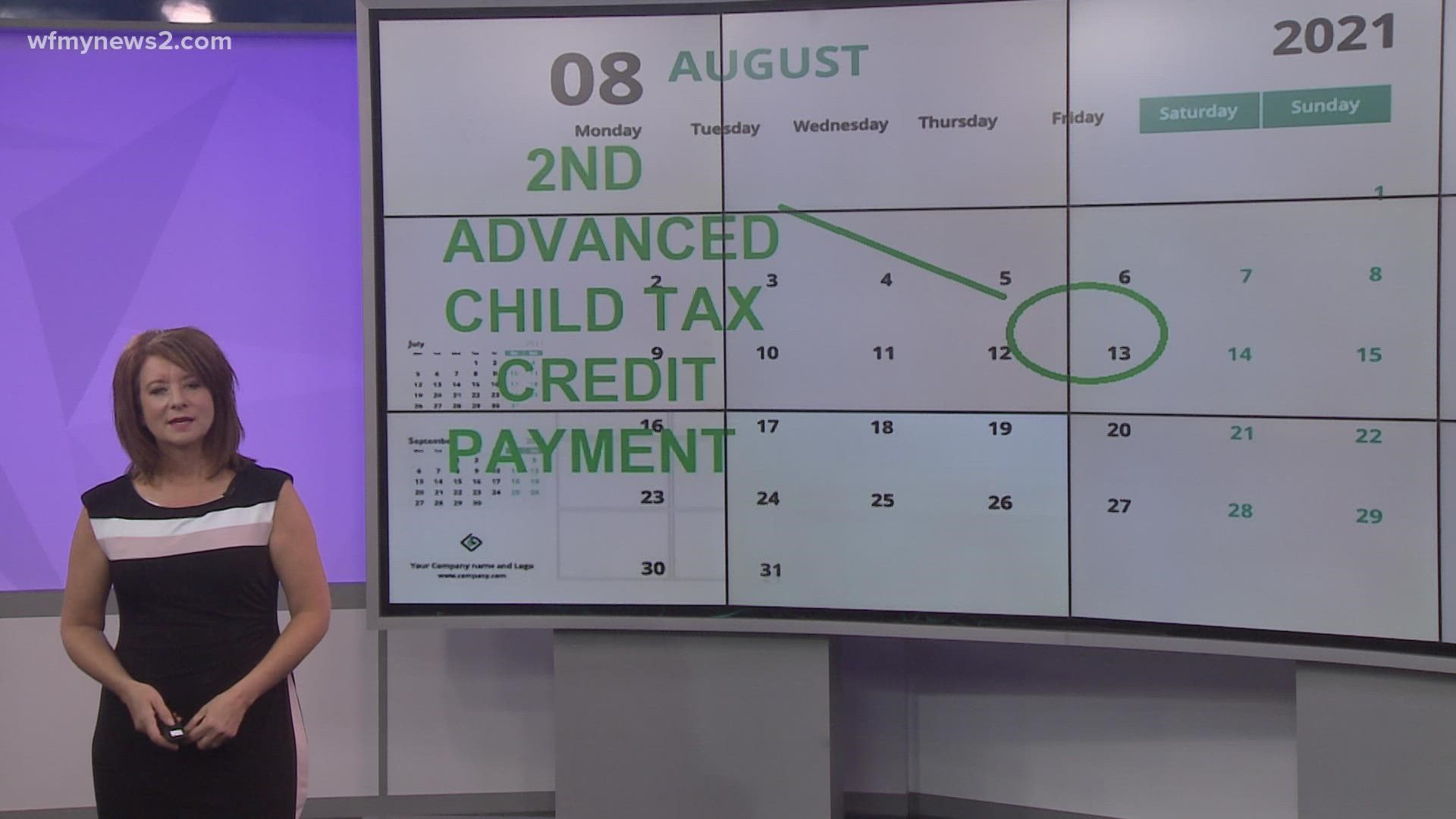

GREENSBORO, N.C. — The second round of Advanced Child Tax Credit payments went out on August 13, 2021. The deadline to unenroll or opt out of the rest of the payments is at the end of this month. Just recently, the IRS also confirmed married couples must unenroll separately, or half payments will still be made.

WHY UNENROLL IN THE CHILD TAX CREDIT PAYMENTS?

The advance payments total about half the total child tax credit you will see on your 2021 taxes. If you like getting one big deduction at tax time, you’ll want to unenroll from the payments.

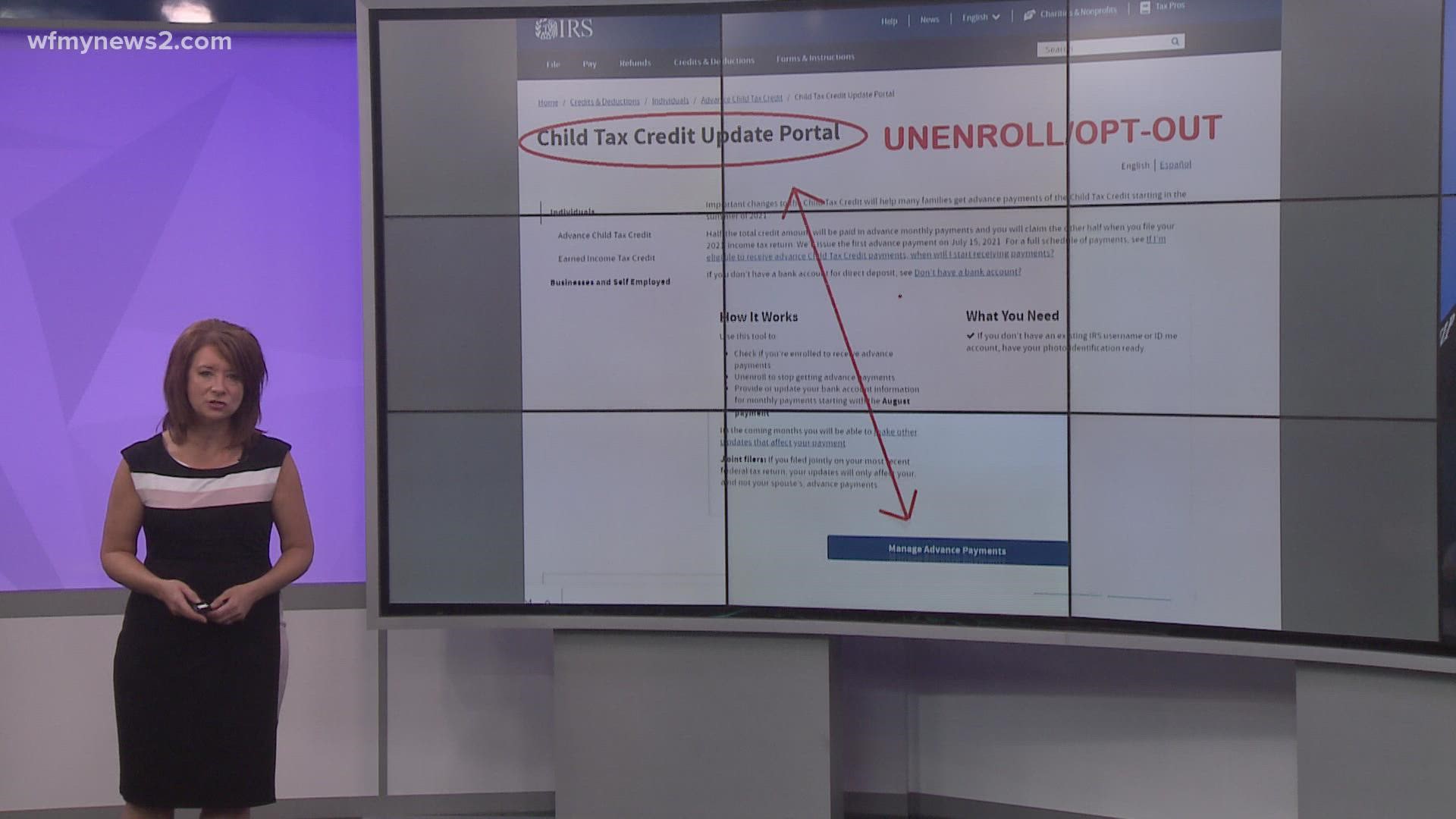

Also, if you're on the high end of the income threshold and you don't want the possibility of owing Uncle Sam, you may want to opt out. To unenroll you will use the Child Tax Credit Portal.

DEADLINE TO UNENROLL FROM THE CHILD TAX CREDIT ADVANCE PAYMENTS

If you unenroll by August 30, 2021, by 11:59 pm, this will stop the rest of the payments, meaning the September, October, November, and December advance payments will not be made to you, and you will be able to claim them during tax time in 2022.

MARRIED COUPLES MUST UNENROLL SEPARATELY

The first we have heard about this was during the IRS news release on August 13, 2021. Here is the information: For married couples, each spouse must enroll separately. If they each choose to unenroll, they will receive no monthly payments. If only one spouse unenrolls, they will still receive monthly payments, but they will be half the normal amount.

PORTAL TO CHANGE ADDRESS, DEPENDENTS, ETC.

If you need to make changes to your address, the number of dependents, marital status, or income, that doesn't come until later this summer, we'll keep you posted.

Do you have to do anything to get this? No.

It's automatic, but if you are a non-tax filer, the IRS just created a tool for you to put your info in so your direct deposit or check is not delayed.

STOP THE MISINFORMATION!

In the meantime, stories about the Advanced Child Tax Credit payments always get the same kind of comments about how people “should just go to work instead of collecting this money." Those comments are pure misinformation. The Advanced Child Tax Credit has nothing to do with jobs, unemployment, or benefits. This is a tax credit every parent can claim, every year, if eligible when they do their taxes. Parents are just getting to claim half of it a little early.