GREENSBORO, N.C. — Insurance can be confusing, and confusion over something you pay for can be frustrating.

Which company should you go with to cover your home and car?

Why are their rates different?

How can I prepare for severe weather?

The N-C Department of Insurance saved and recovered *millions* of dollars to consumers in 2020 form complaints and in other ways.

But how did they do it?

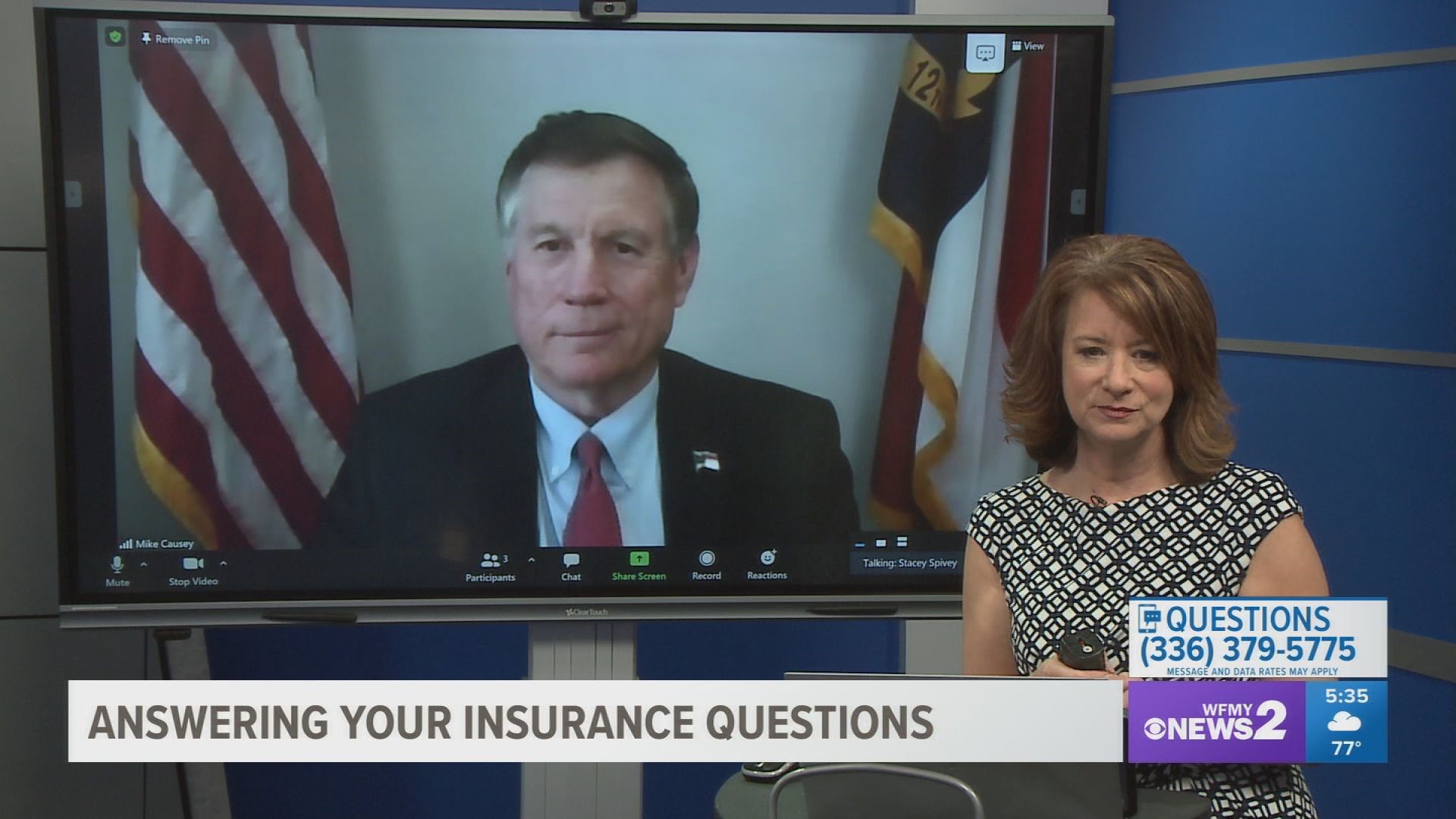

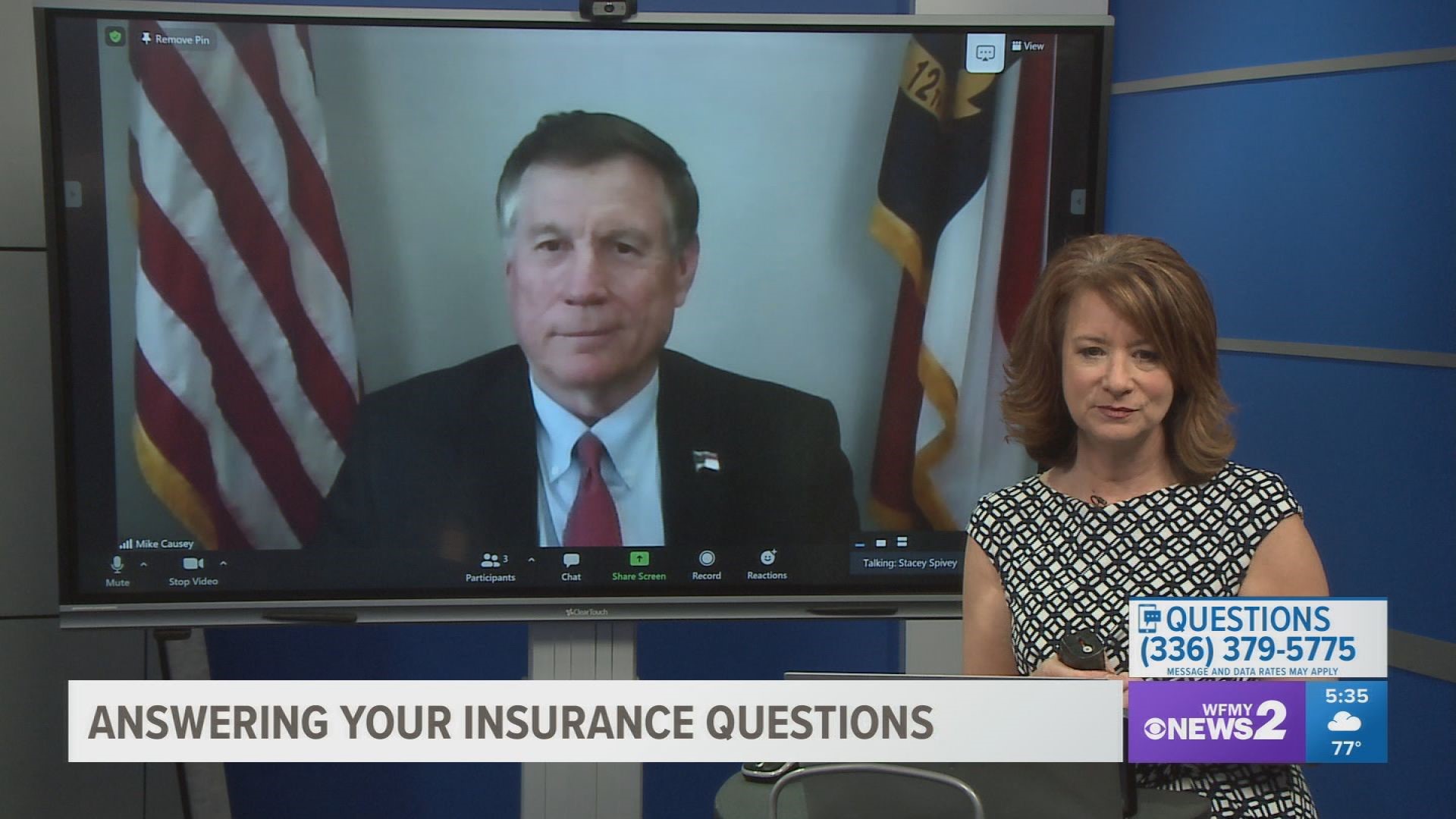

NC Department of Insurance Commissioner Mike Causey joined 2 Wants to Know to explain to viewers exactly what the department does and how it's helped so many customers save or get their money back.

What does the NC Department of Insurance do?

The department fights for more competition in the industry and wards off insurance fraud to drive rates lower for consumers.

What can consumers talk to the department about?

There's no limit on questions, but you can contact the department about:

- Car insurance

- Homeowners insurance

- Life insurance

- Health insurance

- Annuities

- Business insurance

- Disability income insurance

- Travel insurance

Addressing distracted driving:

Distracted driving is one of the major factors putting upward pressure on automobile insurance rates. Distracted driving includes texting and cell phone use, adjusting GPS, radio stations, eating/drinking while driving, putting on makeup, tending to children. Causes property damage, injury and loss of life.

Preparing consumers for severe weather:

Be prepared for severe weather. Talk to your insurance agent to make sure you have the appropriate insurance for your property, including flood insurance. Also, check for earthquake insurance. We're not immune from earthquakes in NC. DOI is sponsoring continued education courses on flood insurance for insurance agents, adjusters, real estate agents.

Do I need a smoke alarm in my house?

Smoke alarms save lives. The best chance you have of surviving a fire is if you have a working smoke alarm. Test them, make sure they're working. Fire departments distributing and installing smoke alarms.

How does the department help with insurance fraud and how do I report it?

About 20 cents on each insurance premium dollar goes to cover the cost of insurance fraud. Commissioner Causey has more than doubled the number of fraud investigator Special Agents since first taking office in 2017.

You may report insurance fraud using any of the methods below

- Report Insurance Fraud Online

- Phone: 919-807-6840 or Toll-Free 888-680-7684 (NC Only)

- Fax: 919-715-1156

- Email: reportfraud@ncdoi.gov

- Mail: Criminal Investigations Division, NC Department of Insurance, 1201 Mail Service Center, Raleigh, NC 27699-1201

I have old medications I don't need anymore, should I throw them away?

We have a big campaign going to get people to empty their medicine cabinets of old medicines you don't need any more. Bring them to one of our drop sites and we'll dispose of them properly. That keeps these drugs out of the hands of children and drug dealers, and protects our waterways. Find a permanent drop-off location at our Operation Medicine Drop website.

How can I contact the Department of Insurance with general questions?

Physical Address:

Albemarle Building

325 N. Salisbury Street

Raleigh NC 27603-5926

Mailing Address:

NC Department of Insurance

1201 Mail Service Center

Raleigh NC 27699-1201

Toll Free 855-408-1212

Agent Services: 919-807-6800

The Public Information Office contact number is 919-807-6011

Or you can email the Commissioner directly at Mike.Causey@ncdoi.gov