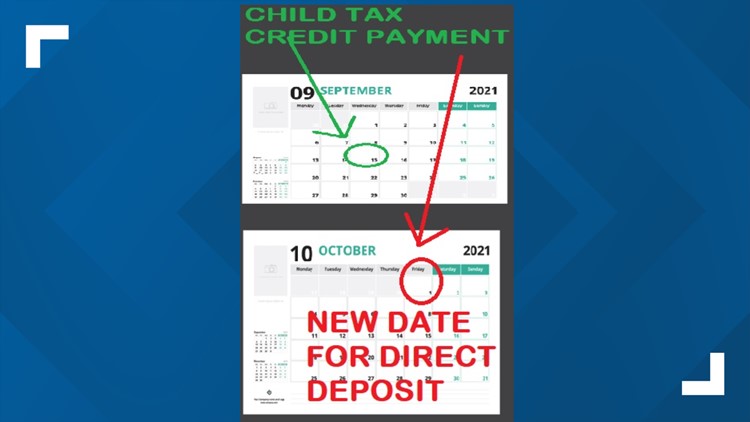

GREENSBORO, N.C. — If you're still waiting for the advanced child tax payment that was due Sept. 15, there’s good news and bad news.

The good news first: The IRS said if you get a direct deposit the money could be there by Friday, October 1.

The bad news, if you're getting a check it could be several more days after that. The IRS explained what happened in a statement.

There was a technical issue and estimate fewer than 2% of payment recipients didn't get their money. The impacted group was primarily taxpayers who recently made updates on their bank account or address in the portal. We know people depend on receiving these payments on time and we apologize for the delay.

The IRS says people are also seeing different amounts than they expected:

*If one spouse changed an address or bank account, the other spouse's half could be going to the old address. This could lead to full payment.

*Recently processed tax returns could lead to other amounts

Got questions? You can't get a hold of the IRS, your best bet is to create an account and check the IRS Child Payment Portal.

The next Advanced Child Tax payment is due to go out on October 15th. The total child tax credit for 2021 is $3,600 for each child under 6 and $3,000 for each child 6 to 17 years old.

Each month, the payments will be either $300 or $250 for each child. Half of the amount of the tax credit will be split up between six payment dates, the rest will be deducted when you do your taxes in 2022.