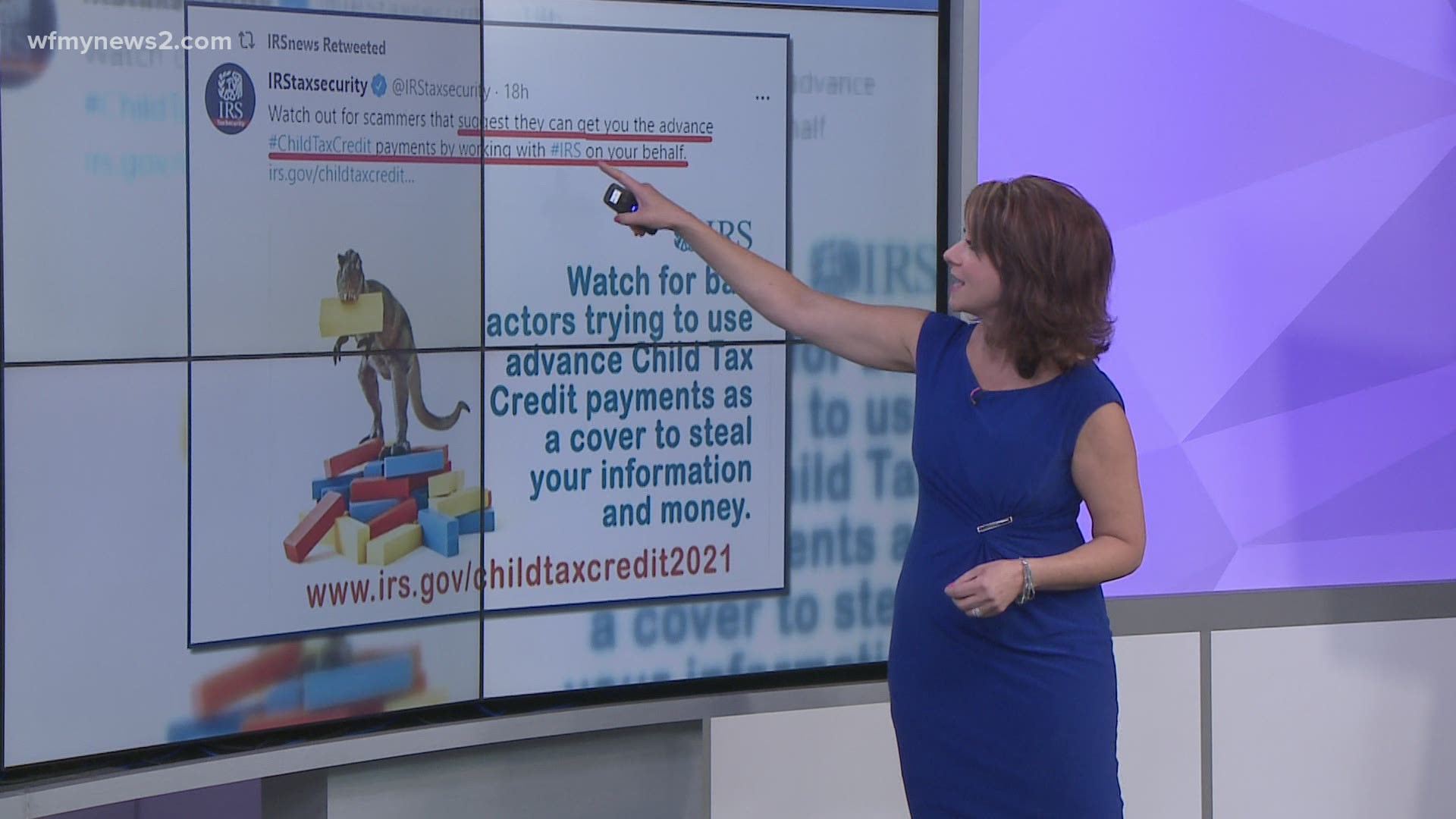

GREENSBORO, N.C. — The dinosaur is meant to grab your attention. The picture says, “Watch for bad actors trying to use Advance Child Tax Credit payments as a cover to steal your information and money”.

How would a scammer do that? The IRS gives one example in this tweet confirming if someone calls, texts, or emails and “Suggests they can get you the Advance Child Tax Credit payments by working with the IRS on your behalf” it’s a scam!

You don't need any help in getting the payments. The Advance Child Tax Credit Payments begin July 15, 2021. Payments are made every month through the end of the year.

These payments will total half of the total tax credit, the other half you'll claim when you file your 2021 taxes in 2022. The total credit is $3,600 for children under 6 years old and $3,000 for kids 6 to 17 years old.

The monthly payments will be either $250 or $300 per child.

The IRS has designed three portals:

Advance Child Tax Credit Eligibility Assistant -- this can help you figure out if you're able to get the credit

The Non-Filer Tool—this helps those who don't file taxes put in their information for the IRS

Update Portal—this allows you to opt-out or unenroll from the payments.

The portal to change your information, banking info, child status is not up yet.

That last portal is key-- the unenroll option. If you like to get a really big tax refund, you may want to unenroll from the monthly payments. The deadline to unenroll for the July 15 payment is passed. But you can unenroll for the next payment in August.