GREENSBORO, N.C. — Maybe you have one credit card. But would it matter if you had three more credit cards or if you had a whole wallet full of credit cards?

Is it the number of credit cards that impacts your credit score or how you're using those cards?

“When you're using your credit card and maxing them out, it makes it look like you can’t manage your money or you're relying too heavily on credit,” said Christina Roman, Experian’s Consumer Education Advocacy Manager.

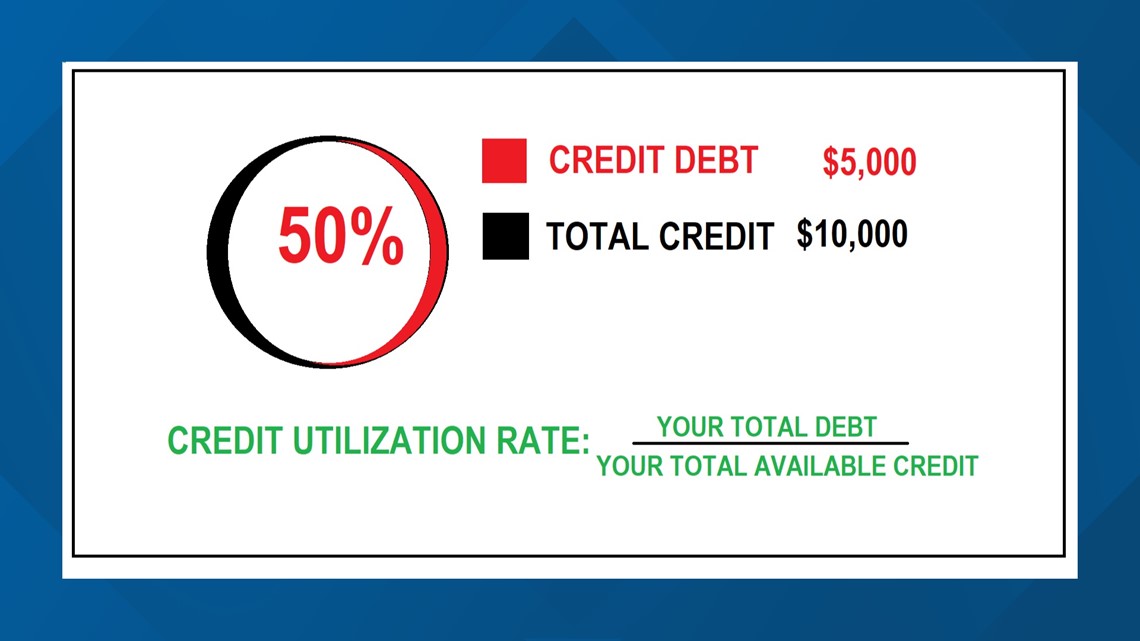

It’s all about your credit utilization rate which is your total debt divided by your total available credit.

Here’s an example:

If your total credit amount, what you can spend on a credit card, is $10,000 and you have charged $5,000 on that card, you have $5,000 of credit debt.

Your credit utilization, what you're using on that card, and the balance you're carrying month to month, is 50% of that card.

A low credit utilization shows you're using less of your available credit and you're doing a good job by not overspending.

According to credit bureau Experian, this rate can impact your credit score by up to 30%.

“Your credit impacts so much of your financial life from interest rates if you make a major purchase, what you're approved for. You having to pay deposits for utilities can impact your being able to rent an apartment,” said Roman.

Your credit score impacts the premiums you'll pay for car and home insurance. Employers often pull credit scores on people they want to hire.

So, what can you do to get that credit score up?

Get the credit utilization percentage lower. It's the second biggest factor in your credit score.

The biggest factor in determining your credit score is

bill payment history. That means paying your bills on time, not just your credit card bills, but your car payments, house payments, and utilities as well.