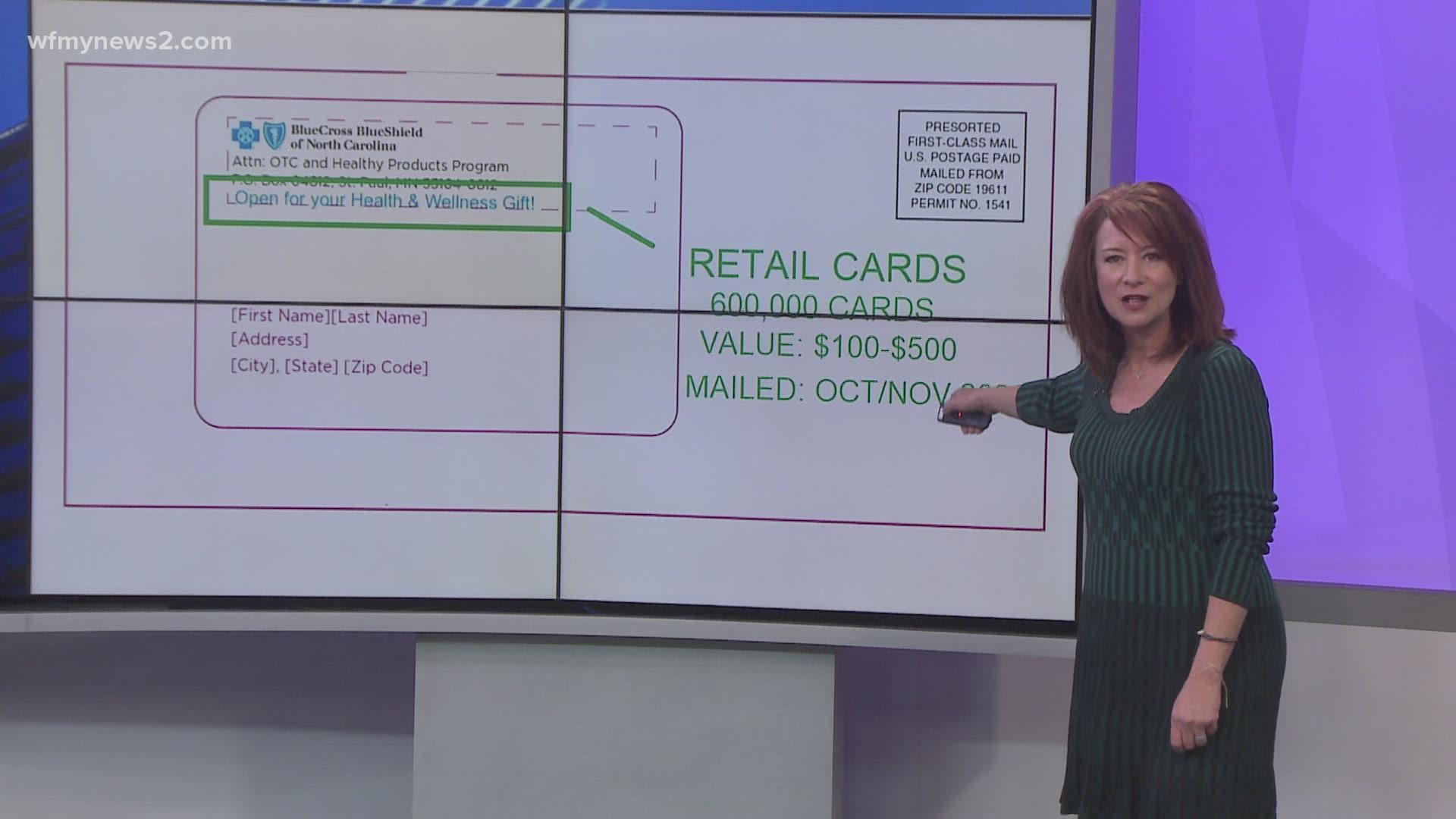

GREENSBORO, N.C. — In September of 2020, I was telling you about Blue Cross Blue Shield of North Carolina sending out ‘retail cards’ in the mail.

It's always good when you can tell folks money is coming to them.

Now, fast forward and a year and a half later, what has happened to those 600,000 cards with values between $100 and $500?

“With the pandemic and everything COVID happening, I wanted to have a cushion, so I put it aside and didn't spend it and I wanted to make sure it was there when I needed it,” said Amy Clemmons.

Amy had been saving her retail card for a rainy day. It can be used at stores to buy food, wellness products, baby items. She went to use it recently and…

“It didn't work, so it was declined. I tried calling their customer service, but they didn't know anything about it so I called you,” said Amy.

2 Wants To Know got in touch with Blue Cross Blue Shield of North Carolina and found out, the cards stopped working in October 2021, a year after they were mailed out. Good news though, you can still get your money.

Blue Cross NC's agreement with the vendor that issued these cards ended in October, and as a result, Blue Cross NC deactivated cards associated with this program on October 31, 2021.

However, subscribers are eligible to receive any remaining funds on the cards. To check program eligibility and access any remaining funds:

*Call the number on the back of your Blue Cross NC Member ID card

*Call the customer service number at 1-877-277-7912 (TTY: 711)

What you can use the retail cards for? Food, health-related expenses, over the counter medications, first aid supplied, vitamins, exercise equipment, baby care items

Where can you use the card? Some of the big-name retailers include Walmart, CVS, Walgreens, Rite Aid, Dollar General, and Family Dollar

What can't you use it for? Your insurance premiums, co-pays or deductibles, prescription drugs, tobacco, alcohol, and firearms. The card will reject any purchases of these items.

*So, if you're doing your grocery shopping with this card, make sure you don't include that bottle of wine and you pay for it on your own dime. Otherwise, the card could reject your whole purchase.

How much will you get?

“We have different premium levels based on coverage so it is tied to the underlying cost of the products the members had, so those who have more expensive products get the higher gift card and those who have the lower expensive products get the lower gift card,” explained Perry.

The retail cards are for those enrolled in the under 65 individual customers and fully insured employer groups. The cards do not have an expiration date. Once the cards are mailed, BCBSNC will have a place on their website to answer questions, including if you happen to throw away your card by mistake. The total for the cards is $200,000,000.

Where did they get this money? According to the BCBS release, it is from the Risk Corridor Program. These were the funds the government set aside before the Affordable Care Act. The funds were to protect insurers from losses. Here is a sample from the release:

Risk Corridor Program Funds

Blue Cross NC is able to fund these health and wellness retail cards for the direct benefit of its members from the monies received from the federal government following litigation related to the Affordable Care Act (ACA) temporary risk corridor program.

In April 2020, the United States Supreme Court ruled that the federal government is required to follow-through on the promise of the ACA risk corridor program that covered years 2014 through 2016. While not intended to protect insurers from all losses in the ACA marketplace, the risk corridor program provided an appropriate and necessary backstop on losses for insurers that were willing to serve people in the new marketplace.

In addition to the health and wellness retail cards, Blue Cross NC applied the remaining risk corridor funds to help keep 2021 rates for many of its customers lower. The company has been working hard to contain rates for several years and has achieved results. For example, for 2021, ACA plans offered to individuals will be reduced by an average of one percent on a statewide basis, the third straight year that Blue Cross NC has lowered ACA rates and a three-year cumulative reduction since 2018 of nearly $1 billion.