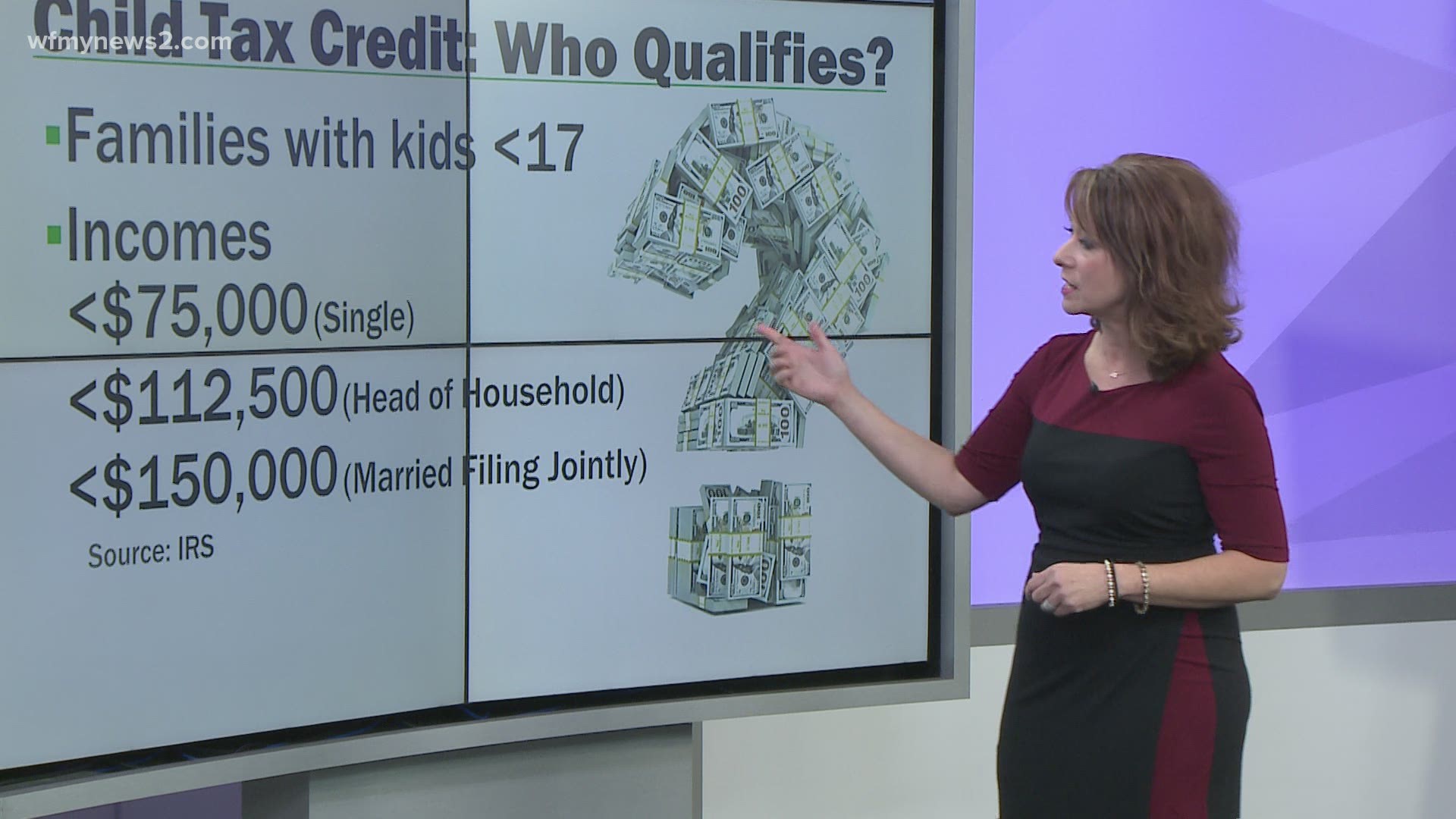

GREENSBORO, N.C. — Parents are set to get their first Child Tax Credit Advance payment on July 15, 2021. Parents of kids 17 and younger will either get $250 or $300 per kid each month on the 15th until the end of the year, except for August, it will be the 13th since the 15th is on a weekend.

These payments are an advance on the child tax credit on the 2021 taxes. Parents will automatically get the payments unless they opt-out or unenroll. If you opt-out, then you will be able to collect all of the tax credit at one time. Some taxpayers may want to do this to get a bigger refund.

Why are parents getting this money? Parents were due to get this money when they filed their 2021 taxes, it is a tax credit. Instead of waiting for tax time, the government is giving advance payments. You'll get about half of the tax credit this year and claim the rest next year on your taxes.

Total, parents receive either $3,600 for each child under 6 years old or $3,000 for each child 6 years old to 17 years old.

Most of the payments will be made by direct deposit, otherwise, the payment comes by mailed check.

Update Portal allows people to unenroll

Instead of receiving these advance payments, some families may prefer to wait until the end of the year and receive the entire credit as a refund when they file their 2021 return. In this first release of the tool, the Child Tax Credit Update Portal now enables these families to quickly and easily unenroll from receiving monthly payments.

The unenroll feature can also be helpful to any family that no longer qualifies for the Child Tax Credit or believes they will not qualify when they file their 2021 return. This could happen if, for example:

- Their income in 2021 is too high to qualify them for the credit.

- Someone else (an ex-spouse or another family member, for example) qualifies to claim their child or children as dependents in 2021.

- Their main home was outside of the United States for more than half of 2021

Accessing the Update Portal

To access the Child Tax Credit Update Portal, a person must first verify their identity. If a person has an existing IRS username or an ID.me account with a verified identity, they can use those accounts to easily sign in. People without an existing account will be asked to verify their identity with a form of photo identification using ID.me, a trusted third party for the IRS. Identity verification is an important safeguard and will protect your account from identity theft.

Anyone who lacks internet access or otherwise cannot use the online tool may unenroll by contacting the IRS at the phone number included in your outreach letter.

DO YOU QUALIFY FOR A CHILD TAX CREDIT?

The new Child Tax Credit Eligibility Assistant allows families to answer a series of questions to quickly determine whether they qualify for the advance credit.

Coming soon, families will be able to use the Child Tax Credit Update Portal to check the status of their payments. In late June, people will be able to update their bank account information for payments starting in August. In early August, a feature is planned that will allow people to update their mailing address. Then, in future updates planned for this summer and fall, they will be able to use this tool for things like updating family status and changes in income.

For more information see the FAQs, which will continue to be updated.