GREENSBORO, N.C. — Just a few days ago, the IRS was telling folks in 20 states to hold off on filing their taxes. North Carolina was not one of those states, but a lot of folks were wondering why some states were part of the delay and some weren't. Here's the 101.

“Because of surpluses or COVID or what have you, the states have decided to issue refunds or rebates to their citizens. In California it was to battle inflation, in Florida it was a surplus. Because they've done that, the IRS had not yet determined if those rebates are taxable for federal purposes or not,” said Ryan Dodson of Liberty Tax Services.

The IRS has determined taxpayers in most states would not have to pay taxes on the state rebates. But a handful of states, Alaska, Georgia, Virginia, South Carolina, and Massachusetts have some instances when some taxpayers would have to pay if certain criteria were met.

While taxpayers might have liked the idea of getting a delay, tax preparers say delays aren't good for anyone really except scammers.

“We encourage folks to file as soon as their paperwork comes in because of identity theft. The IRS serves on a first come first serve basis, so if you get it in before an identity theft person gets it in, it is safe,” said

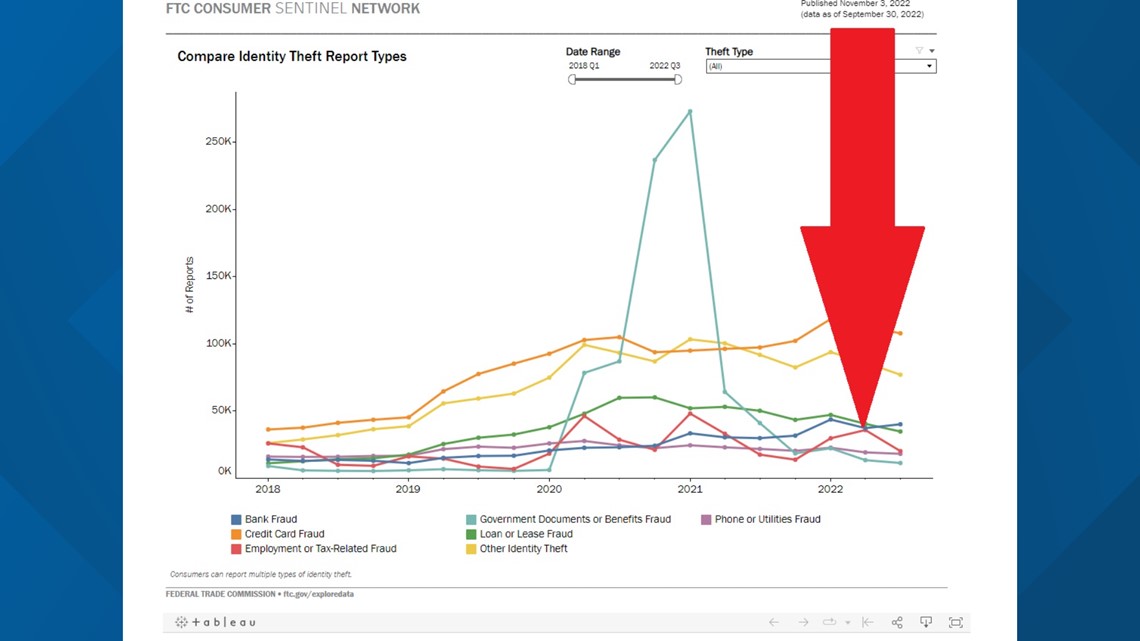

The Federal Trade Commission tracks all kinds of identity theft. In the graph, the red line is employment or tax-related fraud. While it's not as high as credit card fraud, you don't want to be one of the thousands upon thousands of people trying to figure out how to fix the mess.

Let me remind you, the IRS has free e-file options.

If you made $73,000 or less in 2022, you can file your taxes electronically for free--- using brand name software.