More reports of potential card skimmers keep resurfacing on social media posts from across the Triad.

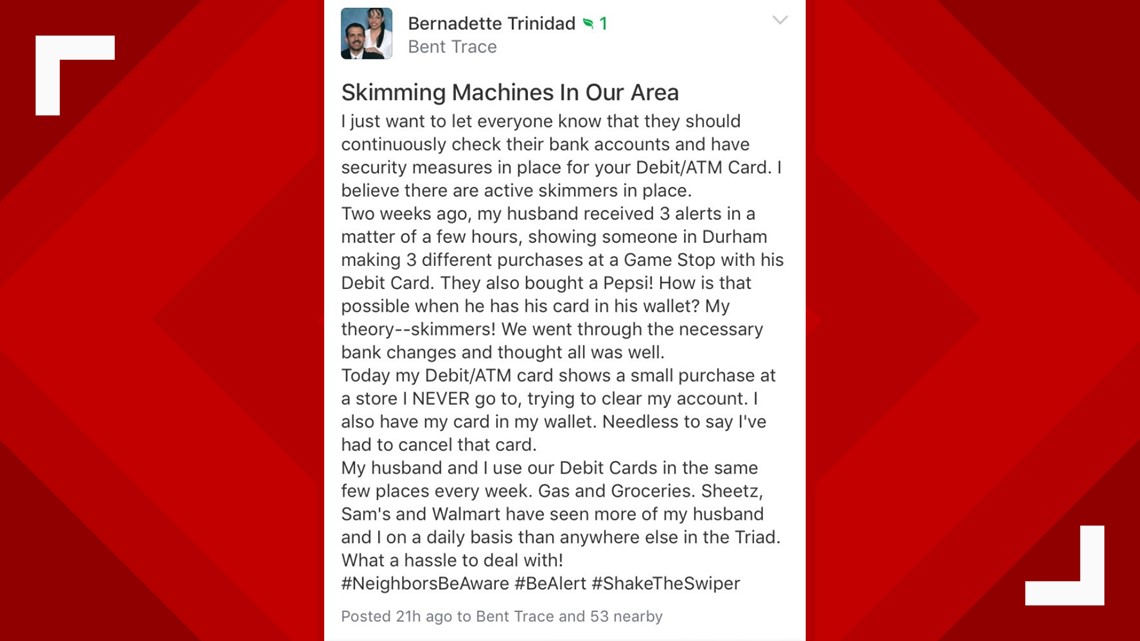

Bernadette Trinidad is one who shared her experience on the Nextdoor app.

Every day, Trinidad gets an email from her bank with her most recent transactions and Monday she realized something was off.

"I saw a charge on my card for Walgreens in Chicago," Trinidad said.

Trinidad hasn't been to Chicago in years nor has her husband been in Durham shopping at a GameStop three times.

In fact, she says they always shop at the same places and only use their cards for gas and groceries.

You've probably seen many stories like this about credit card skimmers at places like gas pumps and ATMs, but better safe than sorry.

So, how do skimmers use information while your cards are still in your pocket?

"The fact that someone can use your information while you're in possession of it is because they have a duplicate of that information," said Bryce Porter, Chief Information Security Officer at UNCG.

He says street-side ATMs and gas pumps are easy targets for scammers.

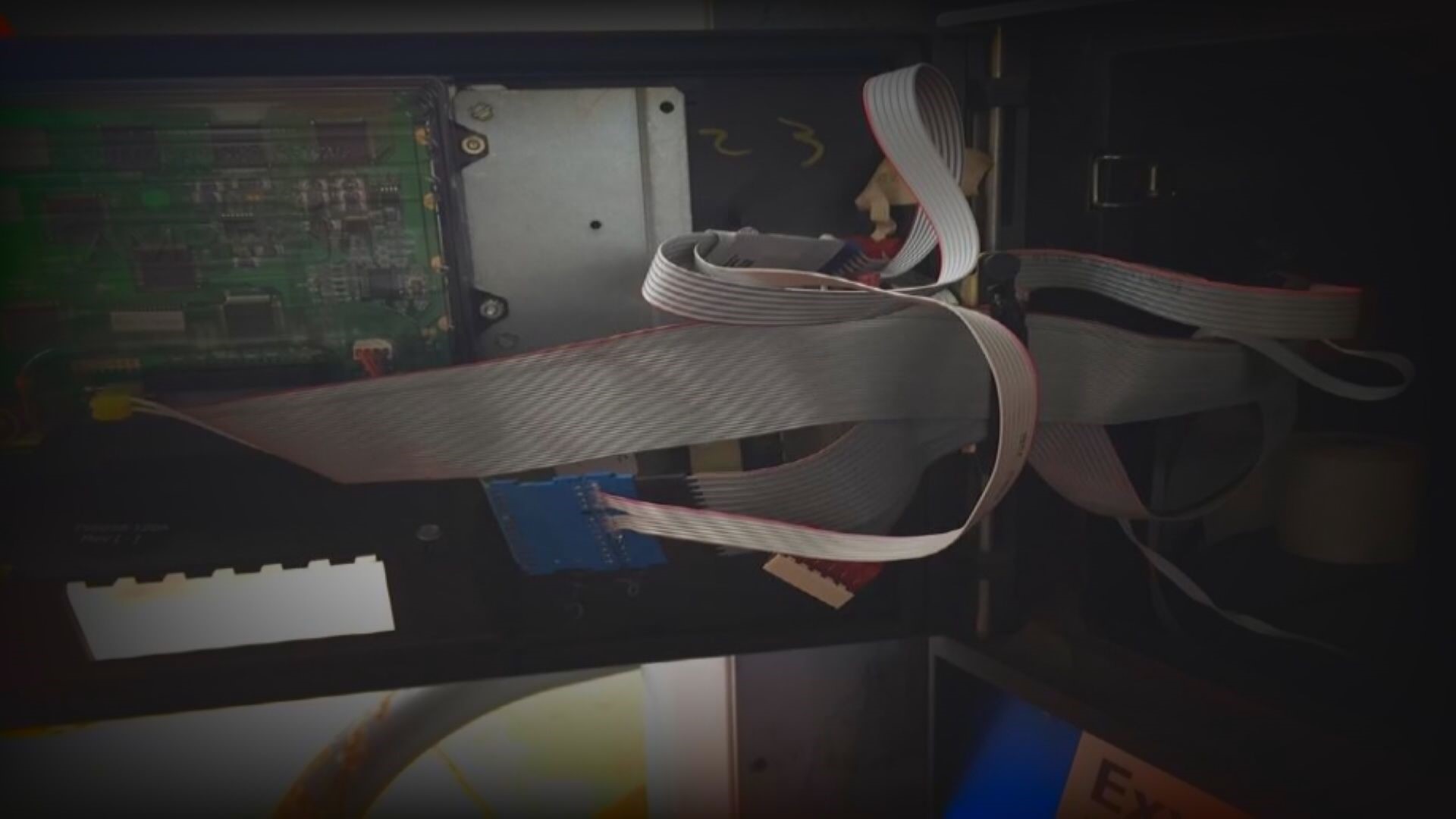

Physical skimmers are place inside card readers that make copies of the information on your card.

"They're stealing your credit card or your debit card when you insert by skimming that magnetic stripe on its way into the machine," Porter explained.

And these scammers are getting more savvy.

You may think debit and credit cards with the chip can combat these type of issues, and they do, but from skimmers only.

A relatively newer technology called “shimmers” can use wireless software and cheap devices then programmed to read your card.

Yes, it’s a similar concept to a skimmer, except these can steal information off your chip card.

But while that chip card can have some of its information stolen, the card itself can't be fully duplicated because of the extra security of the chip.

Detective Smith with Greensboro Police says the first thing you need to do if you don't recognize a transaction is to contact your bank.

"Let them go ahead and start locking everything down," Smith said. "Once you have that taken care of go ahead and call us, file a police report with us and we'll get started on it."

If you believe your information has been stolen, the easiest way to track this is by sign up for alerts from your bank.

These alerts can be sent to your computer or mobile device and will let you know about any activity, suspicious or regular, from your bank.

With these alerts, you’ll be able to keep track of any money coming out of your bank you might have not authorized.