GREENSBORO, N.C. — Covid-19 has made a mess of a lot of our finances. Thankfully, there's been some help:

No evictions.

No shutting off water or electricity.

Protection for those who need to miss payments on credit cards, mortgages and student loans

But what one of your neighbors is dealing with maybe your issue too.

The viewer says, “I had to miss a couple of payments during COVID on my credit cards. I communicated with these companies and now have caught up. The rub is...it still pings your credit. My score dropped by 100 points.”

Yipes! When your credit score goes down by 100 points, it's a big deal.

Your credit score determines how much you get charged in interest for loans, it can keep you from getting the apartment you want to rent or even a job.

So, what do you do? Financial expert Ja’Net Adams explains, “If she requested help after March 13th (when the President declared the Coronavirus a national emergency) she is safe with the CARES Act. It says in the CARES Act she shouldn't be penalized because she asked for the relief like she was supposed to.”

RELATED: 'It's an economic virus': NC Treasurer warns of cities and counties dipping into money reserves

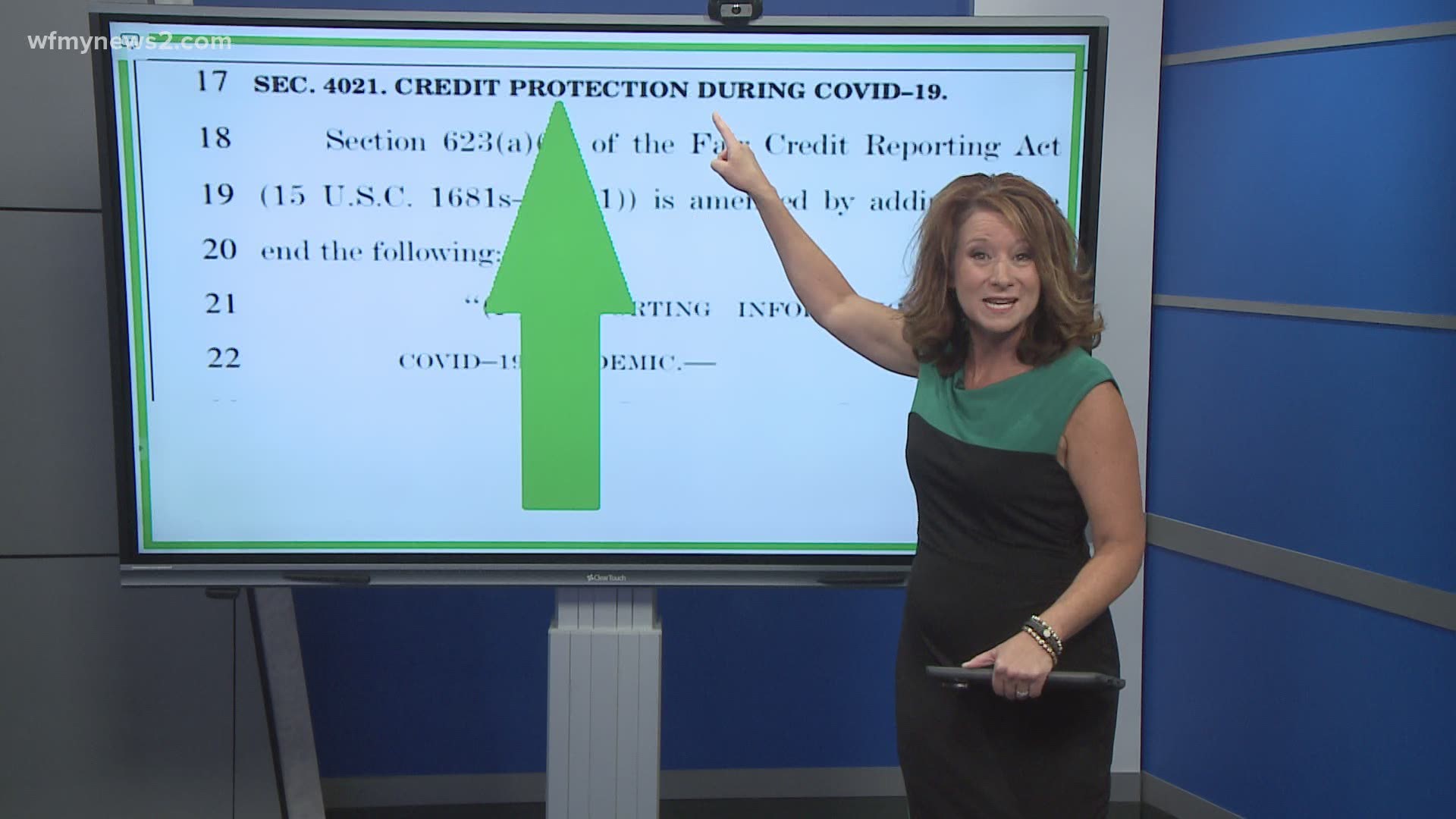

Section 4021 of the CARES Act temporarily amends a section of the Fair Credit Reporting Act. Basically, it says if the creditor makes accommodation for payments then the creditor is obligated to report the account as current. Therefore, keeping your credit standing and score intact.

But, mistakes happen. You need to pay attention to. Most credit card companies will give you your credit score for free-- check it. And if it's wrong, start making calls!

“Reach out to the creditor and remind them of their obligation and to correct it they need to call each credit bureau. To follow up, you might want to call the credit bureaus yourself,” advises Adams.

And if you think you need more help there are free Consumer Credit Counseling offices all over the nation.