CONSUMER REPORTS -- Whether you’ve locked your keys in the car, gotten a flat tire, need to be towed, or your battery died, most of the time you’ll need roadside assistance to bail you out.

So what kind should you get? Consumer Reports goes through all the options.

First off, do your research. For example, many insurance companies offer roadside assistance as part of a basic package or as an add-on to your coverage. Some examples: Geico, Nationwide and Allstate, which offer additional protection by expanding your coverage.

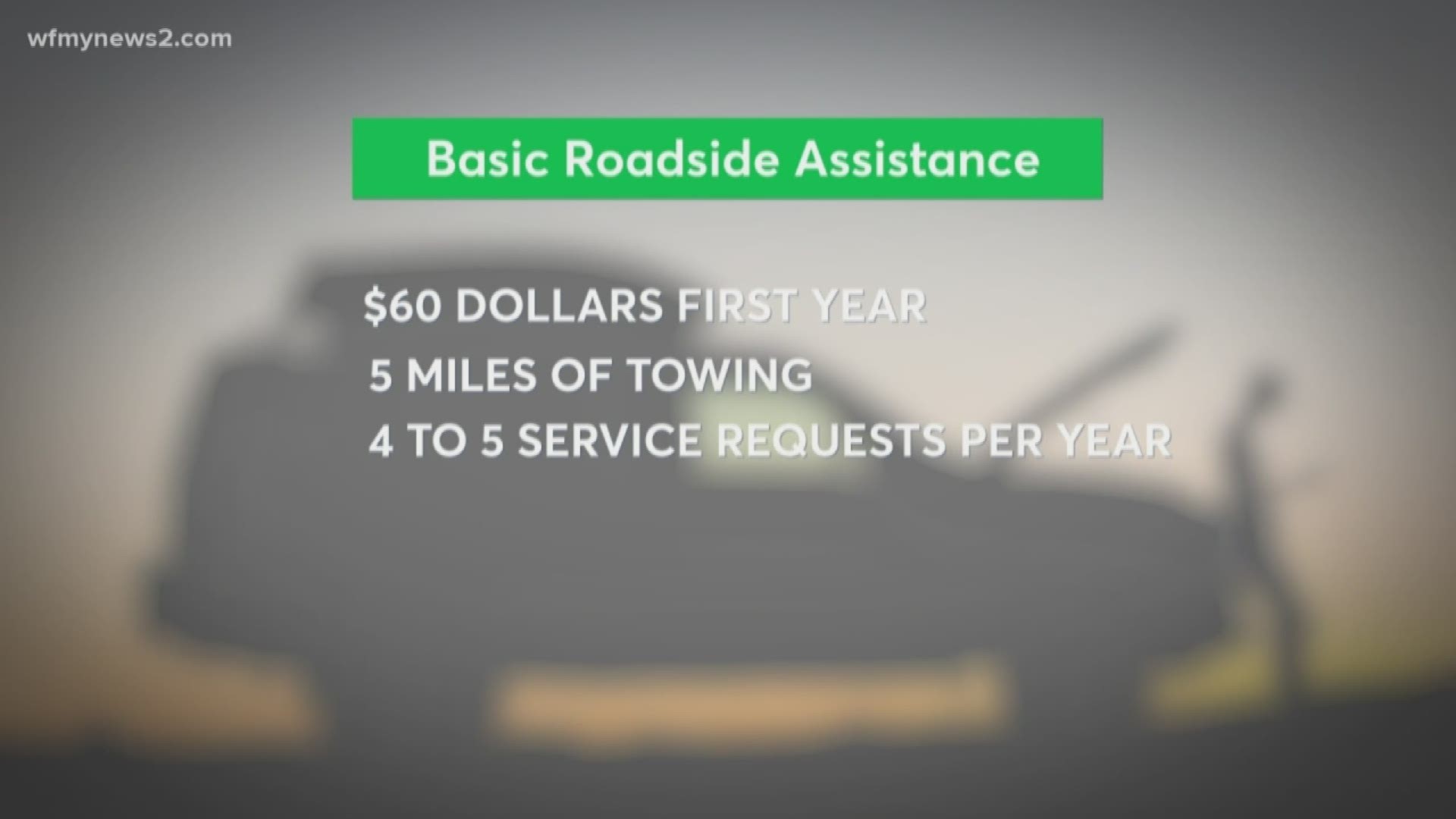

Typically, basic plans can start around $60 the first year. And usually include no more than 5 miles of towing per request and up to 4 to 5 service requests per year.

For long distance travelers, opt for premium roadside service. It CAN cost hundreds of dollars annually but may also include hundreds of towing miles, emergency fuel delivery, and even medical assistance.

It’s important for you to narrow down your needs. If your spouse or even teenage children drive, look for a plan that covers multiple drivers like AAA, National General Motor Club and Good Sam Roadside Assistance.

Auto manufacturers often provide coverage for their specific cars during the warranty period. And vehicles equipped with telematics, such as Hyundai Blue Link, and Toyota Safety Connect, may offer roadside assistance so you can avoid additional roadside memberships.

And did you know that credit card issuers such as Chase Bank offer roadside assistance? As does American Express, who will contact a third party service and get you help when you need it 24/7.