GREENSBORO, N.C. — Would you give a credit card to an elementary school kid? No, of course not. But credit cards are “given” to kids when a scammer steals their Social Security number and opens up lines of credit using the stolen numbers.

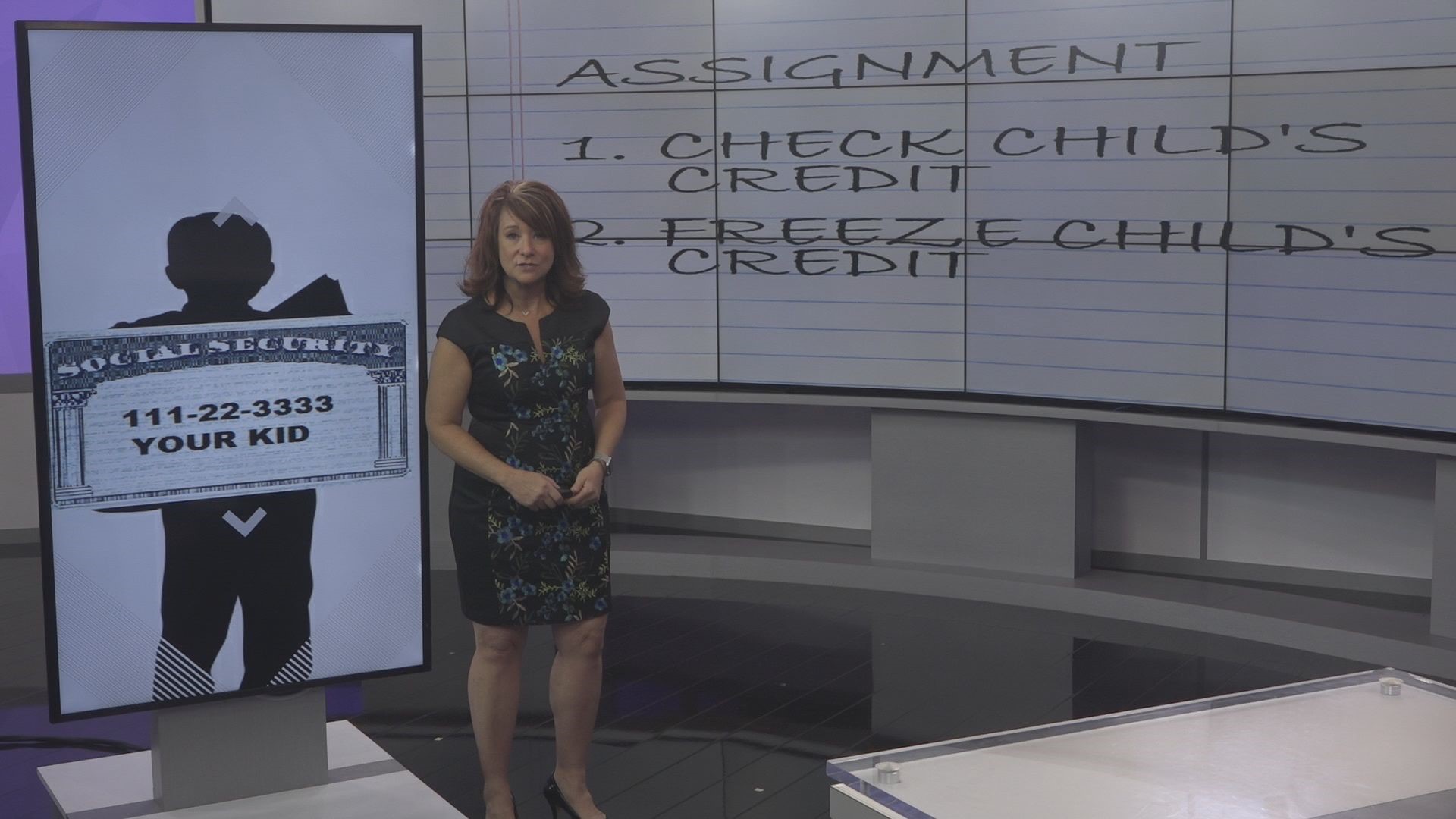

Back-to-school means every parent has homework. The assignment: checking your child's credit and freezing it so an identity thief can't use it.

“The social security numbers for camps, for various school activities and so little by little they're social security number and private information gets out to the public,” said a consumer advocate.

The first thing you want to do is check to see if your child has a credit report. This will tell you if their identity has already been compromised.

Checking your child’s credit starts online, you will print out and fill out your info as the parent, their info as the kid along with copies of your driver's license...your child's birth certificate, and the child's social security card.

You then will mail it all in. By law, it has to be done that way.

It's not a quick process, but can you imagine your kid turning 18, applying for a school loan, and then finding out someone has been using their credit? It happens.

You want to check and freeze with each credit bureau.

To make sure identity theft doesn’t happen, you can pro-actively freeze your child's credit so no one can open any kind of credit in their name.

According to Experian: There's no reason for most children to have credit reports, since it's illegal for anyone under 16 to apply for a loan or credit card in their own name. Fraudulent loan and credit card applications can generate credit reports, however, and by the time you or the child discovers them, they could be full of unpaid accounts.