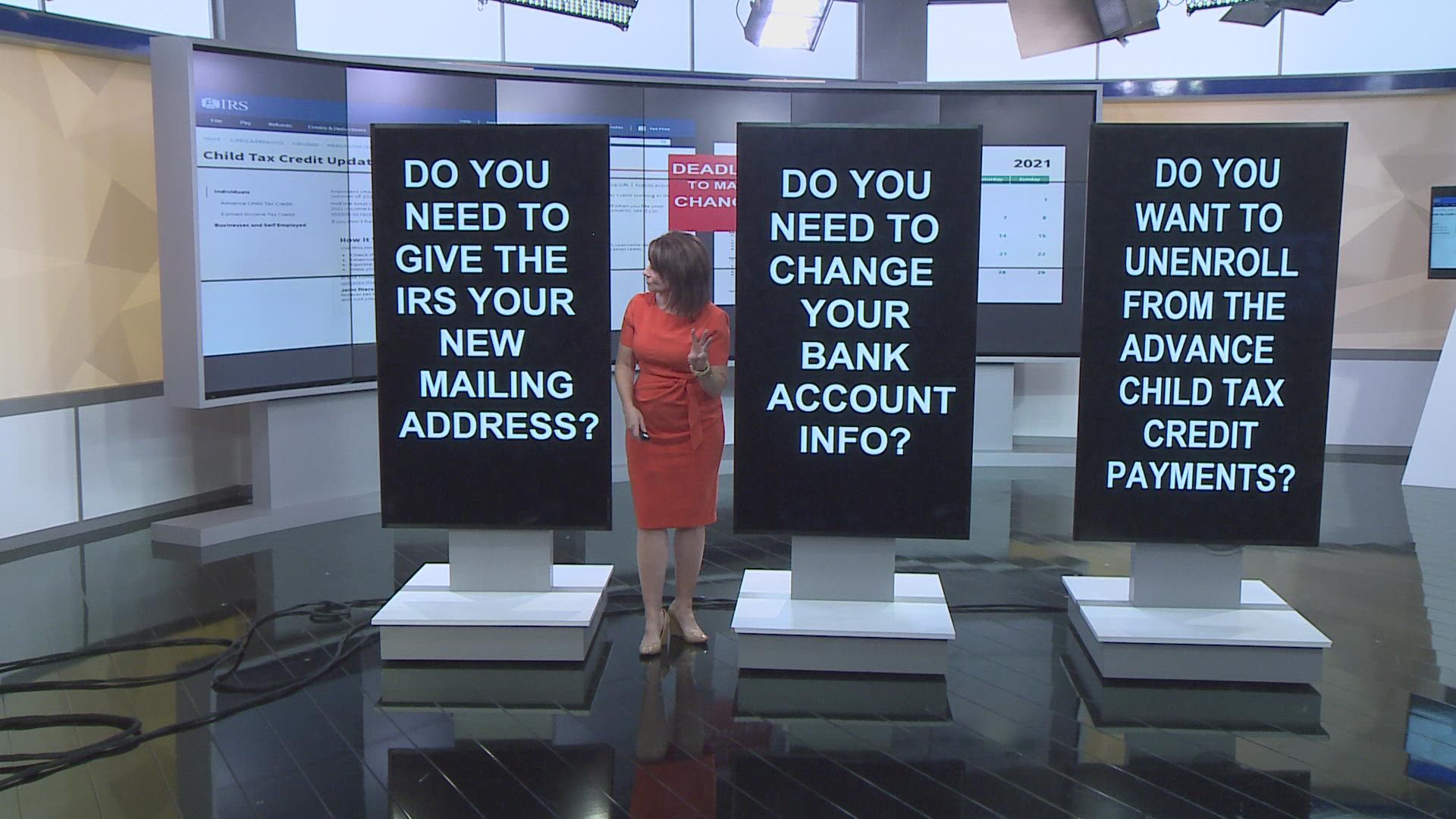

GREENSBORO, N.C. — Do you want to unenroll from the Advanced Child Tax Credit payments? Maybe you need to change your address or give the IRS your new bank account info. Now is your chance.

The Internal Revenue Service Child Tax Credit Update Portal is now ready to take updated mailing information. According to the IRS, this feature will help any family that chooses to receive their payment by paper check avoid mailing delays or even having a check returned as undeliverable.

Any family can easily have their September check and all future checks sent to their new address by using the portal to make an address change request. To have the change take effect in September, people need to complete the request before midnight Eastern Time on Monday, August 30. Families can still make changes after that date, but their request will not be effective until the next scheduled monthly payment.

IRS PORTAL CHANGES:

The address change feature joins a growing set of services available through the Child Tax Credit Update Portal. Available only on IRS.gov, the portal already allows families to verify their eligibility for the payments and then if they choose to:

- Switch from receiving a paper check to direct deposit;

- Change the account where their payment is direct deposited; or

- Stop monthly payments for the rest of 2021.

Any of these changes made before midnight ET on August 30, will apply to the September 15 payment and all subsequent monthly payments, scheduled for October 15, November 15, and December 15.

WHY UNENROLL IN THE CHILD TAX CREDIT PAYMENTS?

The advance payments total about half the total child tax credit you will see on your 2021 taxes. If you like getting one big deduction at tax time, you’ll want to unenroll from the payments.

Also, if you're on the high end of the income threshold and you don't want the possibility of owing Uncle Sam, you may want to opt out. To unenroll you will use the Child Tax Credit Portal.

DEADLINE TO UNENROLL FROM THE CHILD TAX CREDIT ADVANCE PAYMENTS

If you unenroll by August 30, 2021, by 11:59 pm, this will stop the rest of the payments, meaning the September, October, November, and December advance payments will not be made to you, and you will be able to claim them during tax time in 2022.

MARRIED COUPLES MUST UNENROLL SEPARATELY

The first we have heard about this was during the IRS news release on August 13, 2021. Here is the information: For married couples, each spouse must enroll separately. If they each choose to unenroll, they will receive no monthly payments. If only one spouse unenrolls, they will still receive monthly payments, but they will be half the normal amount.

WHAT PAYMENT CAN YOU EXPECT?

Parents will get $300 for each child under the age of 6

and $250 for each child ages 6 to 17 years old.

WHEN DO THE PAYMENTS COME?

the advance payments on the Child Tax Credit will be made once a month through December. Each of the due dates is the 15th of the month except for August when the 15th falls on a weekend.

Future enhancements are planned for the Child Tax Credit Portal

Later this year, families will also be able to use the Update Portal tool to:

- Add or remove children in most situations;

- Report a change in marital status; or

- Report a significant change in income.