GREENSBORO, N.C. — You put gas in it, you put oil in it, you pay for the insurance.

What more is there?!?!? Funny you should ask! Chase Smith from Alliance Insurance Services says a phone call would be nice.

“If you can't even remember the last time your agent called to see if your insurance needs have changed, that's a pretty good sign that it might be time to review and re-think your coverage.”

In our NC you have to have liability insurance. That pays for damage and injuries to the other driver when you get into a crash.

But collision coverage is optional on cars you're no longer paying a loan for. Collision pays for damages to your car. If you don't have collision, you don't get paid to fix your car.

“That's not the best time to find that out. That’s where that yearly call to your agent comes in! You may have wanted a cheaper bill and decided to forgo collision, but that doesn’t mean it's better. You can have varying amounts of coverage.”

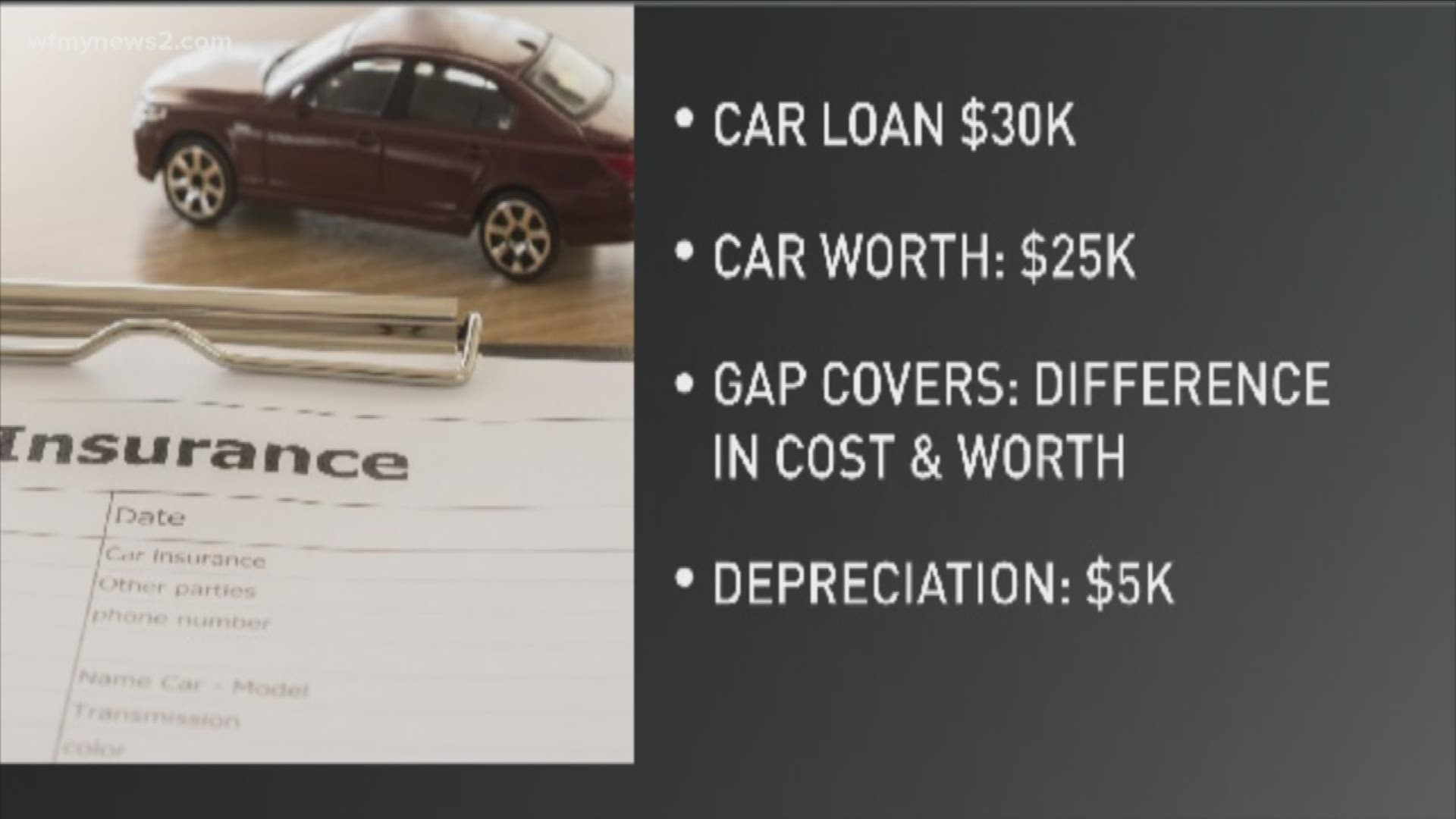

Next, GAP coverage. If your loan is $30,000 but your car is worth $25,000, you have a gap of $5,000. And if you get into a crash and you have no gap insurance, insurance is going to pay what the car is worth, leaving you with money you have to come up with to pay off your loan.

One of the other common questions people ask, which insurance pays if a tree from my house or my carport collapses on my vehicle? The answer is not your homeowners, it is your car insurance. But that’s if you have comprehensive coverage—which covers any damage done to your car when it isn’t involved in a crash.