GREENSBORO, N.C. — How do you like your tax refund? If you like to deduct a few things here and there and get a little something, great. But if you like the idea of having a much bigger tax refund, then you need to take action right now.

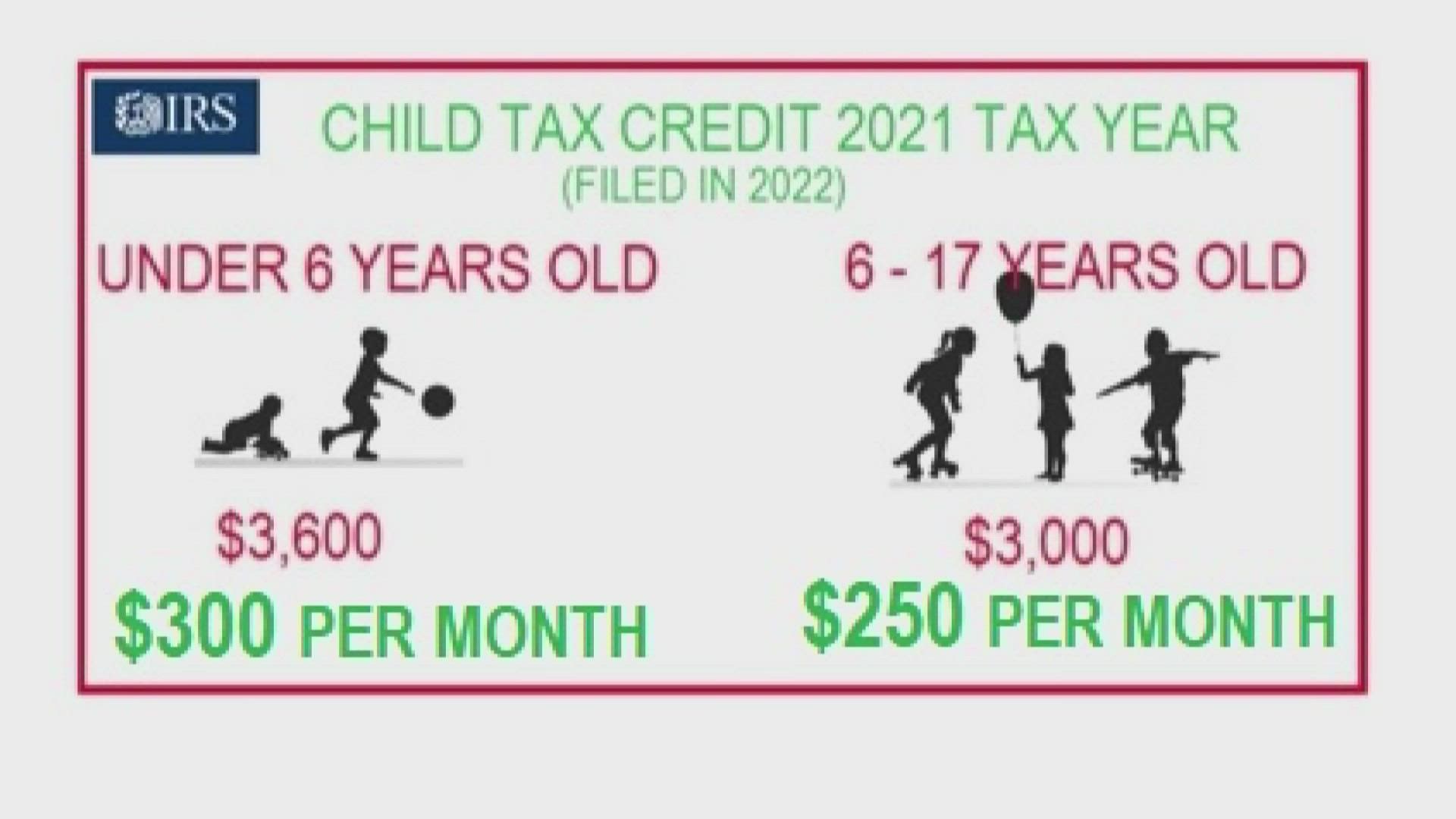

The next Advanced Child Tax Credit payments are set to go out on September 15th. Every time one of the advanced payments is sent to you, you have less to deduct come tax time. The total Child Tax Credit for 2021 is $3,600 for each child under 6 years old and $3,00 for each child 6 to 17 years old.

Usually, you get to make these big deductions all at once on your taxes, but this year, half of the amount was available in advance payments, as a form of COVID relief.

If you want to skip the payments now so you have the bigger deduction at tax time, you need to unenroll or opt-out of the payments before midnight August 30, 2021. To opt-out or unenroll, you have to go to the IRS Child Tax Credit Portal.

And don't miss this, besides the midnight deadline, if you're married, both you and your spouse have to opt-out separately or you'll get partial payments.

If you want to get the payments and have a smaller deduction at tax time, you don’t need to do anything to get the remaining payments, they will come as they have the last two months.

If you've had a child this year, the IRS isn't ready to take that info as of yet, but a portal is promised in the next month or so.