GREENSBORO, N.C. — The clock is ticking for you to file your tax returns. The deadline this year is April 18.

To get you prepared for Tax Day, 2 Wants to Know got Ryan Dodson with Liberty Tax Services to answer your questions:

Why is Tax Day on a Tuesday?

Tax Day is April 18 this year, a Tuesday. Since 1955, Tax Day has typically fallen on whichever Monday is closest to April 15.

That would have been April 17 this year, but by law, Washington, D.C. holidays impact tax deadlines for everyone in the same way as federal holidays.

This year's due date is April 18, instead of April 15, because of the weekend and the District of Columbia's Emancipation Day holiday, which falls on Monday, April 17.

Filing an extension

If you need more time, you can file for an extension. This does not give you a payment extension.

The IRS says you should estimate and pay any owed taxes by the regular deadline (April 18) to help avoid possible penalties.

An extension gives you more time to complete the actual return. Filing for an extension gives you until October 16 to file your taxes this year.

Tips for a faster refund

To get your refund as soon as possible, the IRS recommends you file electronically and opt to get your refund via direct deposit.

By doing so, you're getting the return straight from the IRS rather than facing potential mailing delays.

3 things to know about filing

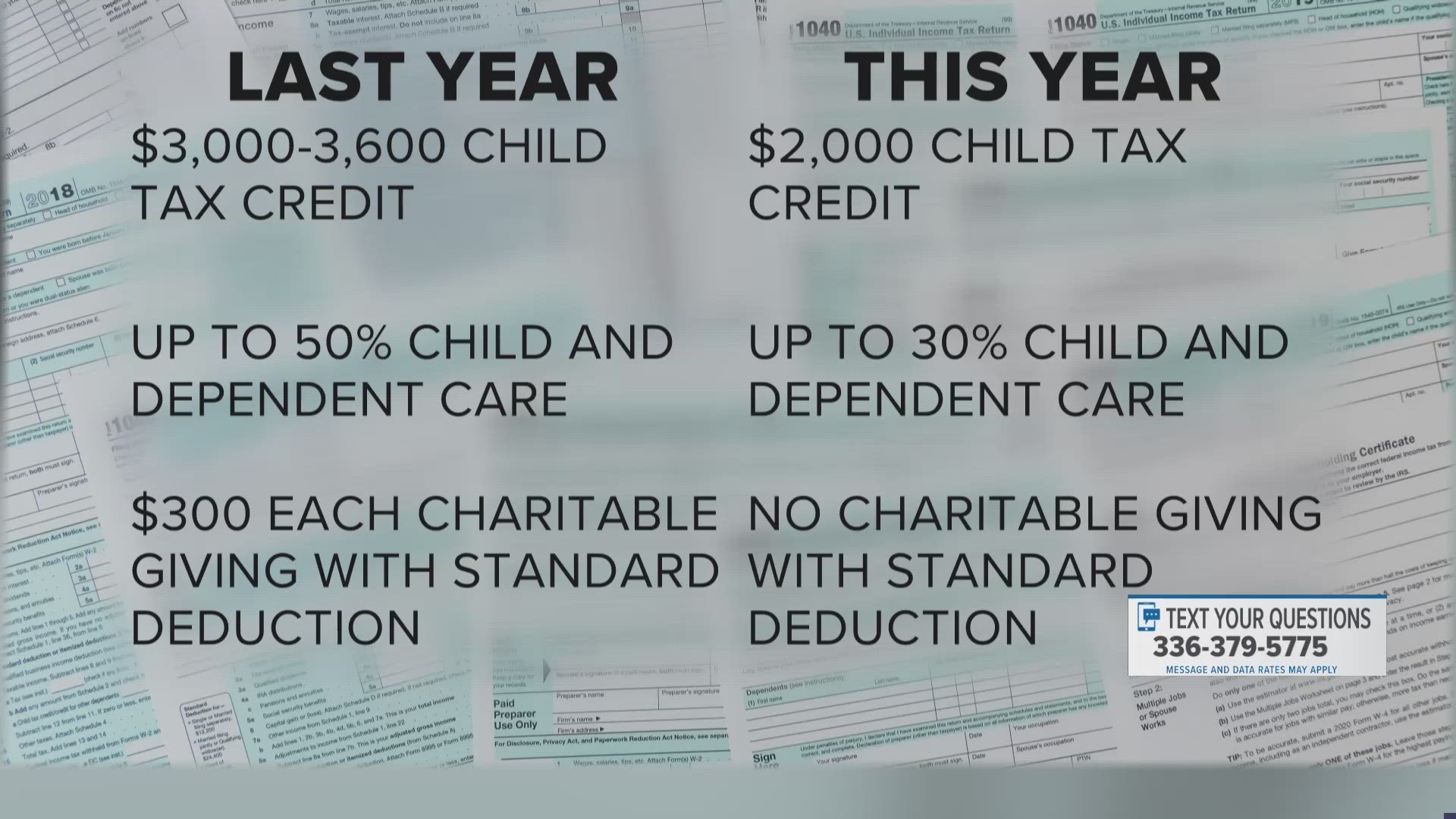

- The $300 charitable deduction is available to everyone even if you do not itemize.

- First and second stimulus payments can be included on your 2020 tax return if you did not previously receive them.

- You can use your prior year earned income if it gives you a better answer on your child tax credit and earned income credit.