanced Child Tax Credit go out. July 15, 2021, is the payment date.

WHAT PAYMENT CAN YOU EXPECT?

Parents will get $300 for each child under the age of 6

and $250 for each child ages 6 to 17 years old.

WHEN DO THE PAYMENTS COME?

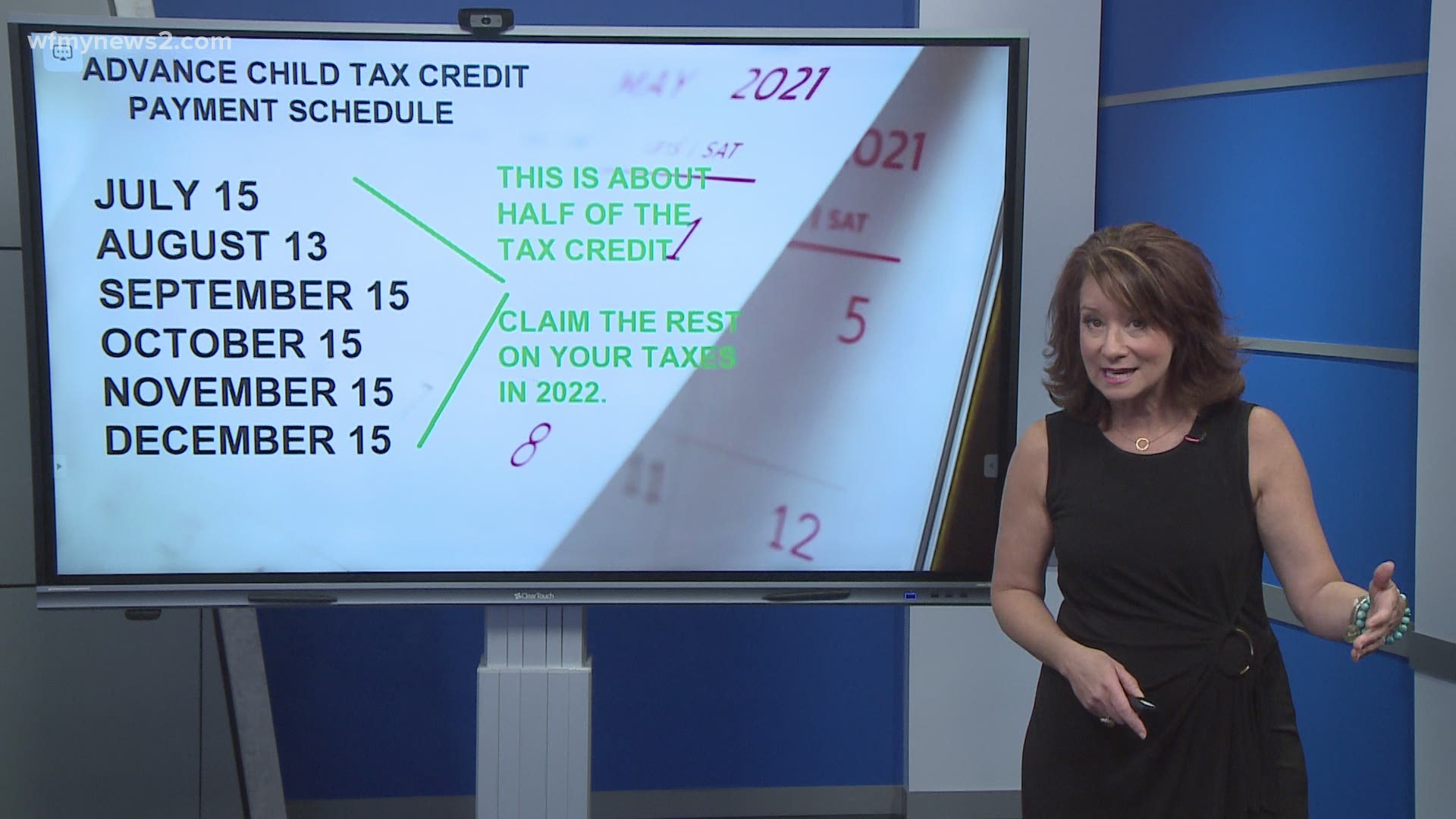

the advance payments on the Child Tax Credit will be made once a month through December. Each of the due dates is the 15th of the month except for August when the 15th falls on a weekend. That payment will be made on August 13.

WILL THIS COUNT AGAINST ME AT TAX TIME?

Yes and No. This is not income that you will be taxed on, so no, it doesn’t count against you.

This is half the total of the entire tax credit that you claim on your 2021 taxes in 2022. If you like to get all of the tax credit at one time, you’ll want to unenroll in this payment program.

OPT-OUT OR UNENROLL

To opt-out or unenroll, you need to go to the IRS website. You only need to unenroll one time for it to be effective. You can also choose to get some payments and unenroll from the rest. There is a timeline for unenroll deadlines for each payment.

If you opt-out or unenroll, you will claim the full credit during tax time.

To unenroll or opt-out, you use the Child Tax Credit Update Portal.

This portal also allows you to give the IRS your banking information or new banking information to make sure the direct deposit goes to the right account.

If you need to make changes to your address, make changes to the number of dependents, marital status, or income, the IRS has a timeline out for those portals, which is later this summer.

Do you have to do anything to get this? No.

It's automatic, but if you are a non-tax filer, the IRS just created a tool for you to put your info in so your direct deposit or check is not delayed.