GREENSBORO, N.C. — We're in the last full week of February and according to the IRS, President's Day kicks off a peak period of two weeks when folks are doing their taxes and calling the IRS for help.

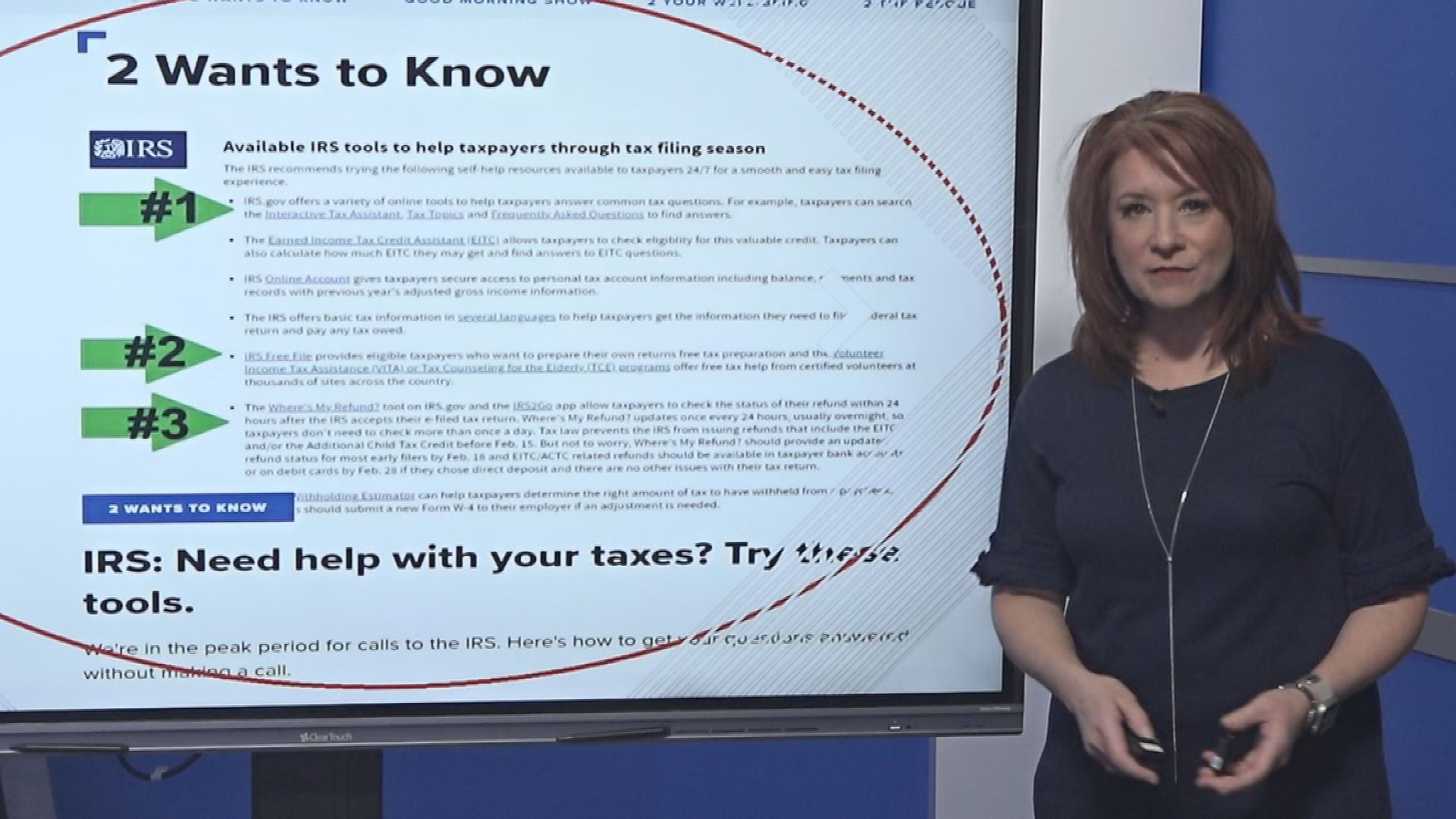

If that's you, let me give you something more than a busy signal. The IRS has a list of online tools to help get you through tax filing season. 2WTK is going to highlight three of them.

The search bar on the ITA page is geared toward answering the most common questions.

When do you need to file a return?

Which forms do I need to use?

When should I file an amended return?

Who can I claim as a dependent?

What part of my Social Security or retirement plans are taxable?

You can file your taxes online for free and use guided tax software to help you. To qualify you need to make less than $73,000.

On the IRS free file web page it says:

What Is IRS Free File?

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies that provide their online tax preparation and filing for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications if needed. It provides a free option to taxpayers whose income (AGI) is greater than $73,000.

Get this, 24 hours after you file your taxes you can check the status of your refund. Be aware, you will need your Social Security number, your filing status, and the exact amount of your refund.