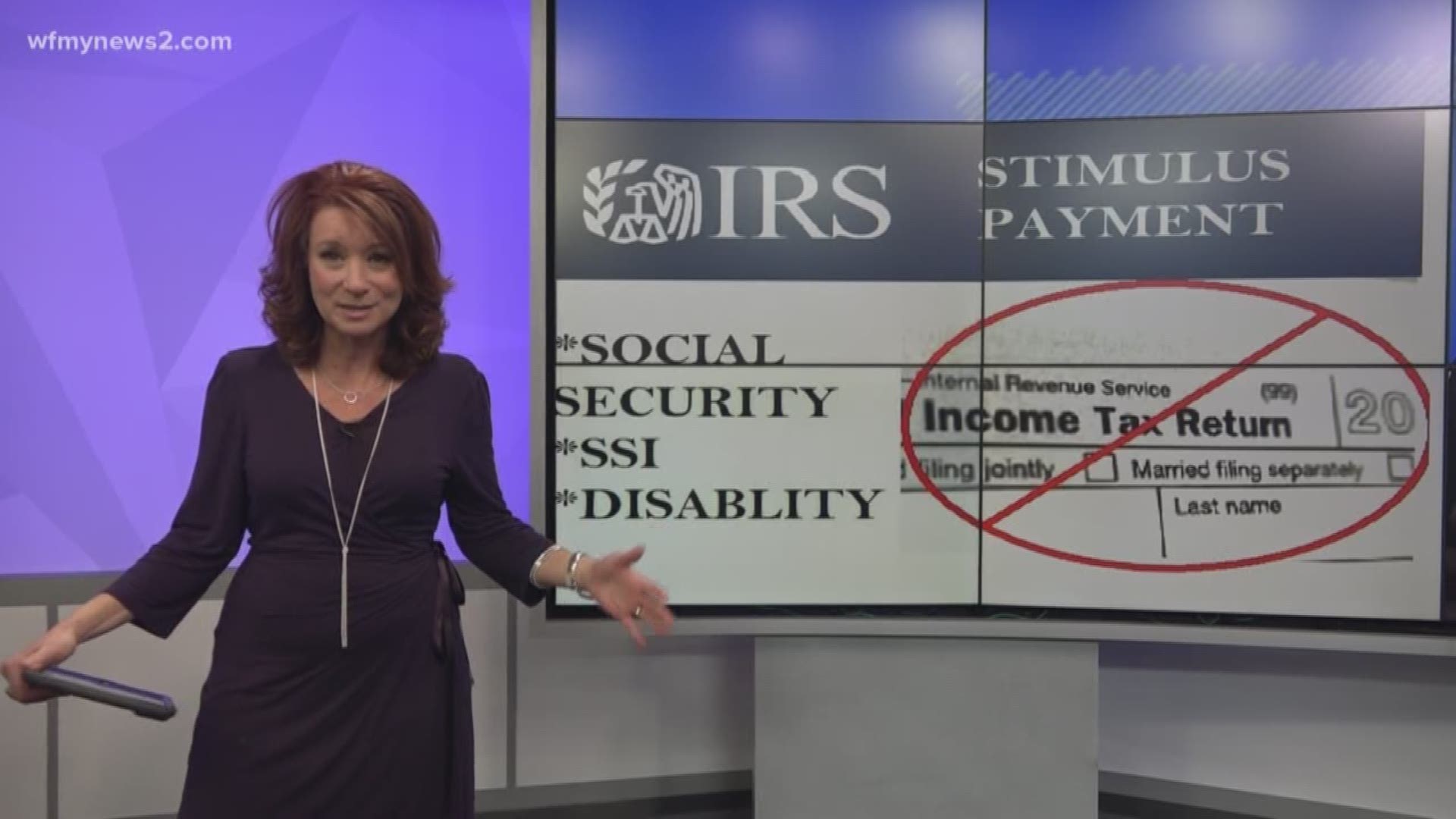

Are you getting a stimulus check? Most likely, yes! You don’t even have to do anything to get it. The IRS will use your tax return info from 2018/2019 or they will use your Social Security benefits info.

You don't have to do ANYTHING to get your stimulus payment!

This is when the bad guys come out of the woodwork. Get ready for emails, texts, Facebook messages, and phone calls.

“The scammers are going to say we need info like your Social Security number or we need your bank account to make sure you get the stimulus. This is untrue,” said Lechelle Yates from the Better Business Bureau.

Seriously, the scammers are going to make it appear they are from agencies or the government, but that is NOT true.

“No matter how urgent it seems or how legitimate it may seem, you don’t have to do anything to get your money from the government. You can’t get it quicker. There’s nothing wrong with your account. Don’t let them fool you.”

Here are the amounts:

Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns will receive the full payment of $1,200 and there is $500 for each qualifying child younger than 17.

Eligible taxpayers who filed tax returns for 2019 or 2018 will automatically receive an economic impact payment. The IRS will direct deposit payments from info from your tax return, otherwise, there will be a check.

Social Security recipients, SSI, disability recipients and railroad retirees who are otherwise not required to file a tax return are also eligible and WILL NOT be required to file a return. You will get the stimulus automatically.