As some are forced to close their doors, other businesses are using federal money, to stay afloat. They use the Paycheck Protection Program. It offers low-interest loans, to help keep workers on the payroll.

Which businesses actually get the money is public record. WFMY News 2's Maddie Gardner poured through the documents and spoke to the Small Business Administration.

Right off the bat, let's clear up the definition of a small business.

"The rule of thumb is usually 500 employees or below, nonprofits, including faith-based organizations are eligible as well," Thomas Stitch, District Director of the SBA of North Carolina said.

In North Carolina alone, 122,000 small businesses got loans totaling $12 billion.

The SBA says how much they got all depends on their payroll.

"The lending organization looks at their average monthly payroll and therefore their paycheck protection loan is two and half times their average monthly payroll for the particular small business," Stith said.

The database doesn't name businesses that got less than $150,000 dollars. 80% of North Carolina businesses fall into this category. So let's dig into the other 20% - places that got between $150,000 and $10 million.

"When we talk about small businesses, the average loan was around $100,000 which lets us know that there was a large range of loan value," Stith said.

About 1,500 small businesses in Winston-Salem, Greensboro and High Point received more than 150 thousand dollars in PPP money.

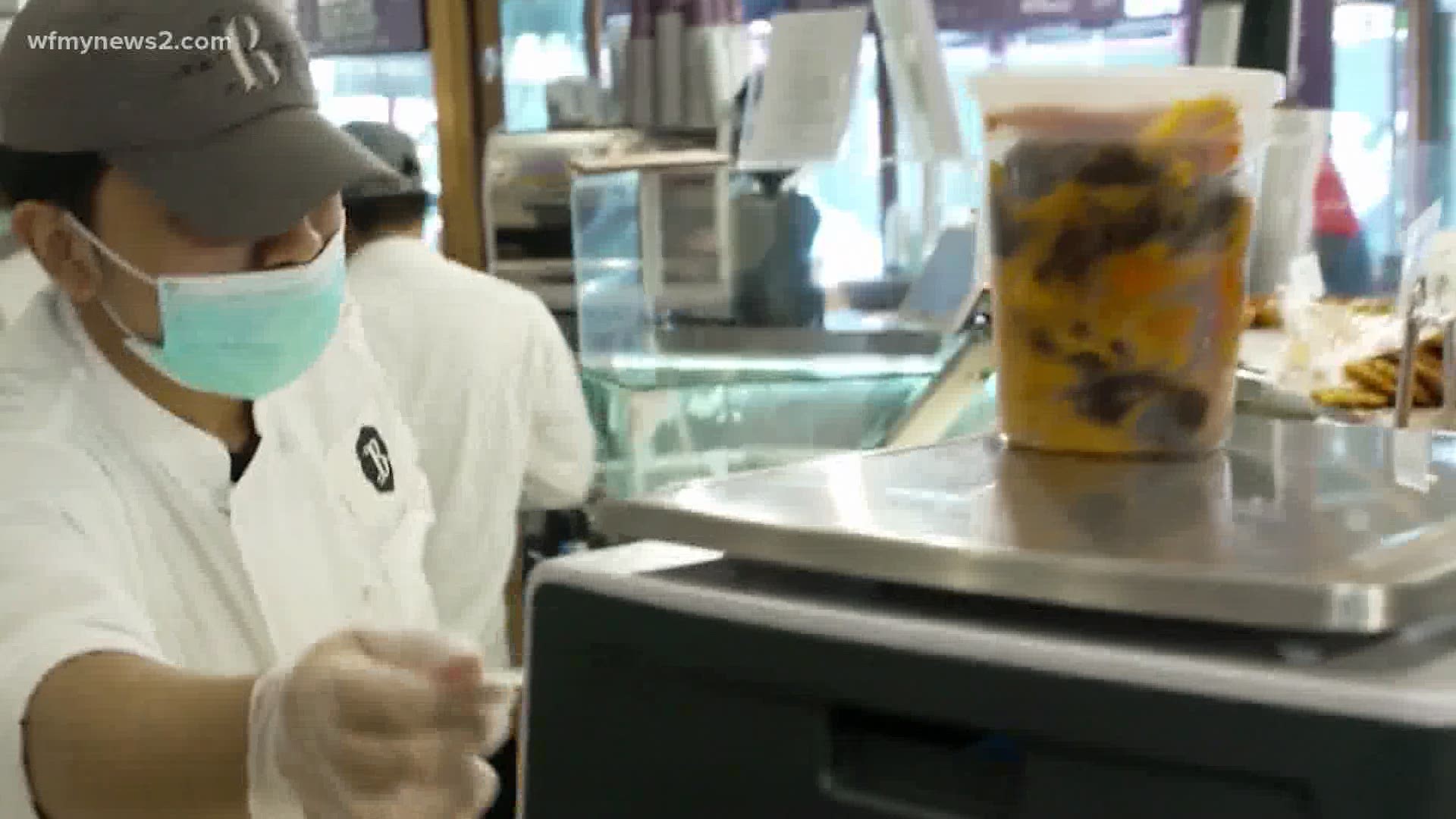

The group is diverse: Restaurants like Biscuitville, Hops and Cookout; schools including Guilford College, Salem Academy and Greensboro Day School; breweries like Natty Greene's and Joymongers, even companies like Koury Corporation and RE Carroll Management Company all qualified.

Stith says the loans, without a doubt, put money in people's pockets.

"We know there have been jobs that have been saved with our small business community and our non profits."