GREENSBORO, N.C. — December 15, 2021, marks the last of the Advanced Child Tax Credit payments. In total, six payments were made this year, starting in July.

The December payout was $16 billion nationwide. Here is part of the IRS news release:

- Families will see the direct deposit payments in their accounts starting Dec. 15. Like the prior payments, the vast majority of families will receive them by direct deposit.

- For those receiving payments by paper check, be sure to allow extra time, through the end of December, for delivery by mail.

- Payments are going to eligible families who filed a 2019 or 2020 federal income tax return. Returns processed by Dec. 1 are reflected in these payments. This includes people who don’t typically file a return but either during 2020 successfully filed a return to register for Economic Impact Payments using the IRS Non-Filers tool on IRS.gov, or in 2021 successfully filed a return by using the Non-filer Sign-up Tool for advance CTC.

- Families who did not get a July, August, September, October or November payment and are getting their first monthly payment this month will still receive their total advance payment amount for the year (which is half of their total Child Tax Credit). This means that the total advance payment amount will be made in one December payment.

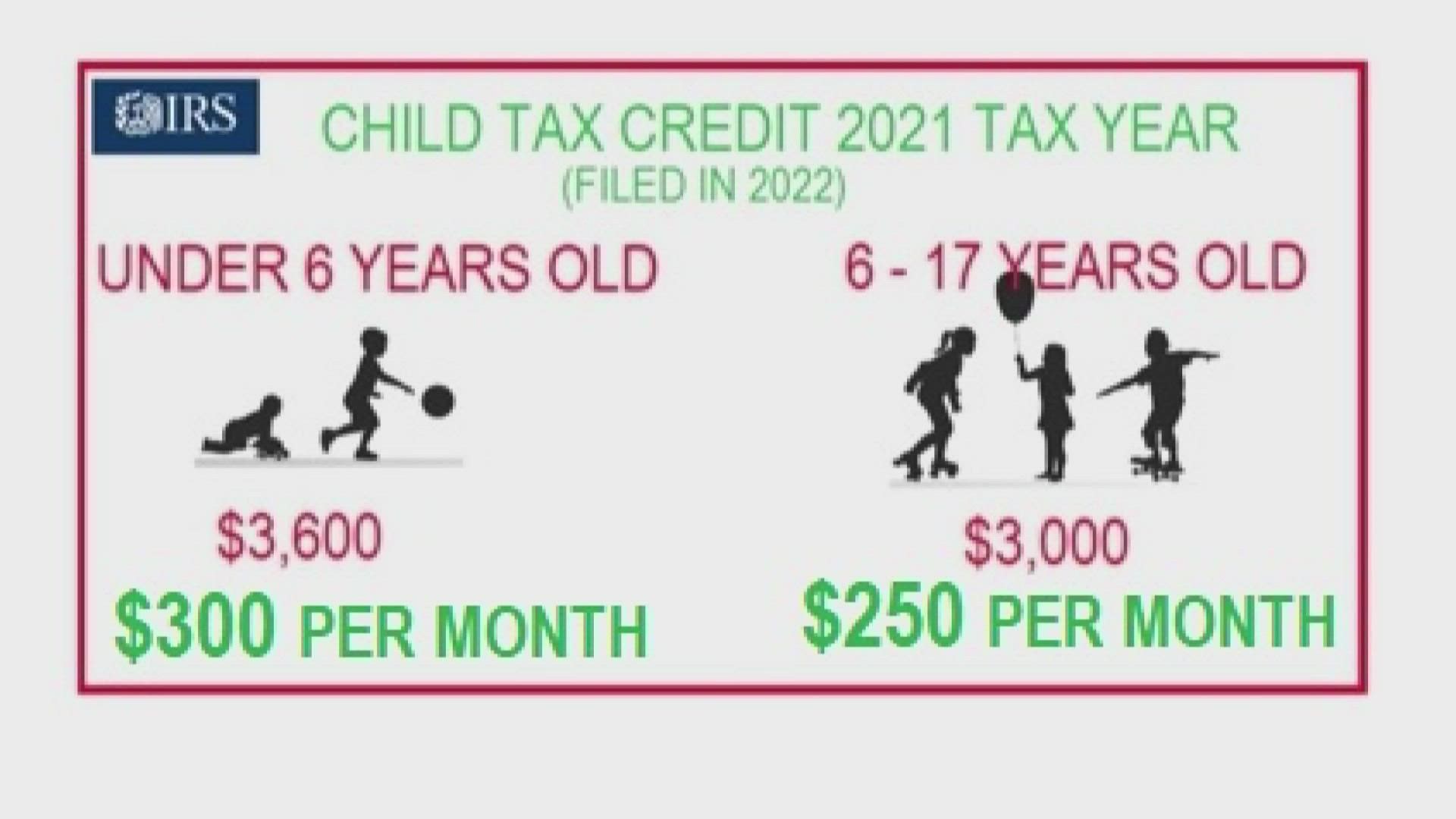

The majority of payments are $250 or $300 per child depending on the child's age. Eligible children include those in the age range from birth to 17 years old.

What if you don’t get this payment or you missed payments?

The IRS confirms:

Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return, filed in 2022. This includes families who don’t normally need to file a return.

Families who received advance payments will need to file a 2021 tax return and compare the advance Child Tax Credit payments they received in 2021 with the amount of the Child Tax Credit they can properly claim on their 2021 tax return.

To help taxpayers reconcile the advance payments, the IRS will send Letter 6419 in January 2022 with the total amount of advance Child Tax Credit payments taxpayers received in 2021 and the number of qualifying children used to calculate the advance payments. People should keep this and any other IRS letters about advance Child Tax Credit payments with their tax records.

WHY DID PEOPLE GET THESE PAYMENTS?

President Joe Biden expanded the American Rescue plan in two ways:

1. Increased the tax credit amounts

2. Allowed for six advanced payments to be made from July to December.