GREENSBORO, N.C. —

The American Rescue Plan created a lot of relief for folks:

$1,400 stimulus checks, waiving up to $10,200 of unemployment income on federal taxes and suspending the requirement to repay excess advance payments of the 2020 premium tax credit.

But not everyone is getting the message about the ACA payment credits.

Viewer Pamela emailed 2 Wants To Know:

Many people, including myself, lost their employer medical coverage due to COVID-19 layoffs and went to the Healthcare.gov website to get coverage and are now facing large tax penalties.

“The problem is that the Rescue bill was not into law until March 12 of this year. So, as a result of all this, some people are going to pay it back. Some people are getting confusing messages and they're wondering do I or don't I pay this back,” said Charles Gaba of ACAsignups.net.

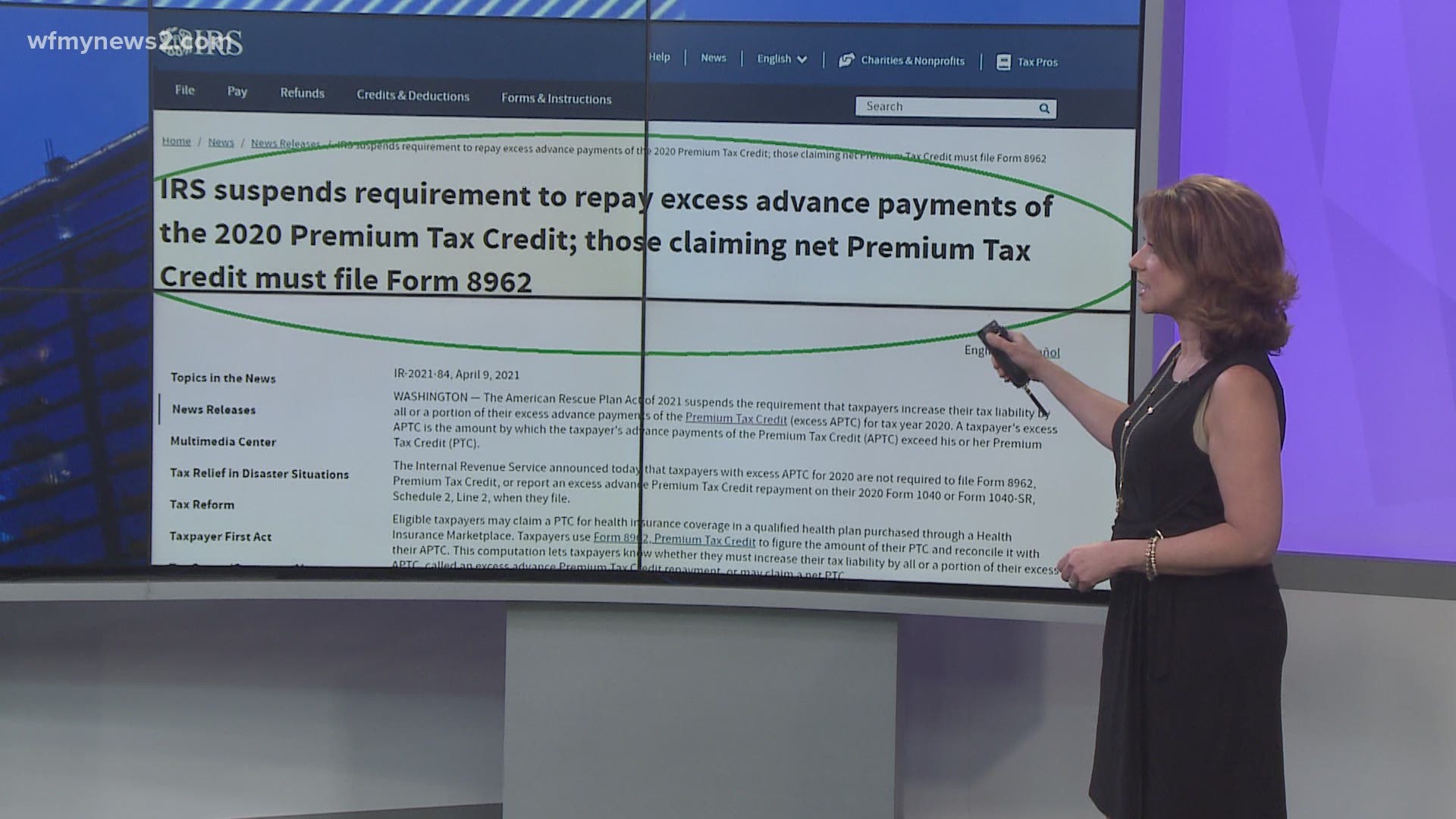

The IRS recently put out an alert. In part it says:

The IRS suspends the requirement to repay excess advance payments of the 2020 premium tax credit. Taxpayers who received a letter about a missing Form 8962 should disregard the letter if they have excess APTC for 2020. The IRS will process tax returns without Form 8962 for the tax year 2020 by reducing the excess advance premium tax credit repayment amount to zero.

What if you already filed?

The IRS says you should not file an amended return and don't contact them.

The IRS will reimburse people who have already repaid any excess advance premium tax credit on their 2020 tax return.

When? Good question. The IRS hasn't released that information as of yet. We'll keep you posted. It will most likely come in the form of a check sent by mail this summer much like the unemployment overpayment.

Unemployment Income Waived

The IRS could be sending you another payment this summer. It's not a stimulus payment, let me explain.

If you filed your 2020 taxes already and you got unemployment income in 2020, chances are you're going to get money back from the IRS. Here's why: the American Rescue Plan allowed taxpayers to exclude up to $10,200 in unemployment benefits from their Adjusted Gross Income (AGI).

Because of that, taxpayers didn't have to pay taxes on that income, but the legislation took effect after many filed returns and paid that tax. So now, Uncle Sam owes you that money back. The refunds will come automatically, you don't have to do anything. The IRS estimates the refunds will start to go out in May and will continue through the summer.