![Thanks To Mobile Banking Checks Can Be Cashed Twice[ID=29641973] ID=29641973](http://wfmy-download.edgesuite.net/video/29641973/29641973_Still.jpg)

GREENSBORO, NC -- A consumer alert for those of us still using the good old fashioned check book. There is a new wave of fraud to look out for. Thanks to the intersection of old and new banking technology - those checks could be cashed twice.

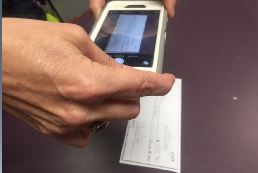

Before mobile banking -- payees had to physically had over checks when they deposited them. Now - mobile banking allows you to simply snap a picture of the check. So after it's deposited, the original is still floating around. This means that – whether accidentally or on purpose – the check could be deposited a SECOND time.

It's called "double presentment." Banks are typically good at catching this at the same bank, using the same channel. So if you forget and accidentally cash a check again, it's likely to be flagged.

But here's where the fraud comes into play. If criminals use different channels like once on a phone and then at the ATM, it gets trickier.

A bigger problem -- depositing the same check into multiple checking accounts with multiple banks.

Security hasn't quite caught up to the technology. So in the meantime - YOU are the best line of defense. Keep up with your bank account balance. Don't depend on your bank to catch the fraud. The earlier you report it, the easier it is to make it right.

![635714555923891293-mobile-check-cashing [ID=29640943]](http://cdn.tegna-tv.com/-mm-/e4dfe71447efa4592267c5cb9115edf91933b706/r=500x335/local/-/media/2015/07/02/WFMY/WFMY/635714555923891293-mobile-check-cashing.JPG)