GREENSBORO, N.C. — It's April 15, normally that's Tax Day. In 2021, Tax Day is May 17, 2021.

While filing and paying federal taxes moved to May 17, only filing your NC state taxes moved to May 17.

If you owe, then by law, you’re supposed to be paying your taxes on April 15 and if you didn't pay by then, the state can now start charging you interest.

Wait. Don't panic. Chances are the interest is all going to be waived. So why wasn't it done before now?

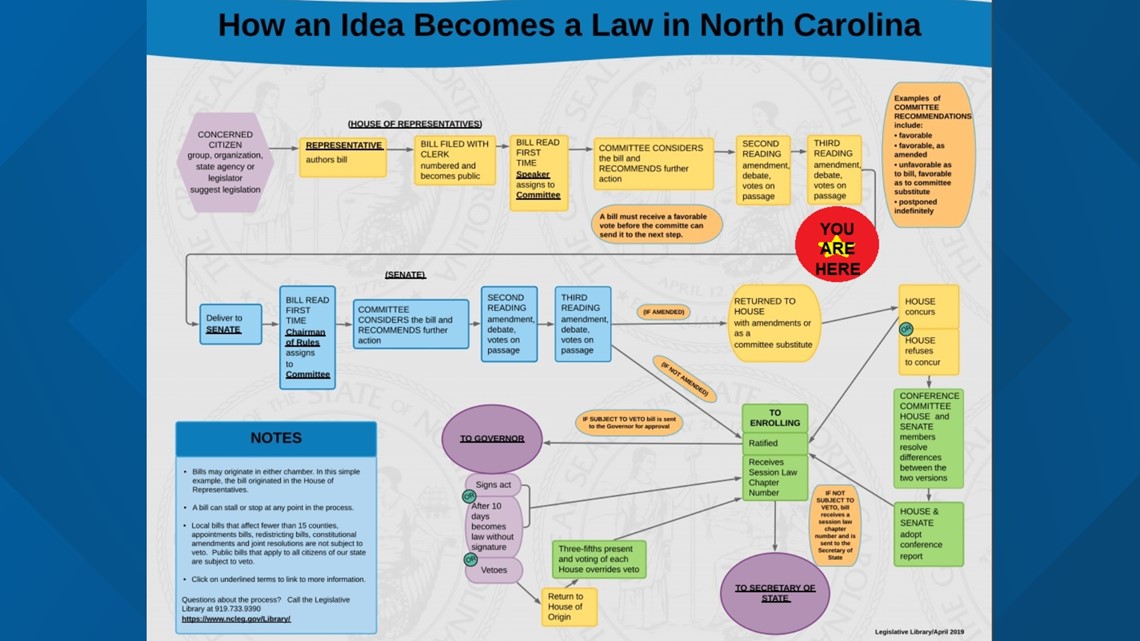

It's a matter of state law. North Carolina lawmakers have to change a law to move the interest on tax payments. They talked about House Bill 279 and even passed it on the third reading, but it's not law as of yet.

It may take another two weeks. Why? Check out the way a bill becomes a law in North Carolina. (Think of this as the map you see in the airport or the mall. See the ‘You Are Here’ icon)

While the bill continues to make the journey, are you racking up a heavy interest payment? Not really.

“They did change the law last year it's exactly what happened last year when Tax Day was moved from April to July. The NC legislature came in and made the change,” said Ryan Dodson of Liberty Tax Services.

So, now we wait for the bill to pass and the interest to be waived.

The NC DOR confirmed interest is not applied immediately on April 16 and the department will allow several weeks to see if there is a law change before moving forward with interest.