GREENSBORO, N.C. — It is the start of the 2022 hurricane season, it is June 1.

While most people look at the coast as having the biggest problems, you can get storm flooding almost anywhere.

2 Wants To Know doesn't want you to miss this because it could cost you a whole lot of money: flood insurance is not automatic.

“On the standard homeowners form, earthquake or earth movement and flood are two of the most common exclusions. you don’t have this coverage in any form or fashion if you want this coverage you need to buy it,” said Christopher Cook of Alliance Insurance Services.

To be clear, your regular homeowners policies cover nothing flood-related. Flood damage and content policies are extra.

How much? For example, a $150,000 house in a low-risk area will cost you about $400 a year.

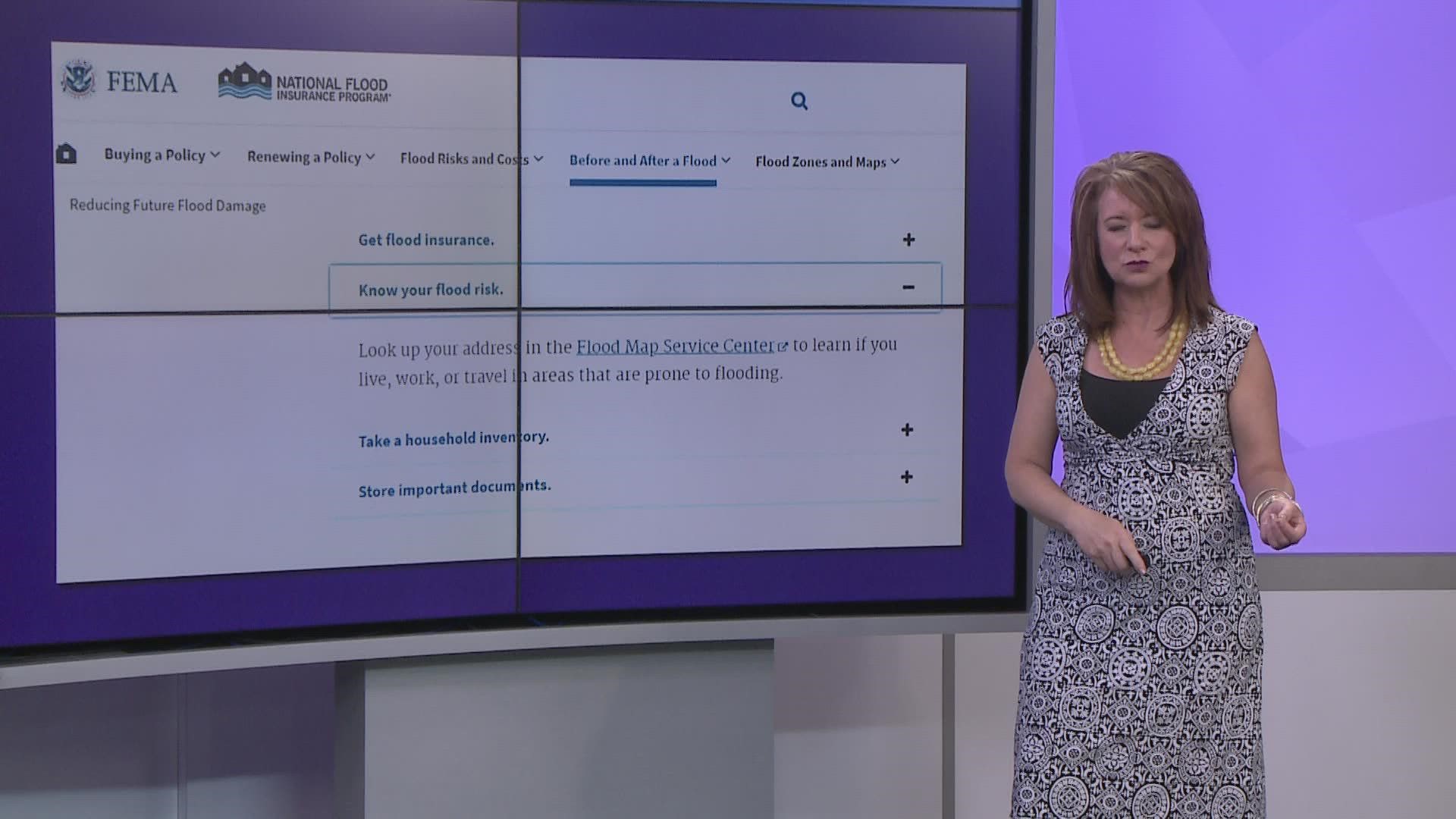

The FEMA website lists the steps you should take before flooding becomes an issue. The first recommendation is: Get flood insurance.

The next is to find out where you live in relation to flood-prone areas. FEMA provides a way for you to look up your address in the flood map service center to see if you live, work or travel in areas prone to flood.

Next on this list: Take a household inventory.

“It doesn't have to be complicated, you can even use the camera on your phone,” said a Consumer Reports expert.

Open up closets, cabinets, and drawers. Walk around your home, and describe everything you would want to replace if there was a flood, fire, or tornado. It's easier to reference this video than try to remember everything.

FEMA has a flood simulator, an inch of water can cost $25,000 in damage. Go up to a foot of water and you're looking at $70,000 plus.

One last note, when you get flood insurance, it doesn’t take effect for 30 days, so doing it right before a storm, won’t help you.