GREENSBORO, N.C. —

NEW CARS & DEPRECIATION

Your new car is worth the most the day you buy it. But just drive that new car off the lot and Carfax says you're looking at 10% depreciation the first few months. A year from purchase, while it's still new to you, the car can be worth 20% less.

This isn't totally surprising. You've heard this before. But have you considered that you need different insurance coverage?

NEW CAR REPLACEMENT VALUE COVERAGE

"If you have the replacement value coverage and you get into an accident and your car is a total loss, your vehicle may be two or three years old, but with Replacement Value Coverage, they'll pay for a brand new car. That's a big deal," said Mike Causey, NC Insurance Commissioner.

New Car Replacement Coverage gives you money for a brand new car of the same make and model, minus your deductible. Now, it's a different story if you don't have New Car Replacement Coverage and your new-ish car is totaled.

Loan $40,000

Car Worth (after 1-year depreciation) $32,000

Difference $8,000

Insurance will pay you for your car's worth, which is depreciated from how much you bought it for and maybe how much you have on your loan. Without New Car Replacement Coverage, you will pay the difference out of pocket to pay the original loan off.

According to Forbes.com, many insurance companies have stipulations of what they cover and for how long. It's common for this kind of coverage to be for models two years old or less and those that have less than 15,000 miles.

So, what if your car isn't this new?

GAP INSURANCE -- LOAN/LEASE COVERAGE

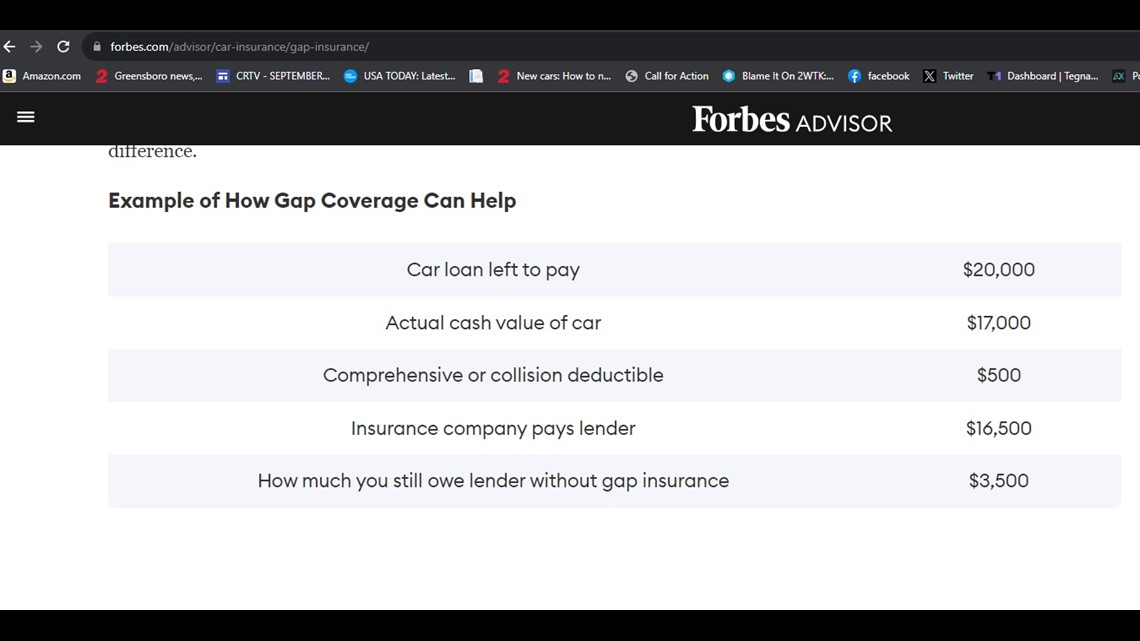

This kind of coverage pays the difference between what the car is worth and how much you owe on the car. It works much like New Car Replacement Coverage. The example from Forbes.com shows a gap between car the loan. the value of your car, and then what you still owe on the loan. Without gap coverage, you would be stuck with paying off the rest of the loan for a car that is not driveable.