GREENSBORO, N.C. — What is Wednesday, April 7th? It's a stimulus payday with more than 25 million payments going out!

Wednesday's payments were made to Social Security beneficiaries who didn't file taxes. That's about 19 million payments between SS, SSDI folks.

More than three million payments were made to Supplemental Security Income beneficiaries and about 85,000 payments were issued to Railroad Retirement Board folks.

Added to those payments, more than a million people who already got a Stimulus #3 payment were issued a credit payment because their recently filed tax returns made them eligible for more money.

The majority of the April 7 payments were direct deposited into accounts and are available now, but about a million payments were sent by check through the mail. If you didn't see the payment in your account-- be watching your mailbox.

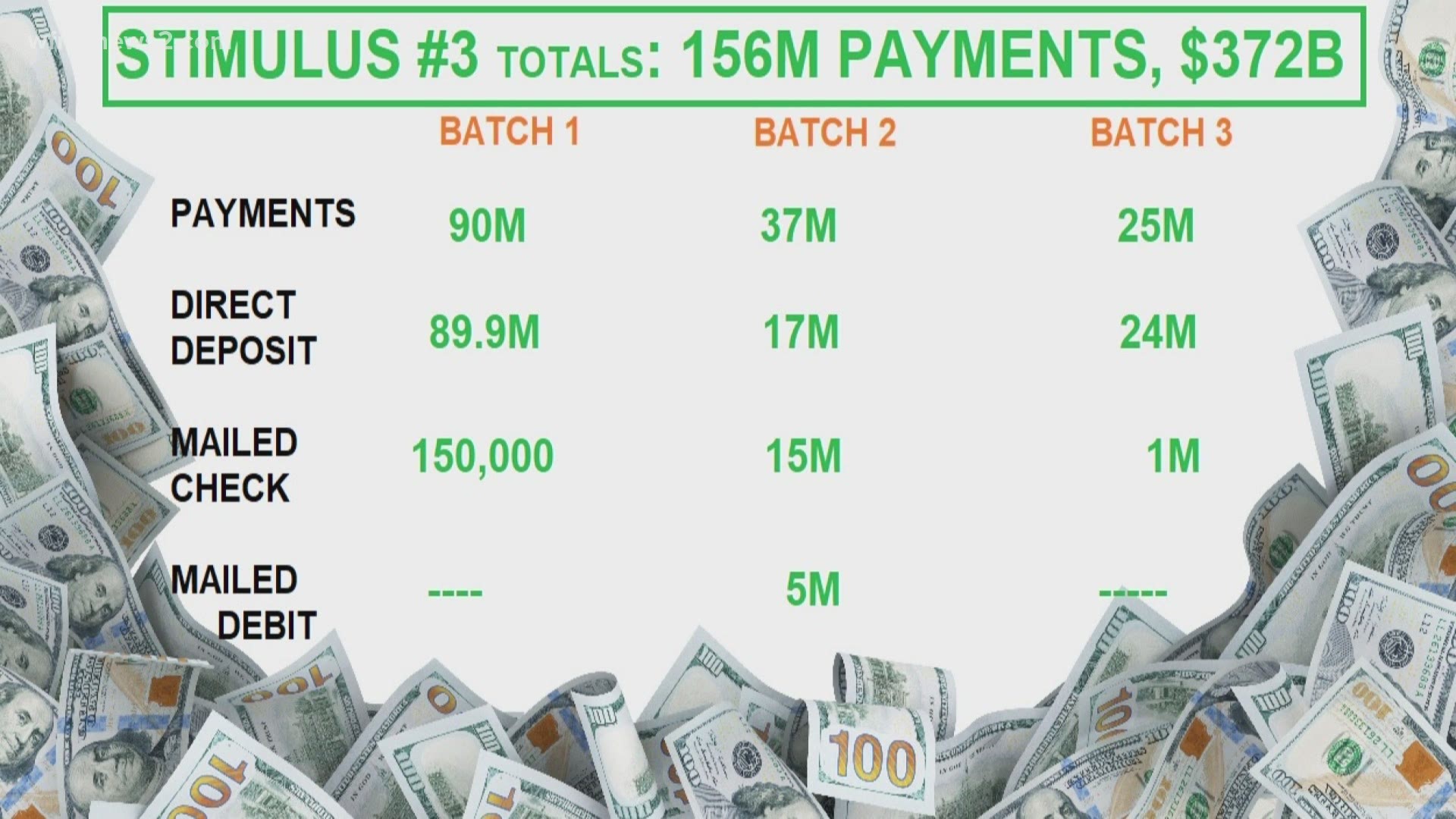

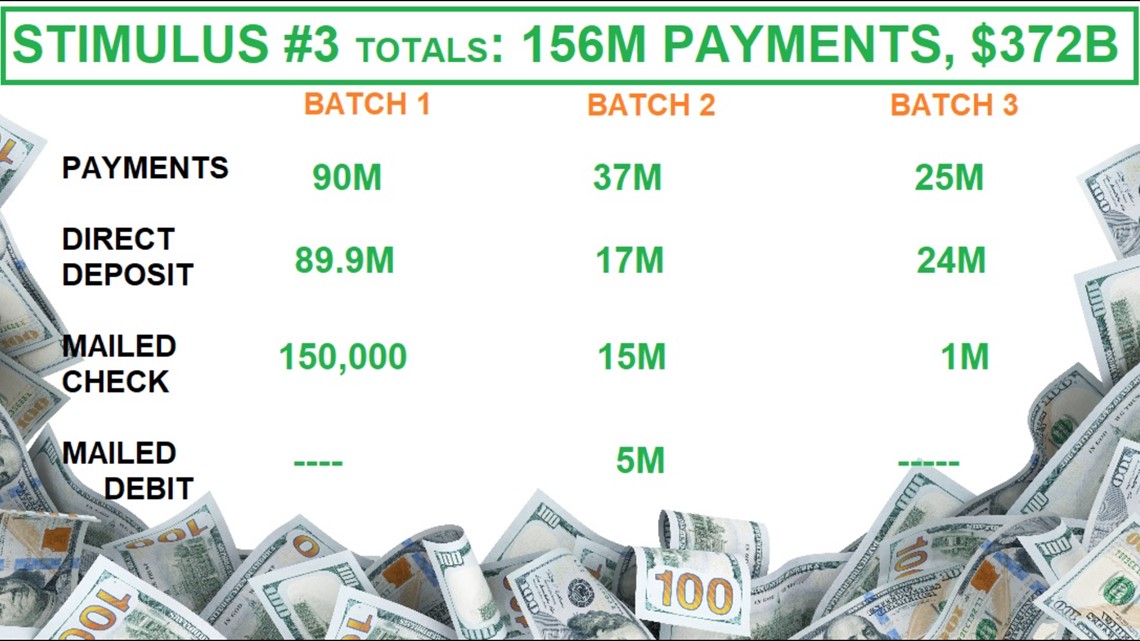

In total, the IRS has sent out 156 million payments totaling about $372 Billion for Stimulus #3.

Here's a look at the breakdown.

By far, direct deposits are the main way to give payment.

NON-FILING VA BENEFICIARIES GET PAYMENT DATE

The next batch of stimulus payments is expected to go out on April 14.

Included in this date are VA beneficiaries who don't file taxes.

Again, most of these will be direct deposited and will be updated in the get my payment tool over the weekend of April 10-11.

WHAT IF YOU DIDN'T GET STIMULUS #1 OR #2?

The short answer is, file your taxes. Even if you don't normally file taxes, file them to claim the stimulus money.

“In some cases, there may be people who didn't get one or both stimulus payments, but by filing the 2020 tax return and making sure line 30 is completed, they may be able to get a refundable credit,” said Kevin Robinson of Robinson Tax & Accounting Services.

On line 30 is the Recovery Rebate Credit, which is your stimulus payment. There is a worksheet to help you figure out what you need to put down on line 30.

To help you, the IRS has several FREE online filing programs for you to use. The folks at the Greensboro Public Library say the programs walk you through doing your taxes.

“What I like about the e-file service is it is a guided step by step service and they use partners like Tax Pro and Turbo Tax and other tax preparing companies. All you have to do is go through the guidelines on the screen. Some have video tutorials. It's very simple,” said Danielle Pritchett of the Greensboro Public Library.