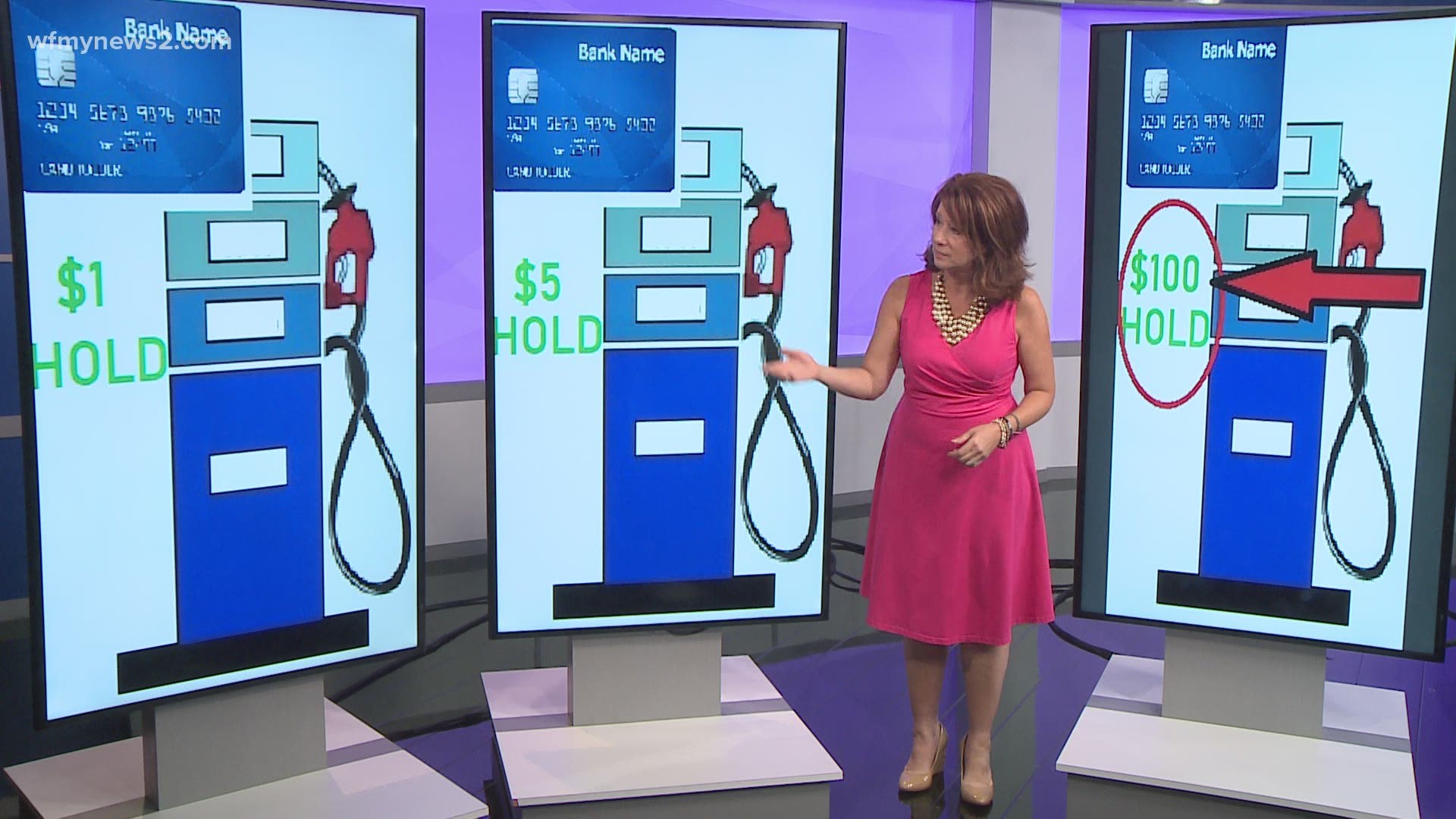

GREENSBORO, N.C. — A "hold fee" of $1 on your card, so you can pump as much gas as you need, is not a big deal. When the hold is $100, you could have some big problems.

“If you're using a debit card, that money in your actual account is frozen until you check out or make the payment,” explained Nathan Grant of Credit Card Insider.

It’s a problem a viewer wrote to us about.

"My daughter pumped $10 worth of gas on her debit card. A hold fee of $100 was put on her card. She has less than that in her account! Now, she's getting overdraft fees and it has lasted several days," Sara said.

Gas stations can put a hold on each card purchase. It could be $1, $5, $100. Each merchant sets the hold fee. There is no standard.

Why do they do it?

“It's a security measure. They don't know if you're going to pump $10 or if you're going to fill up a big truck. It’s much like a hotel deposit for incidentals like room service. You get it back if you don’t use it,” Grant said.

So, how do you get around it?

Go inside. Really. When you use any kind of card, credit or debit, but you go inside and tell the cashier a set amount ahead of time, there is no hold.

“You can avoid that by saying, 'I want to put $10 on pump two.' The hold fee doesn't count for those types of charges,'” Grant said.

With the risk of skimmers on gas pumps, 2 Wants To Know's rule of thumb to protect your money at the pump is to dedicate one credit card to gas. This way, you'll know quickly if a scammer is using it for a non-gas purchase and it's a credit card, so it's not hooked to your bank account.

Remember, a debit card run as a credit card doesn't mean your money is protected like a credit card. A debit card, even if you use it as a credit card is still tied to your bank account. That means your money can be held or frozen so you can’t use it until the transaction clears.

“This could take a while. It has to clear the gas station, the credit card company, the bank. There’s no set time of how long the hold stays on there. It could be a couple of days,” Grant said.