GREENSBORO, N.C. — It's a night out, you're having fun with friends. It's all good until the bill comes and then there's the shuffle of how to split up the bill. If you don't have the waitress do it on separate bills, you're trying to make change for friends, someone ends up with more on their card than they should.

This is why peer-to-peer payment apps are so convenient. We're talking Venmo, Cash App, Zelle, and the various apps from many banks. Like everything else a consumer uses, there are a bunch of complaints about those apps.

In fact, North Carolina is 10th in the nation for the number of complaints about P2P payments apps to the Consumer Financial Protection Bureau. California is number one with more than 1,000 complaints, then there’s Texas, Florida, Georgia, New York, Ohio, and Pennsylvania are in there too.

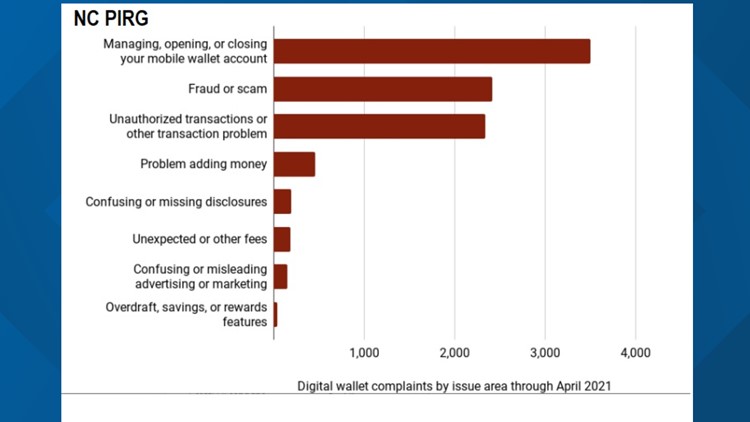

Topping the list of complaints:

- opening, managing, or closing accounts

- frauds and scams

- problems with transactions

Not only are the complaints about these issues rising, but the complaints that the companies won't help is also rising.

“We're seeing a lot of these companies warn of these kinds of problems, unfortunately, when people actually need the help, they don't have the robust customer service that they need to, to deal with these problems,” said Katie Craig NC PIRG, State Director.

NC PIRG, Public Interest Research Group, came out with a study on the complaints along with recommendations for the businesses and for consumers as well.

“A lot of folks don't know it's instantaneous and once you send the money you will never see it back and that covers fraud issues to simple mistakes like typing in the wrong user name,” said Craig.

Make sure you check the security and privacy settings on your apps. The default for some apps is public unless you change it.