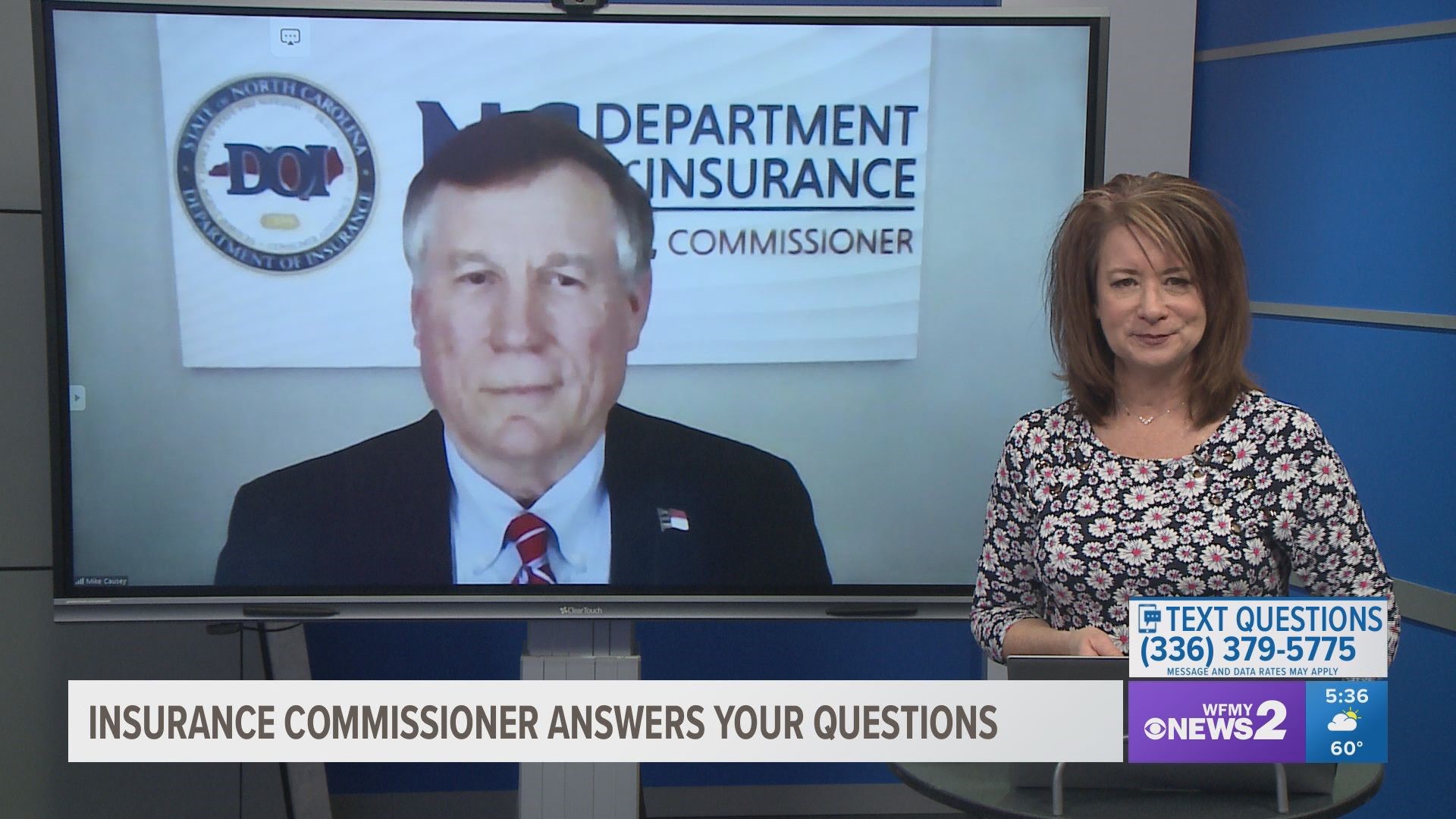

GREENSBORO, N.C. — Insurance claims can be a hassle. You may not always be sure when to file or who to file with.

To clear up the confusion, Department of Insurance Commissioner Mike Causey came on 2 Wants to Know to answer your questions.

Burn Awareness Week

Burn Awareness Week started Monday. Causey said the focus this year is on kitchen fires, one of the leading causes for house fires. The program runs in every state.

Causey said everyone should double down on the safety practices they normally use. He said people tend to cook more often this time of year, which makes fires more likely if people let their guard down.

Earthquake insurance

Causey said we don't typically think of North Carolina as a state prone to earthquakes. However, he said the numbers have been high in recent years.

Causey said earthquake damage coverage is not included in a standard homeowner's policy. People need either an endorsement or a rider to get it on their plan.

It typically does not cost very much, according to Causey.

Flood insurance

Hurricane season is not as far away as it seems.

Causey said people often wait too long to get flood insurance, and then it's too late. He suggests getting it early because there's a 30-day waiting period for the National Flood Insurance Program.

If you wait until a storm is in the forecast, you've likely waited too long.

Potholes

Winter weather has caused potholes to pop up across North Carolina's roads. That can cause car damage.

Causey said people should make sure their policy has comprehensive coverage. He said it's hard to get money back from the city or a municipality. The only way you'll get anything covered is if you can prove negligence.

Comprehensive coverage covers things like pothole damage, and you can get the repairs paid for.