You walked into the dealer knowing you couldn't afford more than $300 a month for a car payment. The dealer met your demand, but to do it, you're paying that $300 a month for 72 months--- not just 36 months!

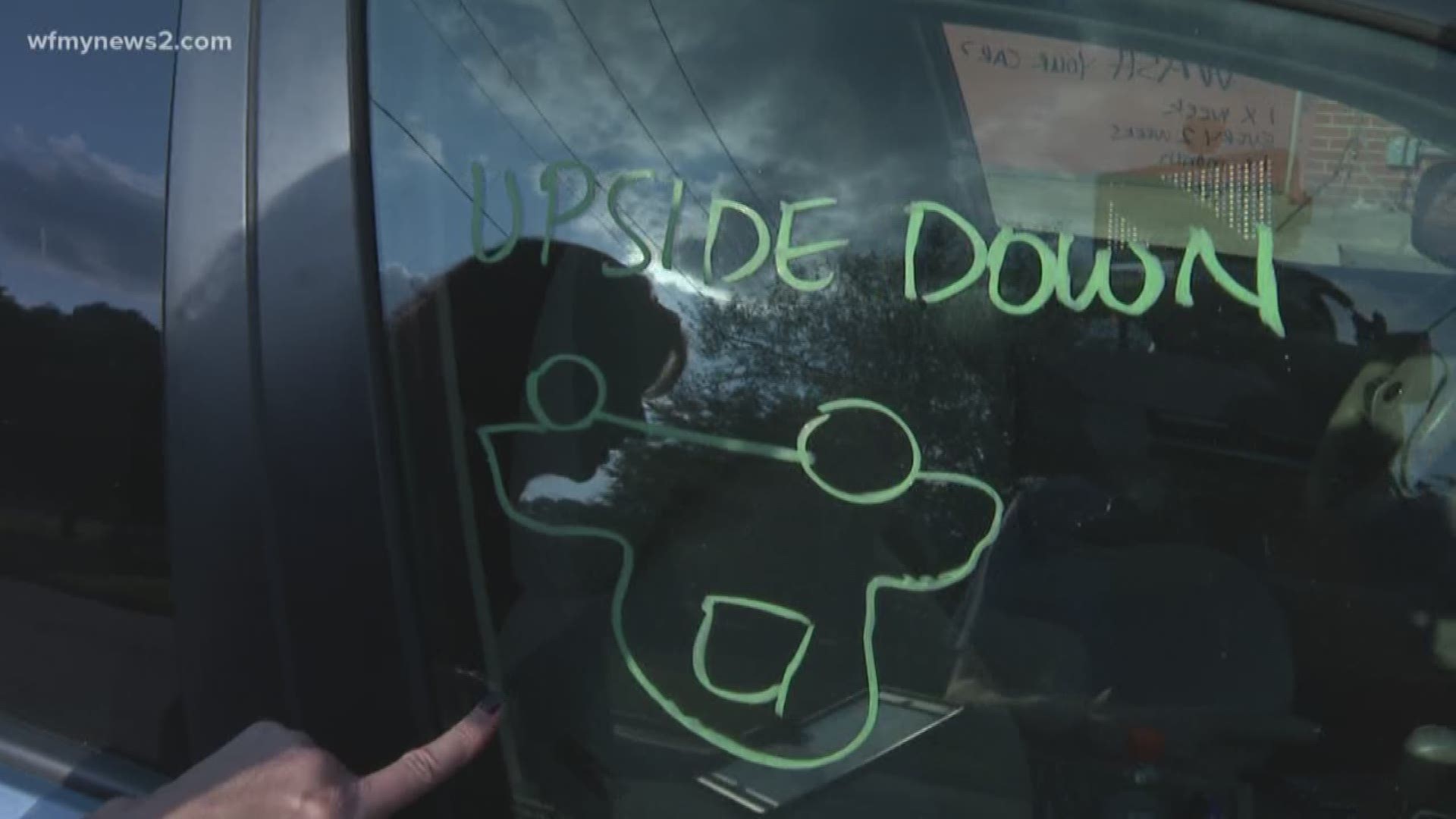

Which means, your car is probably worth $10,000 but your loan balance is $12,000 and you're what's called "upside down” on your loan.

This can be real trouble if you total your car or need to trade it in because you’ll end up having to pay the difference!

To get “right side up” on your loan, Nerd Wallet suggests:

Make extra payments...on the principal of your loan. The faster you pay down the loan, the more “right side up” you get.

Refinance with a shorter loan term. It won't lower your amount, but it will save you money on interest over time. This may mean a higher monthly payment--- so adjustments in your budget need to be made for a year or so.

If you can't do either one, just continue paying down on the loan--eventually you'll catch up. But in the meantime, buy Gap Insurance. This covers the difference when your upside-down loan car gets in an accident and insurance only wants to pay you what the car is worth--not what you owe on the car.