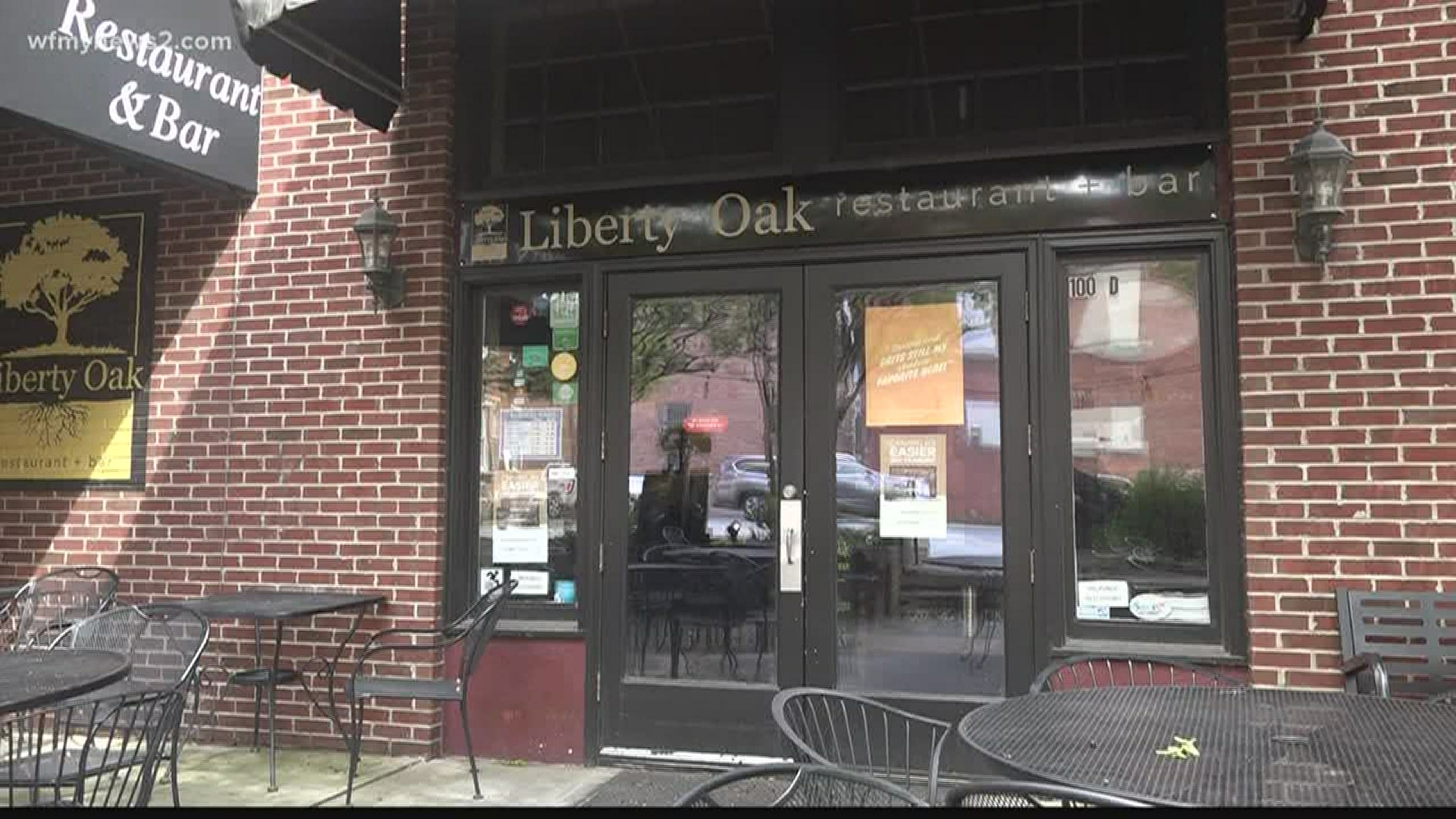

GREENSBORO, N.C. — The yellow chairs are lined up in front of the bar. Bottles of alcohol and wine are stacked on the shelves. In many ways, it might not look too different than it did back in early March? What is missing is people, “We are hoping to be okay. It’s kind of like looking into a crystal ball, it’s rough and there are a lot of unknowns,” said Nick Wilson.

The owner of the 1618 restaurants in Greensboro, like so many small business owners, is struggling to make a profit right now. Wilson has only closed one of his three restaurants, but he has let go of most of his staff, “Going from 98 to 12 people is kind of like a kick in the gut,” said Wilson.

The two restaurants still open only offer take out, curbside pickup or delivery. Wilson says his business profits have dipped upwards of 85-percent in the past few weeks.

Almost right after Governor Roy Cooper ordered all restaurants to stop allowing sit down customers Wilson applied for paycheck protection. The government-backed loan provides small business owners with payroll relief for a little more than two months, “Luckily we were able to get everything in before funds ran out,” said Wilson.

The Paycheck Protection Program injected $350 billion into the economy in hopes employers would not lay off as many workers. The program appears to be a success as the funding ran out not long after the program was introduced.

More than 1.6 million small businesses took advantage of the program and more than 5,000 lenders participated. One of the banks to assist small business owners is Triad Business Bank, “Our employees have taken this extremely personally, they realize (on the) other side of loans is payroll for individuals or families,” said Triad Bank CEO Ramsey Hamadi.

The recently opened bank has processed more than 175 claims and has already secured funding for more than two dozen businesses, “We understand there are families depending upon this basic income,” said Hamadi.

One of the small businesses getting a boost from the loan is RLF Communications. The public relations and marketing company have lost a lot of business since the stay at home order went into effect, “We will use the paycheck protection to pay our employees in April and May when our business has been impacted because of the shutdown,” said CEO Monty Hagler.

While the program has helped millions of people some are critical that several “large” businesses have been able to apply and receive funding. The loophole in the program allows those larger companies to apply if a location is under 500 employees.

The money passed out is free of repayment if 75-percent of the funding is used for payroll. The remaining amount can go toward utilities, rent or other expenses.

At this point, it is unclear if Congress will approve any more funding for the program.

Stay connected to local, national and breaking news: Download the new WFMY News 2 app.

►Text the keyword APP to 336-379-5775

►For the latest weather conditions and forecast text the keyword WEATHER to 336-379-5775

►For local news stories right to your phone text the keyword NEWS to 336-379-5775

►Need our Call for Action Team? Text keyword CFA to 336-379-5775

►For traffic alerts text the word TRAFFIC to 336-379-5775