GREENSBORO, N.C. — January is almost done and if you haven't already, you need to start thinking about your taxes.

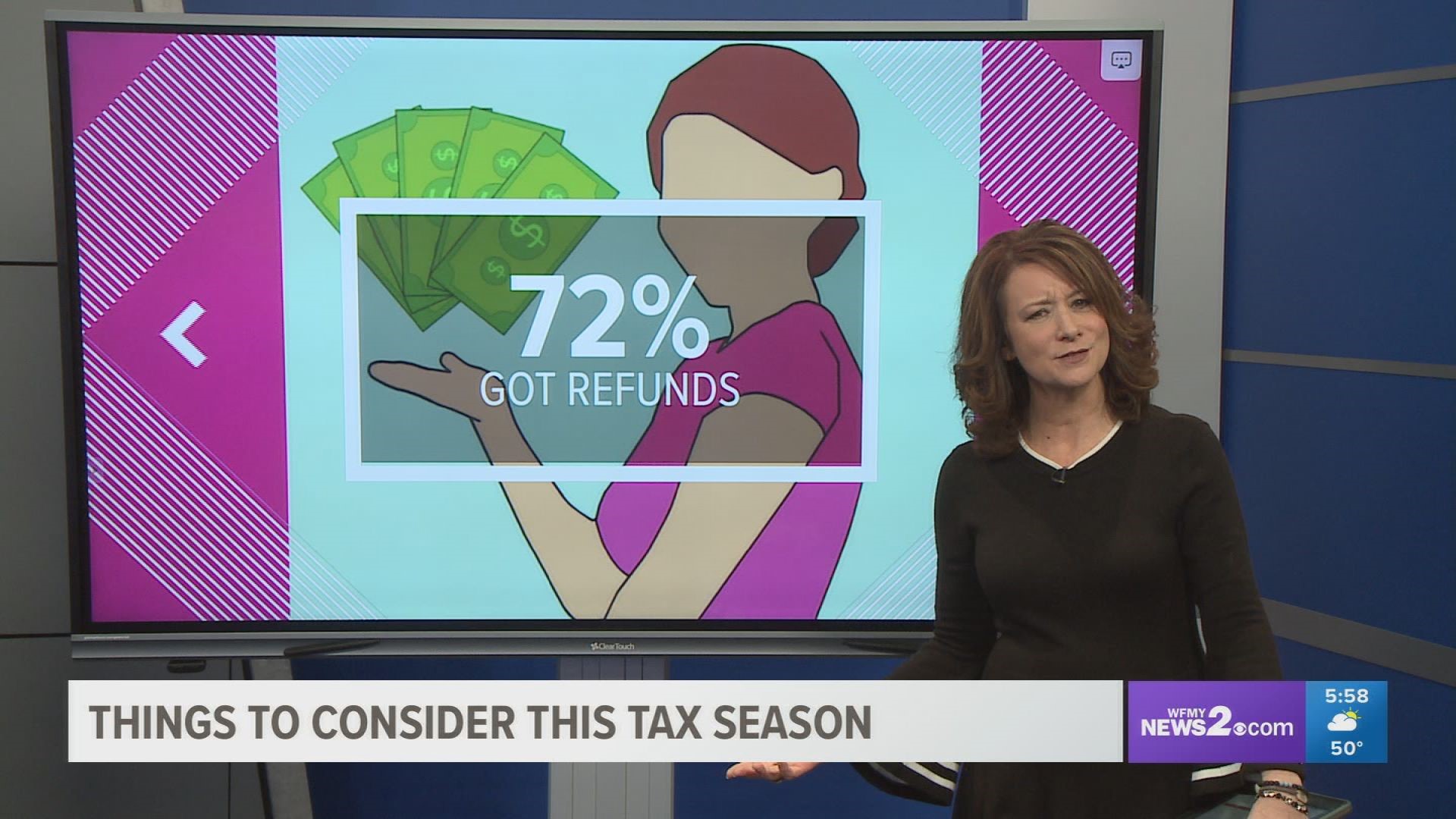

If you're worried about not getting a return, consider this. About 72% of the almost $156 million tax returns filed last year generated a tax refund, according to the IRS.

The average income tax refund was just under $2,869 in 2019. It was $2,910 in 2018.

Now that is slightly down from the average of $2,910 dollars in 2018. The amount of returns is actually down.

You also want to file early. The longer you wait the higher the chances of someone trying to steal your identity and your refund. So file as soon as you get those W-2s.

According to the IRS most refunds will be issued in less than 21 days as long as it doesn't require further review.

But get this, there's a good chance you can file your taxes for absolutely free.

If you make $69,000 a year or less you're allowed to file free

USA Today reports about 70% of taxpayers qualify for the free service, but less than 2% use it because they can't find it or it's frustrating.

We want to make it easy for you. Don't Google because you might wind up on a different site that could charge you. When you go to the irs.gov page, the free filing is in the upper left-hand corner.