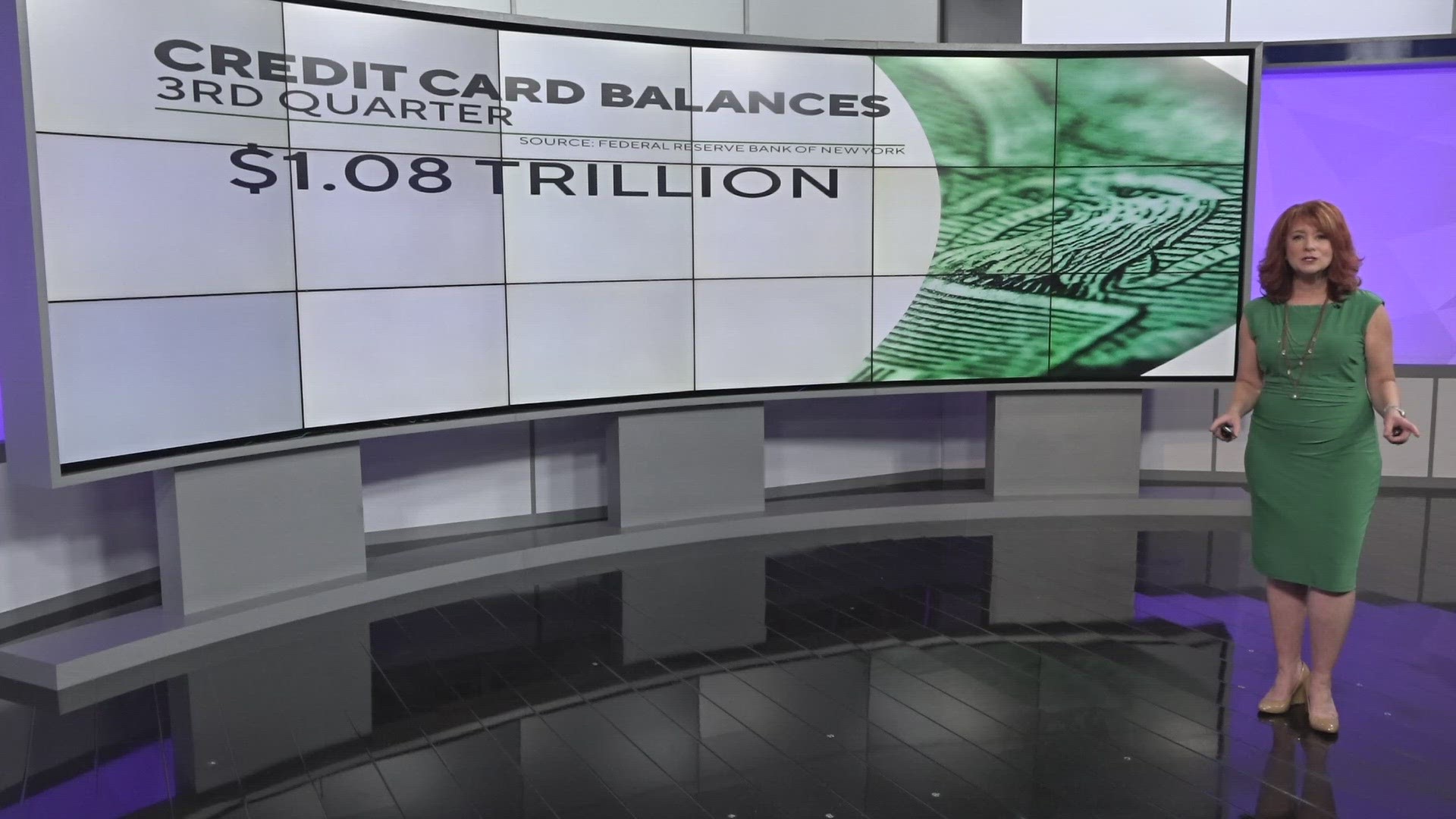

GREENSBORO, N.C. — There's a new record for credit card debt and it's one Trillion dollars. The Federal Reserve Bank of New York says when all U.S. credit card balances are combined it’s $1.04 Trillion. That's up 40% from the beginning of 2021.

“We're talking record-high credit card debt. Record high interest rates as well. The average credit card charges 20.72%. So, I think it's all related; we're talking about higher balances, higher interest rates,” said Tedd Rossman, Bankrate.com

According to Bankrate.com, 53% of credit card users pay off their bills every month and 47% carry a balance.

"That 47% with debt is up from 39% two years ago. So, unfortunately, we're moving in the wrong direction there," said Ted Rossman of Bankrate.com.

We all know interest rates are high, but let me put it into context for you. LendingTree.com says in 2019 only 2% of the 200 cards they reviewed had possible APRs or Annual Percentage Rates of 29.9% and just 1% of those cards reached 30% or higher.

In 2023, the numbers jumped. Now, 35% of the cards reviewed have APRs of 29% and 11% of the cards have an APR of 30% or higher.

“If you're someone who has credit card debt, it is going to affect you. You're going to pay more money each and every month every time they raise that interest rate,” said Ja’Net Adams, Debt Sucks University.

Money experts suggest trying the snowball method. That's where you make the minimum payments on all cards but add some extra on the lowest balance until you pay it off.

Then that progress snowballs towards the next lowest balance, you knock off one at a time.