GREENSBORO, N.C. —

‘Tis the season for shopping. How you pay for what you buy is key. A credit card, not a debit card, is your best protection. If the item isn't right, never shows up or the site you bought it from is a scam, it's simply a charge that your credit card company can reverse, with no money coming out of your pocket.

If you use a debit card, the bank can still get your money back, but it could take a while and that money is real cash out of your account.

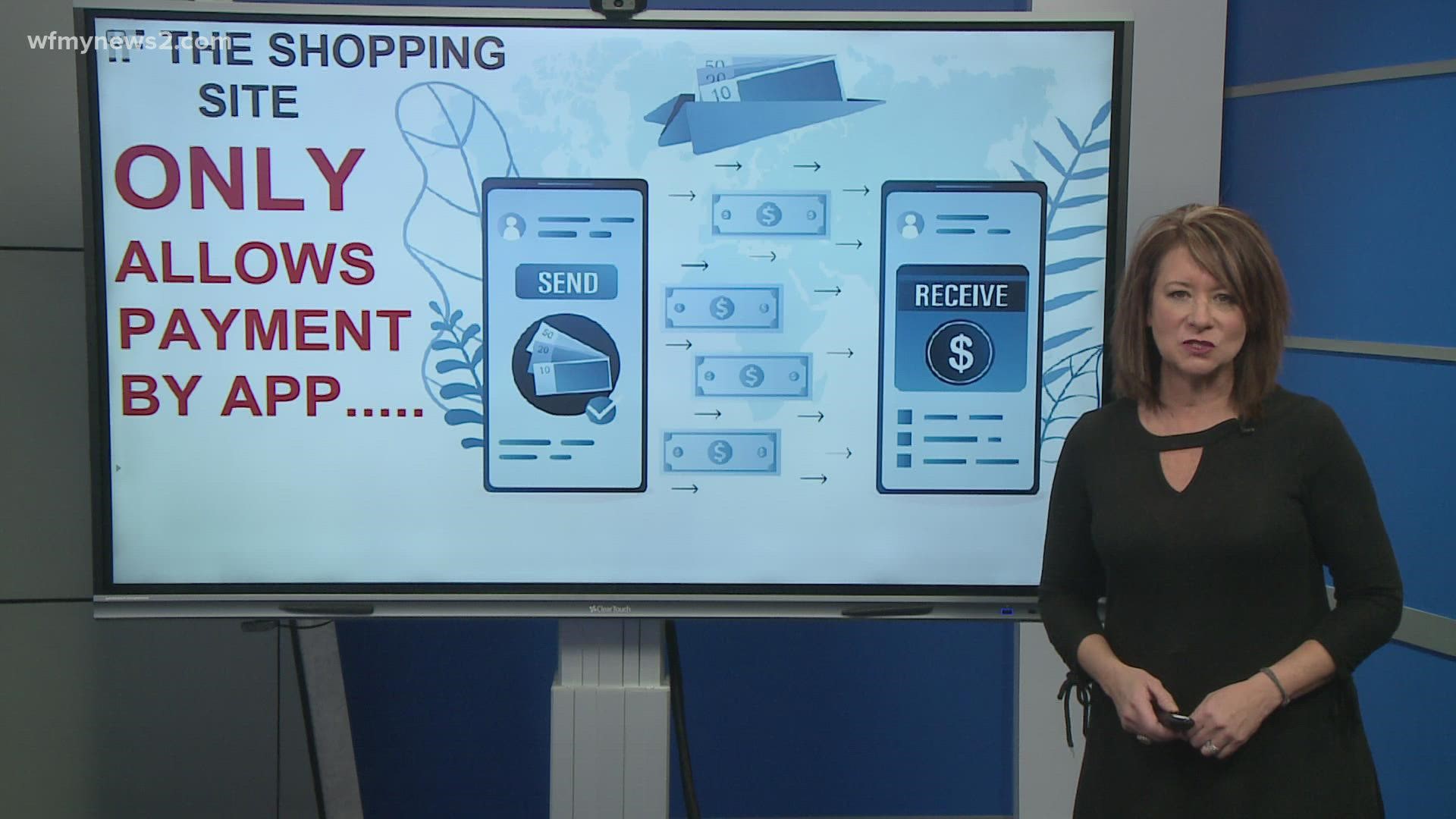

If the shopping site "only" allows you to pay through

an app like Cash App, Venmo or even Zelle, you could be dealing with a scam site.

“These sources and these websites will often only ask for payment via a wire service such as Paypal, Venmo, Zelle places where when those services that where the transaction is put through, those monies are gone. It's very likely almost impossible for the consumer to get their money back,” said Dave Hollister, US Secret Service Cyber Fraud Task Force.

Your credit card or your debit card is tied to a bank or financial company, cash apps or what's called peer-to-peer payments, aren't. They're tied to a 3rd party that just makes the transactions. You're not going to find the customer service the same, you're not going to find the same protections. It's just not there.

North Carolina Public Interest Research Group or PIRG did a survey on digital wallet complaints. The top three: managing, opening or closing an account, fraud or scam, and unauthorized transactions.

“A lot of folks don't know it's instantaneous, once you send the money you will never see it back and that covers fraud issues to simple mistakes like typing in the wrong user name,” said Katie Craig, NC PIRG director.

Again, your credit card is the safest way to pay for holiday shopping... Just remember to pay off that balance.